News

better business decisions

Posted 4 years ago | 6 minute read

Perhaps more than any other commodity, energy has the biggest impact on our daily lives. It establishes the costs of running businesses, which in turn impacts the price of everything we buy. The price of energy largely determined by the wholesale cost, which is set based on its value at any time in traded markets.

But what is energy trading? How does it work? And how is it changing?

Traded markets

In physical terms, the wholesale market plays a central role in the operation of the power system, by allowing the supply of electricity to be balanced with demand. The wholesale market is where electricity is traded (bought and sold) before being delivered to end consumers via the grid.

Trading can take place bilaterally between market participants or on exchanges, such as the Intercontinental Exchange (ICE). Within each of these markets, electricity will be traded across different timescales. Spot products are traded for same-day or next-day delivery (day-ahead and intra-day markets), while forward or futures contracts are traded for delivery at a given point in the future. But why do we need all of these markets?

In a recent interview GridBeyond’s Head of Trading and Optimisation, Paulo Sobral, said:

“One particular aspect of electricity is that it is produced and consumed at the same time, so, without storage technologies, you cannot generate to consume later on.

“Generation and demand are always fluctuating, so the challenge here is to balance the grid in real-time. This is done by using multiple markets that allow trading at different time schedules, and with prices that reflect the value of electricity within that time period.”

Sometimes, despite trading occurring over all these markets, supply and demand are out of balance. To bridge the balance gap between other forward markets and real-time energy delivery, a balancing market is used as the last stage of trading.

Risk & Revenue

As we have seen, there are multiple points at which electricity can be traded, and the markets have been designed in such a way that there are benefits (and risks) to each of them.

“Short-term prices are volatile as the grid balance is influenced by factors, which can fluctuate rapidly, such as cold weather leading to increased electricity demand or events affecting generating facilities. Futures and forwards markets cover the expected spot prices over a longer period, having an averaging effect that makes them less volatile but often more expensive as you pay a premium for price certainty. Balancing markets are the most lucrative of all,” said Sobral.

Historically the success of electricity traders depended on their knowledge of prices at different market locations and their ability to trade at the right time. But markets are changing, and business models with them. As we noted in our previous article, value is increasingly being realised via traded markets closer to delivery and there are significant benefits that can be gained from predicting and trading on price volatility between markets.

But the key to maximising every opportunity is forecasting how markets are going to move. This is made possible by using artificial intelligence (AI) and machine learning to conduct in-depth analysis of multiple factors, benchmarks, and historical data such as weather forecasts that affect volumes of renewable generation, operations of interconnectors, and demand patterns.

Let’s look at an example of how this works in practice.

Customer impact

In this example, GridBeyond’s AI-powered platform produced a solution that took a client from purely importing power at times of high on-site demand to a state that takes into account the possible interconnections between their onsite assets.

Our technology reduced costs by over £1,220,000 per year. In addition, active market trading provided revenues in excess of £5,000/year. But how? The answer is to take advantage of pricing differentials between wholesale markets.

Paulo Sobral explains.

Industry: Healthcare

Historical purchasing strategy: Direct procurement through a utility (dotted line)

On-site assets: Combined Heat and Power plant (CHP), gas-fired boiler

Historically this site purchased energy through a utility provider at a fixed cost. While this provided some level of certainty over energy costs, these were much higher than had energy been purchased directly on markets. In addition, our client was missing out on a lucrative revenue scheme that also enhances its sustainability by providing services to the grid that support the move to net-zero.

A CHP is a gas engine that delivers both electricity and heat, making it a complex asset. If electricity from the grid is very cheap, the site could stop running its CHP and instead import power from the grid. However, the site still needs to match its heat demand, so the gas boiler will need to be used. But how do you choose which asset to use and when? The answer is to go back to your wholesale markets.

At the time of this example, gas in the wholesale market was relatively cheap compared with electricity. In addition, the site was not using its CHP to export power overnight, even though the CHP had spare capacity.

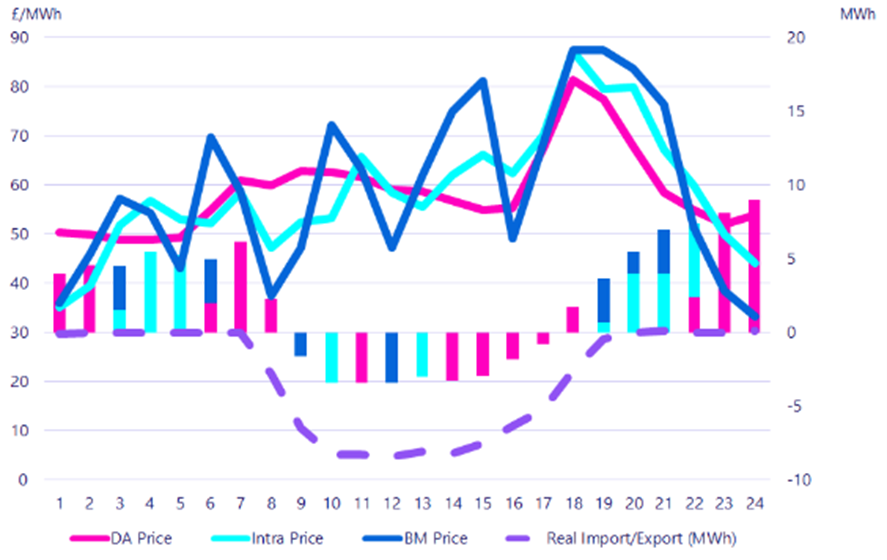

Using over 60 data inputs, GridBeyond’s AI-powered platform, Point, modelled the sites needs and export capacity. It then forecasted the prices across the day-ahead (DA), intra-day (Intra) and Balancing Mechanism (BM) and gave an optimised trading solution for each hour of the day.

Using robotic trading, available load was then placed in that market to achieve the highest revenue. By taking advantage of the on-site gas boiler and trading excess capacity from the CHP on short-term and in balancing market, our client reduced its costs by £1,220,760 per year and made £5,180/year of additional revenue.

GridBeyond’s advanced trading platform provides direct access to the markets. By using robotic trading, AI and machine learning algorithms, consumers are able to purchase their power at its cheapest in the intra-day and day-ahead markets, whilst monetising their flexible demand and excess generation and better managing the financial risks.

If you have any questions around the potential for smart trading on your site, contact our team, or to learn more about the complimenting services offered by GridBeyond’s intelligent energy platform, download the energy services brochure.

Read more

Artificial intelligence in energy – everything you need to know

Forwards, futures and real-time energy markets | Benefits of robotic trading