Insights

better business decisions

Posted 2 years ago | 3 minute read

Annual review of demand side flexibility published

Power Responsive has highlighted the importance of demand side response in balancing electricity markets in its latest Annual Report.

Published on 19 June, the report noted that 2022 was a challenging year for the UK, with gas and power prices surging to unprecedented levels, which highlights the need for further investment in renewable energy sources and demand side flexibility to move away from a dependence on fossil fuels. 2022 presented an opportunity for DSF providers to bid into a growing number of services including new frequency response services. The report also highlighted the importance of batteries to stable system operation – reflected in the near 2GW of installed capacity at the end of 2022.

In 2022, grid connected battery storage assets accounted for 100% of the Dynamic Containment (DC) market. As well as dominating DC and Dynamic Firm Frequency Response (FFR) markets it noted that batteries are increasingly prevalent in the Capacity Market (CM) and Balancing Mechanism (BM). The average size of battery assets reached almost 50MW in 2022, mostly limited by connection regulations at distribution level. In addition, the ESO introduced Dynamic Moderation (DM) and Dynamic Regulation (DR) in 2022 and together with DC, these new services offer a wide range of opportunities for flexible assets with different technical capabilities.

In 2022, Firm Frequency Response (FFR) and DC were the primary sources of revenue for a majority of DSF providers. Over 1GW of dynamic FFR contracts were awarded in some months, at prices that averaged over £18/MWh over the year. DC was worth over £100/MW/hr during limited periods, and consistently awarded contracts to over 1GW of assets across the two service types. However, with DC now reaching saturation and new services launched, 2023 is likely to see more diverse commercial models deployed.

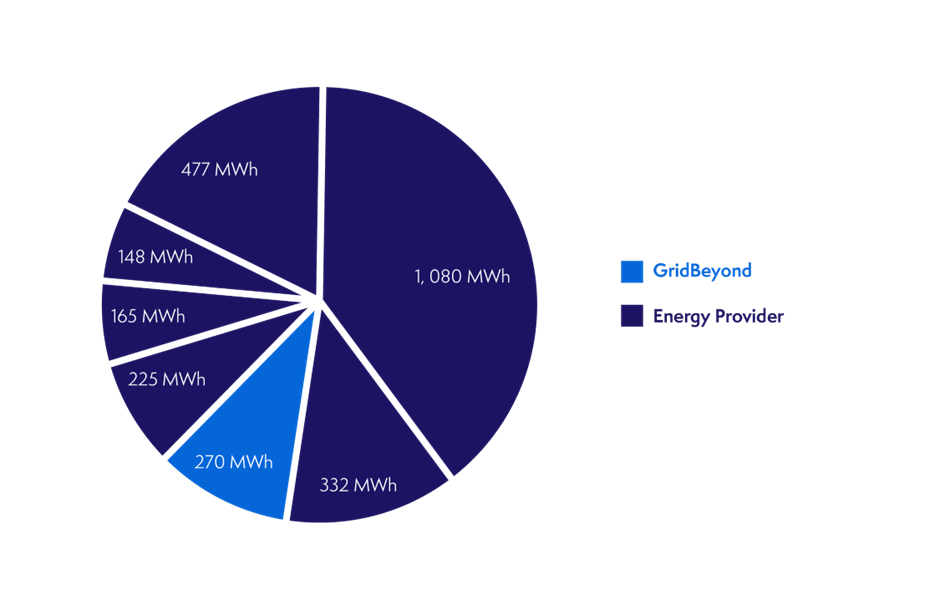

The report also noted that 2022 saw the launch of the Demand Flexibility Service (DFS) with a series of test events designed to trial the new service and give the ESO and providers confidence ahead of live events. The 16 test events and 2 live events that took place before mid-February delivered 312MW of demand reduction from a diverse range of domestic, industrial and commercial energy users. Each earned a guaranteed acceptance price of £3,000/MWh or more for reducing their demand on the grid during periods when supply was tight. Live events procured volumes through pay-as-bid tenders. Two live events took place (23 and 24 of January 2023) 219MW was delivered on the 23 January against a 330MW requirement, and providers delivered 312MW on the 24 January (which also had a 315MW requirement). Of the providers of the DFS service GridBeyond delivered 270MWh across the events, the largest delivery from any non-energy retailer in the programme.

DFS events were dominated by a relatively small number of energy suppliers Demand reduction delivered* during DFS test events to date, by provider, MWh

Source: Power Responsive

DFS was introduced as an enhanced action to support operation of the network, the Demand Flexibility Service was used twice for live events in January 2023 to support the management of the network. While the ESO’s day-to-day operational tools allowed it to operate the network as normal without the active use of DFS to manage margins, this service demonstrated the level of interest and engagement in consumer flexibility. Consumers and businesses notably delivered their highest output for these live events, 20% higher than for regular monthly or onboarding test events.

National Grid ESO is currently undertaking a review of the DFS alongside industry participants and consumers to assess how the service could be improved in future.