News

better business decisions

Posted 4 years ago | 2 minute read

Capacity Market auction clears at record high

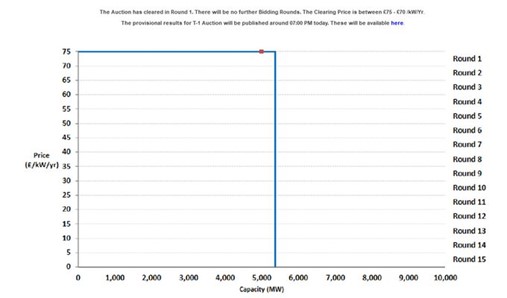

National Grid ESO has confirmed that the latest T-1 Capacity Market auction (delivery year 2022-23) has cleared at the cap, the highest it has ever been.

Published on 15 February the provisional results show the auction cleared in Round 1. There will be no further Bidding Rounds. 4996.224MW de-rated capacity entered the auction. The Clearing Price is between £75-£70 /kW/Yr.

Source: National Grid ESO

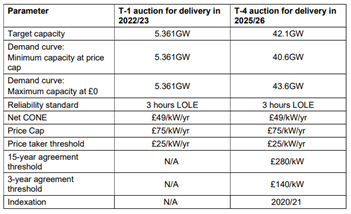

This follows publication of a letter to National Grid, on 25 January, when the government lifted the procurement target 5.361GW for the 2022-23 power Capacity Market auction – 14% above National Grid ESO’s recommended target of 4.7GW. The target was raised after it became clear that some stations with a four-year contract were now unable to fulfill their obligations combined with “broader uncertainties within the power sector.”

Source: BEIS

GridBeyond Managing Director UK & Ireland Mark Davis said:

“Until the unexpected ‘big T1’ of last year auctions haven’t been high enough to encourage new build capacity, combined with policy mandates designed to encourage increased levels of renewables in the power mix have meant that power plants aren’t being replaced. This brings a risk for the system, which still largely relies on gas when the wind isn’t blowing. The high clearing price in this auction combined with the high penalties under the programme, will act as a significant incentive to ensure new capacity comes online. However, the auction hasn’t delivered on the government’s procurement target alternative mechanisms will likely be required to achieve capacity requirements for next winter.

“Through our Secondary Trading Clearing House since 2020 GridBeyond has helped a large number of customers and generators to clear obligation commitments they can’t meet or receive an obligation if they were unable to gain one, thereby avoiding costs and/or gaining unplanned revenues.”