News

better business decisions

Posted 1 year ago | 9 minute read

Finding flexibility with AI in cement mills

This article is published in the International Cement Review, December 2024 Edition

In today’s rapidly-evolving industrial landscape, optimizing production schedules is no longer simply about meeting deadlines or maximizing output. As energy prices become more unpredictable, managing operational costs has become increasingly critical, especially for energy-intensive industries such as cement. To remain competitive and financially viable, companies must develop strategies to navigate these price fluctuations while maintaining efficiency.

Energy prices, particularly electricity, can vary dramatically within a single day due to a range of influencing factors. These include supply and demand dynamics, the growing integration of renewable energy sources, fluctuations in fuel costs and unpredictable weather conditions.

Across most regions, energy prices surge during periods of high demand. When consumption spikes, additional power generation is required, which drives up prices. Conversely, when demand is low, prices tend to drop due to a reduction in consumption and less strain on energy providers.

Additionally, weather plays a significant role in this variability. For instance, extreme temperatures can increase the demand for heating or cooling, which in turn affects energy costs. Renewable energy sources such as solar and wind also add variability to the energy market, as their production fluctuates with weather conditions, such as sunlight or wind availability.

Energy flexibility

Energy flexibility refers to the ability of businesses to adjust their energy consumption or production processes in response to external signals – whether from the energy market or internal operations. By leveraging this flexibility, businesses can reduce their reliance on energy during peak price periods, enabling them to operate more sustainably and at a lower cost.

In the journey towards decarbonization, flexibility plays a crucial role in helping businesses use energy more efficiently. As the cement industry transitions to net-zero carbon emissions and increasingly relies on renewable energy sources, the need for flexibility in energy systems becomes more apparent. As energy grids evolve to accommodate distributed and variable energy generation, such as solar or wind power, the opportunities to exploit energy flexibility are expanding.

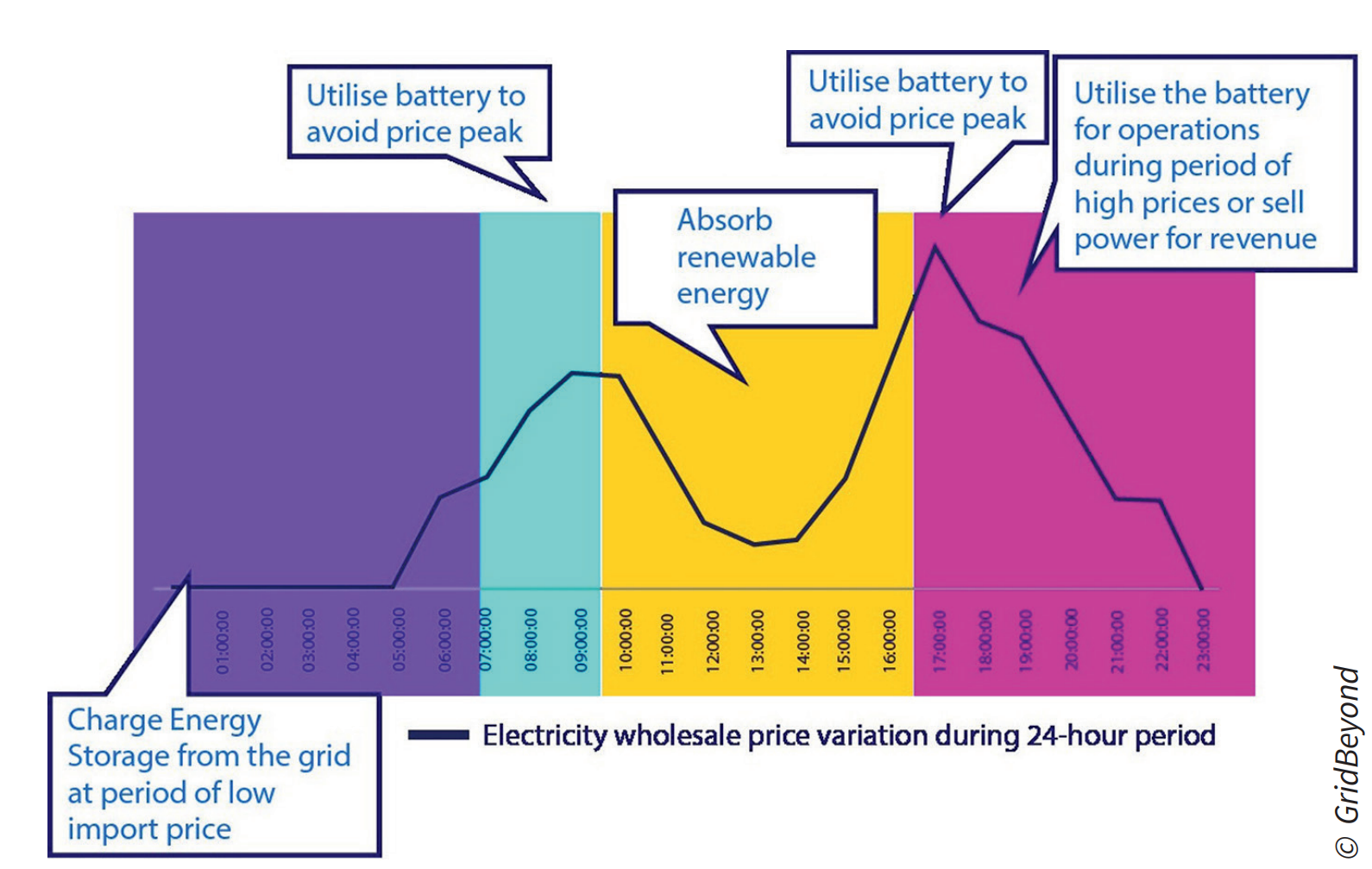

For example, businesses can invest in large-scale batteries that store excess energy during periods of surplus generation. This stored energy can be used during periods of high demand when energy prices are elevated. Alternatively, businesses can modify their production schedules to avoid operating during peak energy price periods, thereby reducing costs.

At the site level, energy flexibility can involve shifting consumption to off-peak hours or reducing usage altogether when prices are high. Businesses that leverage this flexibility can lower energy costs and generate additional revenue through participation in grid programmes and demand response markets. These markets offer financial incentives to businesses for adjusting their energy use during times of high demand, helping to ease pressure on the grid. By participating in demand response initiatives, companies can get paid to reduce their energy usage when it is most expensive, contributing to a more stable energy supply while cutting costs.

During times of high energy prices, operational costs can rise dramatically, affecting profit margins and overall competitiveness. To address these challenges, businesses can employ technology to create more dynamic, data driven production schedules that minimize energy costs.

Historically, production schedules were static and based on fixed parameters, making them ill-suited to the highly dynamic nature of today’s energy markets. Now, with energy prices in constant flux, businesses must adopt a more agile approach to scheduling. This shift involves using data analytics and AI to make real-time adjustments to production schedules based on energy price forecasts and operational needs.

One of the most critical elements of production optimization is understanding when to operate, idle, or shut down equipment. By strategically scheduling the start and stop times of energy-intensive operations, businesses can ensure that they are consuming the least amount of energy at the most cost-effective times. This not only reduces energy consumption but also limits exposure to periods of high energy prices.

Energy management systems

Energy management systems (EMS) are invaluable for optimizing energy flexibility. These systems enable businesses to monitor and control their energy usage in real-time by integrating data from smart meters, Internet of Things (IoT) devices and production equipment. With a comprehensive view of consumption patterns, businesses can identify inefficiencies and take corrective actions, ensuring energy is used in the most efficient manner possible.

Digital twin technology

The introduction of digital twin technology has revolutionized how businesses approach production optimization. A digital twin is a virtual replica of a physical asset, process or system. By creating a real-time, digital copy of a manufacturing site, producers can simulate various production scenarios and forecast future energy demand, generation, and storage.

Using a digital twin, manufacturers can identify potential areas for energy savings before making physical changes to their operations. The technology provides valuable insights into how production schedules can be optimized to avoid high energy price periods without compromising operational efficiency or product quality. It allows for multicriteria decision-making by testing and modelling different strategies to achieve the best balance between energy costs and operational constraints.

One of the unique selling propositions of digital twins is their ability to maximize returns while respecting operational constraints. On sites where specific parameters must be adhered to, digital twins allow for a tailored approach. Businesses can achieve peak efficiency within their operational requirements, balancing profitability with efficient operations. This precision allows businesses to identify real flexibility opportunities, enabling more informed decision-making in optimizing energy, and creating a more efficient and cost-effective energy strategy.

Hedging

Some producers can buy energy in advance (known as hedging) to match their site demand. Hedging, for the most part, is a technique that is meant to reduce a potential loss – not maximize potential gains. Long-term energy procurement can enhance budget predictability. But the market can be a volatile place, and prices are known for going up and down. But having a fixed proportion of energy purchased in advance can help protect cement manufacturers from any unexpected changes in the energy market.

Corporate power purchase agreements

One opportunity is to secure long-term supplies of green electricity via corporate power purchase agreements (CPPAs) for a portion of the plant’s needs at long-term prices. A CPPA will not only help producers increase the visibility of their future electricity costs but will also help them on their journey towards net zero. As CPPAs only ever deal in green energy, companies will be taking a step towards reducing their fossil fuel consumption. This is more and more important from a sustainability point of view, especially as many businesses are starting to set targets around carbon neutrality.

On-site benefits of EMSs

Participation in intelligent load management and demand response markets allow businesses to get paid for reducing energy consumption upon request. Flexibility requests and signals can come in a variety of forms. For example, as outright requests in a programme such as demand response or implicitly through price signals such as time-of-use rates, which organizations can take advantage of by shifting their energy usage to lower-priced hours with solutions such as energy storage.

The drop in cost of small-scale energy production, particularly for on-site PV solar, has helped fuel the adoption of on-site generation. On-site generation offers multiple benefits and businesses can evaluate eligible sites and the associated business cases, with the option to optimize self-use or resale based on market price arbitrages.

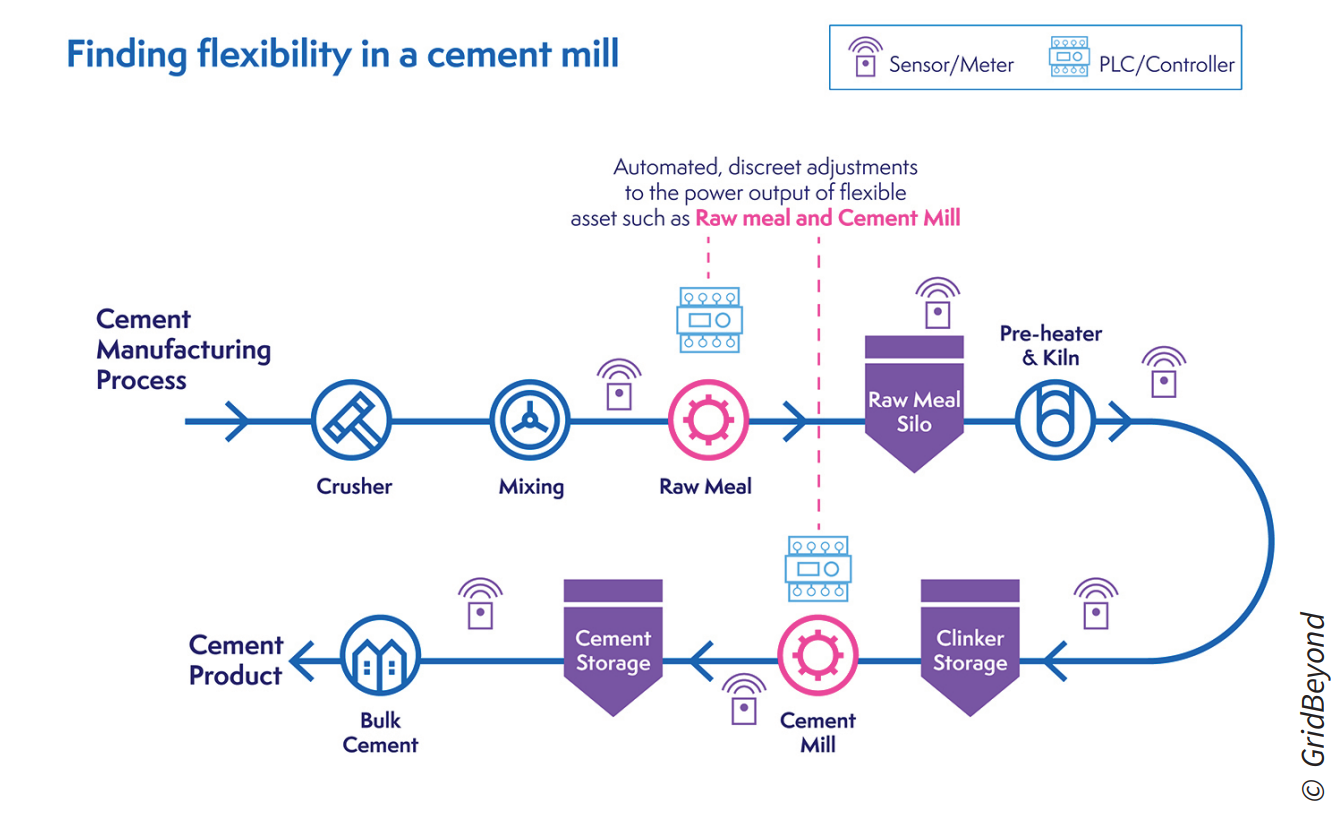

Case study: optimization of cement production for energy price risk

In this example, a cement plant was using power to operate throughout the day, despite the cost of power fluctuating across settlement periods. While the site had a series of fixed asset parameters, flexibility was found in the silo assets without impacting operations or overall product quality – providing an opportunity to make cost savings on electricity and generate revenue for the business.

By reducing production at the three silos on site when at (or near) maximum storage capacity and using ‘robotic trading’, energy flexibility was traded in the highest revenue markets. ‘Robotic trading’ refers to the automation of energy trades using AI to optimize costs and adjust consumption based on real-time market prices. This meant the plant earned revenue from flexibility offered in grid programmes in addition to avoiding the peak price power periods and reducing overall production costs. Production from the kiln, and further downstream in the operational process, was not impacted as these assets were classed as fixed asset parameters with hard constraints of operation.

As a result, GridBeyond’s solution saved the site GBP3.69m (US$4.79m) annually by forecasting market prices, shifting loads, and trading energy efficiently. This approach also led to a significant reduction in scope 2 emissions, enhancing the site’s environmental performance.

Conclusion

Energy is integral to the running of any business, but because energy prices fluctuate daily, buying energy at the right time and in the right amounts is critical. Managing increasing energy prices requires energy sourcing and risk management optimization. In the face of the volatile energy climate, businesses in the cement and aggregates sectors need to manage their energy costs proactively.

Advancements in technology have empowered producers to better manage production schedules in the face of energy price volatility. By harnessing the power of data analytics, AI and machine learning, companies can gain valuable insights into energy consumption patterns, identify cost-saving opportunities and optimize production schedules in real-time. Furthermore, taking a holistic approach to energy purchasing and asset optimization extends beyond electricity cost savings and also supports net-zero ambitions.

GridBeyond’s optimization software outperformed competitors by up to 40% in 2024

GridBeyond’s optimization software outperformed competitors by up to 40% in 2024 GridBeyond’s optimization software outperformed competitors by up to 40% […]

Learn more