News

better business decisions

Posted 4 years ago | 5 minute read

Government lifts Capacity Market procurement target

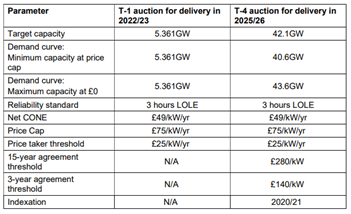

The government has lifted the procurement target in the Capacity Market for the upcoming T-1 auction being held on 15 February.

In a letter to National Grid, published on 25 January, it was confirmed that the auction demand curve is now confirmed to be 5.361GW for the 2022-23 power capacity auction. This is 14% above National Grid ESO’s recommended target of 4.7GW, with the Business Secretary Kwasi Kwarteng attributing the decision to “the broader uncertainties within the power sector.” The 5.361GW target equals the total amount of prequalified and conditionally prequalified capacity for the auction, which would force the auction to clear at the price cap of £75/kW.

The pre-qualified capacity for T-1 is made up predominantly of gas assets (~3GW), more than 1GW of battery storage has also pre-qualified.

T-1 participants have until 1 February to notify National Grid ESO on their intent to proceed or withdraw from the auction.

Meanwhile, the T-4 auction (being held 22 February) procurement target has been reduced by 500MW to 42.1GW to “account for small technical considerations”, including the prequalification decisions of nuclear plant and a consequential lower maximum non-delivery risk.

Source: BEIS

While this decision from the government was unexpected it is important to take account of the wider market situation. On 24 January National Grid ESO issued its first Capacity Market Notice of the year. Meanwhile the UK is facing a convergence of energy-related issues that are exacerbating volatility in the energy market, including high energy prices, increasing renewables and security of supply concerns.

Gas price volatility

In the last few months of 2021, a combination of factors pushed wholesale gas prices up to severe and long-lasting highs. The result was that energy bills across the world rose. But in the UK, the system designed to keep prices as low as possible for domestic consumers presented a problem. Once spot prices for gas rose beyond the retail price cap, operating costs for utilities soared as prices rose and energy use increased into colder months. The result was that, to date, over 30 suppliers in the market failed.

Citizen’s Advice estimates that supplier failures since August 2021 will cost consumers £2.6B – around £94 per customer from 2022 – this figure does not include the initial £1.7B set aside by the government to keep Bulb running.

In addition, many firms in energy intensive industries began rationing production or halting operations. In the UK, for example some rail freight companies made the switch back to diesel due to electricity prices and CF Fertilisers paused production as natural gas prices made its operations uneconomic – a move which had knock on impacts to supply chains.

This has resulted in calls from industry and trade bodies for the government to intervene. While the long-term discussion centres on systemic reform of the energy market, many believe that consumers need relief now to prevent a cost-of-living crisis and shorter-term discussions have included debates over tax reliefs and how to fund the transition to a net zero energy sector.

A changing sector

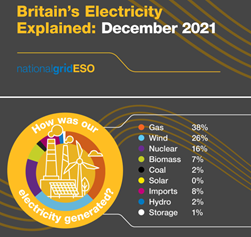

This volatility comes at a time when National Grid ESO, is facing increasing challenges to manage a power system with increasing levels of renewables generation. The UK relies on gas for approximately 40% of its electricity generation, wind makes up a further quarter, but as an intermitted source it presents a risk, as when wind is not blowing energy markets turn to gas to bridge the gap.

Source: National Grid ESO

However, recent government policies aimed at supporting the transition to a net zero energy sector have meant that fossil-fuelled power plants aren’t being replaced at the same rate as they are being decommissioned. In addition, it is expected that around 4GW of baseload nuclear capacity will shut by 2024.

Geopolitical concerns

Concerns around the vulnerability of the UK energy market have also been called into question as tensions rise between Russia, Europe’s biggest gas supplier, and Ukraine have reignited fears that gas exports could be restricted. Gas plants were already in high demand over the past year after slow wind speeds reduced Europe’s renewable energy output in 2021. This played a role in draining Europe’s gas storage facilities to record lows after a long, cold winter last year.

GridBeyond viewpoint

GridBeyond Managing Director UK & Ireland Mark Davis said:

“The stakes are high, when it’s not windy, our reliance on gas is higher, but prices have risen almost fourfold in the past year. Decommissioning thermal generation is commendable in terms of delivering our national goal of becoming a more sustainable country, however, the lack of resilience is causing problems across the network as we don’t yet have a dependable alternative safety net, and this is increasing the risk further. Its increasingly likely that gas will have to be considered the transitional fuel to ensure we have energy security as we move towards our Net Zero goals.

“The aim behind the Capacity Market is to provide an incentive for generators to invest in assets that can provide guaranteed capacity when called upon, but prices over recent auctions haven’t been high enough to encourage new build. Although some assets that have pre-qualified under the T-1 auction are not yet complete (812MW of gas plants that pre-qualified are under construction) the high clearing price, combined with the high penalties under the programme, will act as a significant incentive to ensure projects are completed.

“Through our Capacity Market Clearing House, developed over the last two years, GridBeyond has supported a large number of clients and generators in matching short or long positions regarding their capacity obligation so that they avoid the penalties that the delivery body can bestow whilst also optimising their revenue opportunities.”