News

better business decisions

Posted 2 years ago | 2 minute read

GridBeyond secures 254MW of T-1 capacity

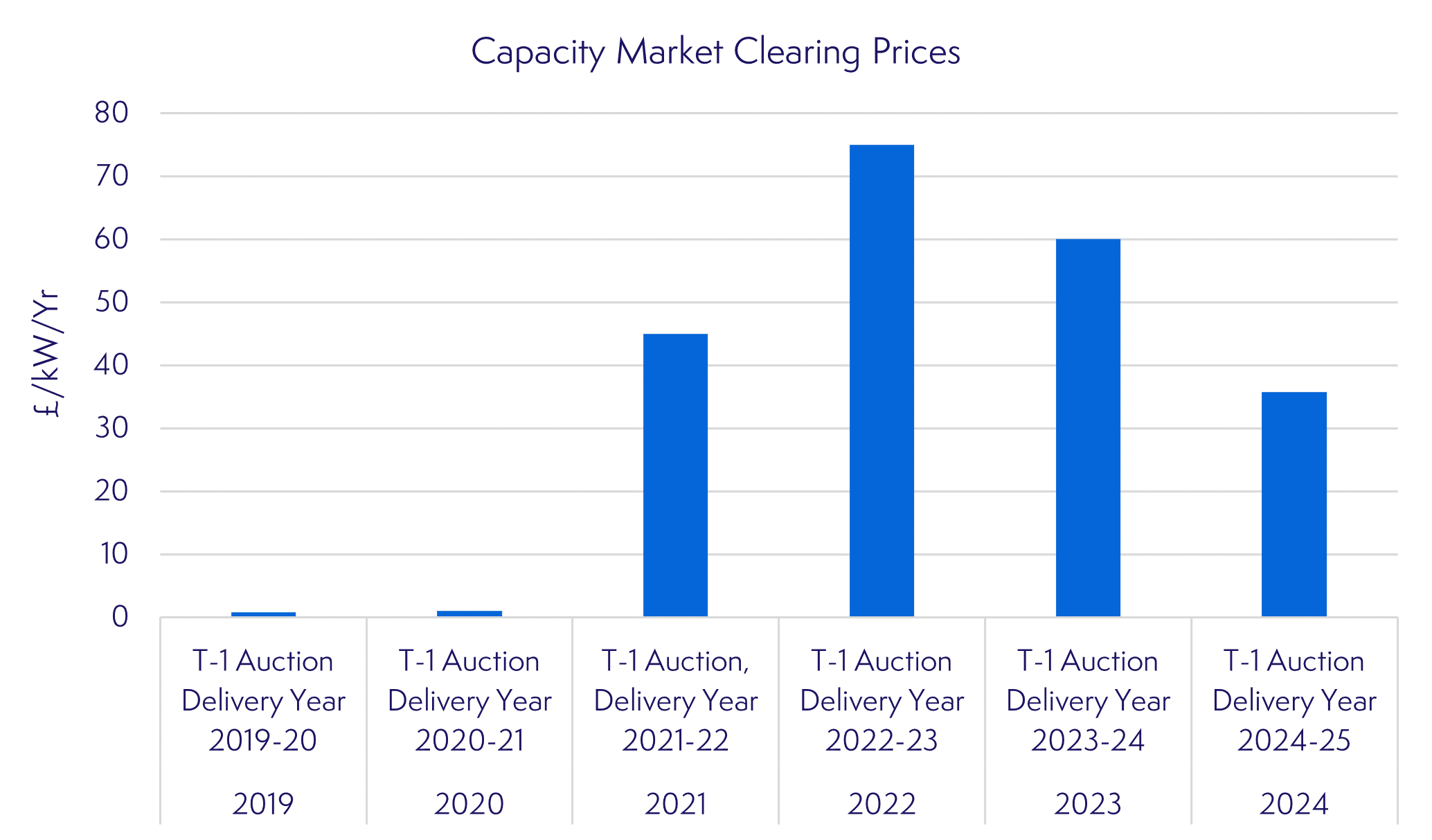

GridBeyond has secured 254MW – the largest T-1 position for demand side response – in the T-1 Capacity Market auction clearing at £35.79/ kW/year.

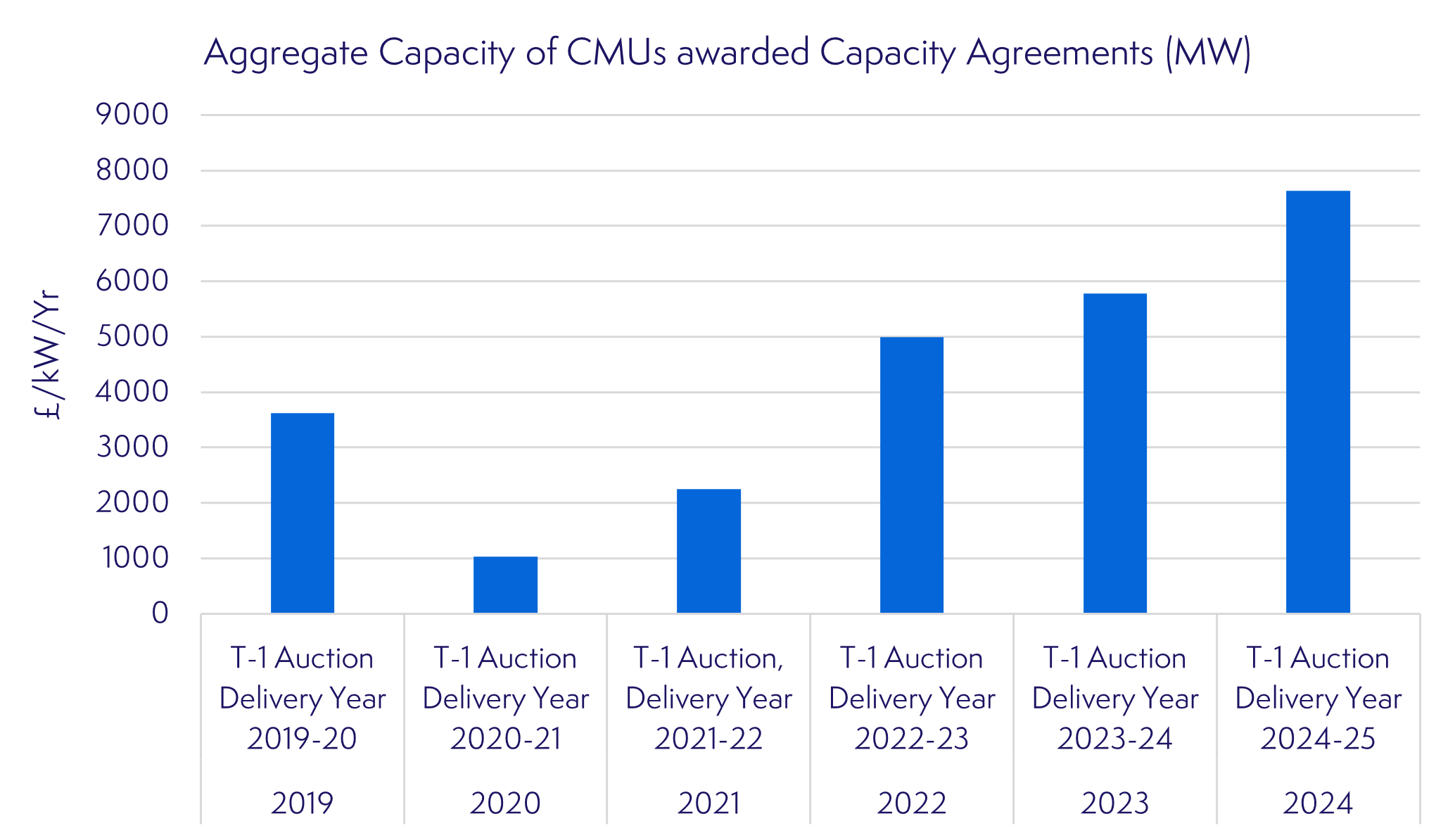

In the auction, which took place on 20 February, the T-1 Capacity Market auction has cleared at £35.79/kW. Under the auction 7639.609MW has been procured across 277 CMUs. By technology type 81.3% was awarded to existing generation, 9% to new build projects and 9.7% to proven and unproven demand side response assets.

Launched in 2014, the Capacity Market is a mechanism introduced by the government to ensure that electricity supply continues to meet demand by offering to pay providers for making supplies available at short notice.

The awarded capacity will come from:

- Gas (2943.79MW),

- Demand side response (710.08)

- Battery storage (655.16MW)

- Nuclear (2767.26MW)

- Other sources (1610.57MW)

Although the £35.79/ kW/year value achieved is lower than previous T-1 auctions, the aggregate capacity of CMUs awarded agreements has increased compared to previous auctions.

Overall, the latest T-1 auction procured a higher amount than over previous years (over 32% more aggregate capacity than the previous auction.

Given the significant value achieved, GridBeyond has enabled multiple customers to directly participate in the T-1 auction. Providing pre-qualification services prior to the deadlines, enabling projects to meet project-specific milestones, and facilitating the bidding strategy and execution in the T1 auction.

Between the last four auctions there has been a stark increase in the volume of new build generation awarded contracts. But the high penalties under the programme (which were recently increased) will act as a significant incentive to ensure new capacity comes online.

Mark Davis, GridBeyond COO commented:

“It is fantastic that GridBeyond have been able to support our extensive and longstanding customer base of industrial, commercial, and battery storage customers access the capacity market, an increasingly important and significant revenue stream.

“For demand side customers this is offsetting increased energy costs, demonstrating how GridBeyond has been able to identify and utilise flexibility in production processes to access capacity market value. Further, we have been able to support new build Batteries access secure income to complement the market-leading value that can be earnt via the GridBeyond trading and optimisation suite”.