Insights

better business decisions

Posted 2 years ago | 3 minute read

Cut demand, boost production, and prepare for a clean energy revolution, says OEUK

The UK’s new government must attract new investment in North Sea gas, oil, and wind – and reform power markets to bring down tariffs, while launching a national effort to cut energy demand, promoting measures like insulation, heat pumps and hydrogen, alongside maintaining its own oil and gas resources, according to Offshore Energies UK (OEUK).

OEUK’s Economic Report 2022: A Focus on UK Energy Security, published on 7 September, examines the impacts of the global energy crisis on the UK and the nation’s prospects for boosting future energy independence.

The report says the UK could face potential energy shortages and high prices this winter and warns that global prices could remain high for at least three years. Analysing the cumulative impacts of rising global gas prices on UK consumers it estimates that domestic consumers’ annual gas and electricity bills will have risen from about £32B in 2021 to around £100B once the next round of price rises takes effect in October. More price rises are predicted in 2023. “Businesses are even more exposed to changes in [global] gas prices as there is no protective price cap in place for non-domestic energy use […] If it was to be assumed that average spend this year was to treble (roughly the same rate of increase as the domestic price cap) then overall spend on electricity and gas by industry and businesses could rise to £108B, from £36B last year.”

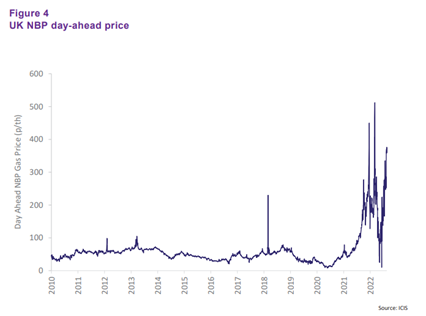

The report notes that the gas price had already been steadily going up last year as demand recovered quickly after the pandemic. Day-ahead contracts increased more than five-fold throughout the year, averaging 115p/th as supply and storage levels remained tight.

Prices and volatility increased further this year, with a day-ahead average of 198p/th to mid-August. This is 72% higher than the 2021 average and almost eight times higher than 2020 (25p/th). The average real price across the decade 2011-21 was 57p/th, reflecting relatively stable conditions for most of this period. But peak gas prices exceeded 500p/th in March for the first time on record, with some intra-day trades even reaching 800p/th.

The weekly average UK electricity price has increased by almost 500% since early 2021, from just over £50/MWh to £258/MWh at the end of June, and forward-looking prices for the coming winter are at a record £750/MWh.

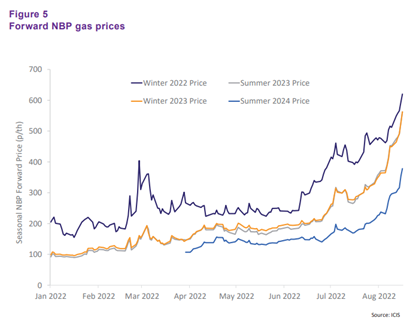

It is expected that gas prices will rise even further in the coming winter period, with forward prices increasing throughout the year. Forward trades in late-August are more than four times higher than at the start of the year. The forward price curve for winter 2022-23 is showing trades of over 800p/th, with winter 2023-24 prices over 700p/th and remaining above 250p/th until 2025.

The result is that the largest business consumers had seen unit price increases of 170% year on year for gas and 37% for electricity. Smaller companies had seen increases of almost 50% for gas and 30% for electricity.

The report suggests an action plan focused on a rapid acceleration of investment into North Sea oil and gas alongside a rapid expansion of offshore wind and reform power markets, while launching a national effort to cut energy demand, promoting measures like insulation, heat pumps and hydrogen, alongside maintaining its own oil and gas resources.