Insights

better business decisions

Posted 2 years ago | 3 minute read

Global clean energy investment outpacing fossil fuel spending

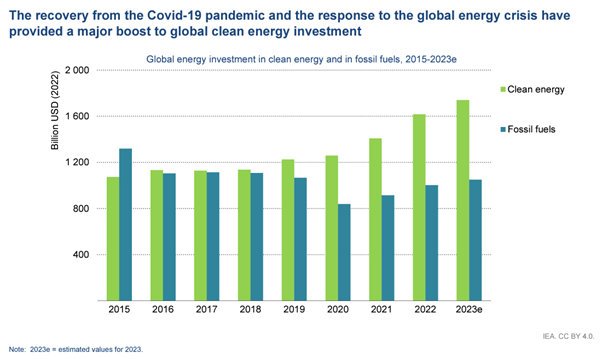

Global investment in clean energy technologies is surpassing spending on fossil fuels, and the energy crisis has further accelerated the momentum of the global green energy transition.

In its latest World Energy Investment report the International Energy Agency (IEA), predicts that investment in the world’s energy system will reach $2.8T in 2023, with over $1.7T allocated to clean energy technologies such as renewables, electric vehicles (EVs), nuclear power plants, power grids, energy storage, low carbon fuels, energy efficiency projects, and heat pumps.

While the remaining amount, just over $1T, is still predicted to be invested in coal, oil, and gas projects, the IEA emphasises that clean energy technologies are progressing faster. The shift in momentum is evident as clean tech investment is expected to increase by 24% between 2021 and 2023, driven primarily by renewables and EVs, compared to a 15% rise in fossil fuel.

Solar energy is highlighted as a prime example of the scale and scope of the clean energy transition, with investments projected to exceed the funding directed towards oil production for the first time this year, with an estimated amount of around $380B. The report also indicates that nearly 90% of global investment in new power generation will be allocated to low carbon electricity technologies.

Battery storage investment has more than doubled worldwide between 2021 and 2022 and is expected to double again in 2023. The report notes the significant growth in global heat pump sales for two consecutive years and a 55% increase in EV sales in 2022, reaching approximately $400B.

Source: IEA

GridBeyond Managing Director Mark Davis said:

“One major effect of the global energy crisis has been to accelerate the deployment of clean energy technologies. While this is good news for the net zero agenda, tight supply chains and higher input costs are pushing up renewable project costs in many markets, especially for behind the meter investments in renewables, battery storage and electrification of assets and vehicles”.

“At GridBeyond we provide a range of finance agreements so you can buy renewable energy equipment for your growing business. Working with a leading investment fund, we have access to an asset financing facility that can help charge point operators implement projects that help them save money on their energy bill or take advantage of additional income by selling the energy. We can also help finance projects where income will be generated from selling energy generated via a Corporate Power Purchase Agreement.”

CapEx-Free Battery | Resilience, carbon reduction and revenue

GridBeyond understands the complexities of battery storage technologies and will work with you to install on-site battery storage system that provides clean, stable and uninterrupted energy supply, eliminating the risk of grid disruption. All at no up-front cost to your business.

Learn more