Insights

better business decisions

Posted 3 years ago | 4 minute read

Avoid peak real time market prices in ERCOT

The Electric Reliability Council of Texas (ERCOT) manages the flow of electric power to over 26M Texas customers. This is done through a real-time market known as the Security Constrained Economic Dispatch (SCED) market. In this market, electricity generation companies offer to supply electricity at different prices and quantities, and ERCOT uses a computer-based optimization program to select the best offers to meet the current demand for electricity, while also maintaining the reliability and security of the grid. This is done by considering various constraints, such as the maximum power output of each generation unit, transmission line capacities, and the availability of fuel sources. The goal is to minimize the overall cost of electricity generation, while ensuring that the system remains secure and reliable.

To participate in the SCED market, generation companies must have their generation units and transmission lines registered with ERCOT. They can then submit offers to supply electricity at different prices and quantities. These offers are typically based on the marginal cost of electricity generation. Once the offers are selected, ERCOT dispatches the generation units.

SCED is an important tool for ensuring the reliability and security of the electric grid in Texas. It allows ERCOT to quickly and efficiently respond to changes in the demand for electricity, while also minimizing the overall cost of electricity generation. The average price on the SCED is determined by the market and prices can vary significantly.

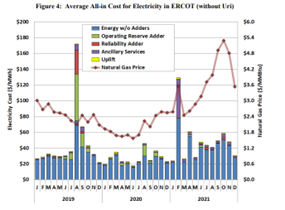

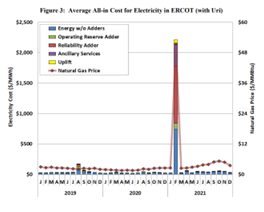

In the latest State of the Market Report, Potomac Economics noted that average real-time prices rose to $167.88/MWh in 2021, more than 6 times higher than in 2020, due almost entirely to the effects of Winter Storm Uri, when prices peaked. Despite firm load shed across the system during the storm, energy prices were clearing at less than $9,000/MWh, which was the system-wide offer cap at the time. The last time ERCOT experienced shortage pricing, in August and September of 2019, its magnitude and duration were much lower than experienced during Winter Storm Uri. When the effects of Winter Storm Uri are removed from the analysis, average real-time prices rose 58% (to $40.73/MWh) in 2021 compared to 2020, driven by higher natural gas prices.

Source: 2021 State of the Markets Report

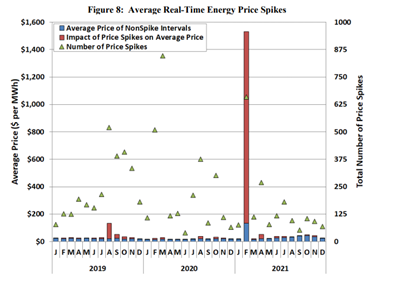

While the vast majority of hours in the Texas energy markets see relatively low prices, under certain circumstances prices can spike and in addition to the impact of rising real-time prices, businesses on block and index contracts will be exposed to periods of price spikes, such as those seen during Storm Uri. The overall impact of price spikes in 2021 was $123.45/MWh, or 74% of the total average price. But what can large energy users do to limit their expose to the real-time market.

Source: 2021 State of the Markets Report

C&I businesses are increasingly optimizing their electricity demand as a means to better manage their operating costs. But this can be a challenge without the right technology and expertise.

Through a deep understanding of your energy consumption, budget, flexibility and your appetite for risk, our experts will draw upon our forecasts, volatility analysis, and trading models to help you to best monetize your indexed position and deliver peak cost avoidance.

As part of our AI-driven solution we monitor your energy usage on a sub-second basis and can even automate the turn down or turn off of your site demand when prices are forecast to reach the peak, ensuring your business isn’t exposed to prices above your set level.

GridBeyond’s Ai. Services open the door for your business to take your energy strategy from passive purchasing and consumption to active energy management and trading.

Using AI and Robotic Trading combined with the expertise of our team, GridBeyond is pioneering a new way of optimizing demand response throughout the US. Our trading experts and Data Scientists can guide you through an array of demand response programs, from load response programs to Synchronized Reserve Market, and help you optimize participation for your business and bottom line.