Insights

better business decisions

Posted 3 years ago | 6 minute read

Sharing is Caring | UK Gas and Power Exports Volumes Versus 2021

Guest blog from Sam Peek, Senior Analyst at Cornwall Insight

It is perhaps unsurprising to highlight that global energy markets have been exposed to significant volatility in recent years. Whether this be through the emergence of a global pandemic, dampening demand and drastically altering consumption behaviour thereafter, to the Russian invasion of Ukraine which resulted in significant changes to historic levels of energy exports to Europe from Russia.

Earlier this year, before the entrance into the summer season, we began to observe that the historic relationship between UK net imports with the continent was changing. Historically, the UK has been a net importer of both gas and power since the early 2000’s – meaning that, in its simplest terms, the volume of gas and power imports was higher than what the UK was sending back across to our interconnected markets. However, from May of this year, the UK has seen a notable alteration in its power and gas import volumes. In fact, for the last ~seven months on average, the UK has been a net exporter.

Whilst the trend of UK gas and power export volumes share the same overarching switch from traditionally being net importing to net exporting, the market fundamentals that have influenced this change are somewhat separate.

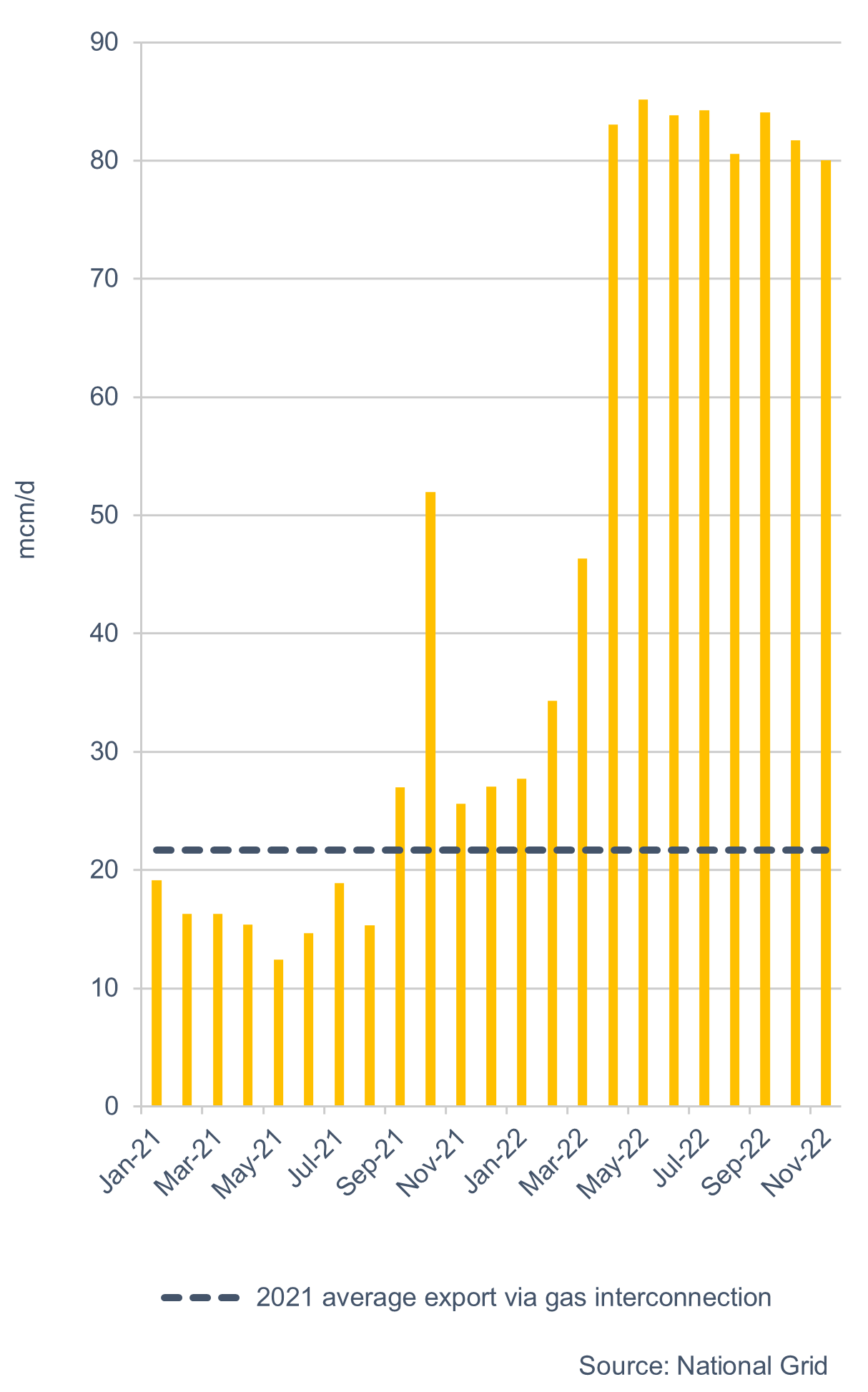

Starting with gas, in response to the Russian invasion of Ukraine, the European gas market has seen a dramatic reduction in its level of natural gas received from Russia, with now only two operational gas pipelines open (flowing under 2bcm in October on average, compared with ~10bcm in October 2021). As a result, the European gas market has increasingly sought to find alternative gas supply in efforts to assure demand can be met as we head into the higher demand winter season. The dependence on Liquified Natural Gas (LNG) has therefore increased significantly. Europe, whilst having terminal capacity to facilitate additional LNG imports to some of its operational LNG landing terminals in places like Belgium, Holland and Germany – has not been able to accommodate these volumes at the rate needed. On the contrary, the UK is somewhat uniquely positioned geographically to receive high volumes of LNG via its deep-water ports. As such, and as part of efforts to assist the European gas market in keeping a steady supply of LNG coming westward from places like the USA and Qatar – the UK continues to act as a ‘gas transit hub’.

The UK has been receiving significant levels of LNG, which is then processed, regasified and then able to be passed through the UK National Transmission System (NTS) and sent out via our gas interconnectors such as the IUK (Belgium) and Balgzand to Bacton Line (Netherlands). The result of this strong influx of LNG reaching the UK is that a significant volume of gas is being piped back out to the continent, resulting in the significant rise in gas export volumes from ~May 2022.

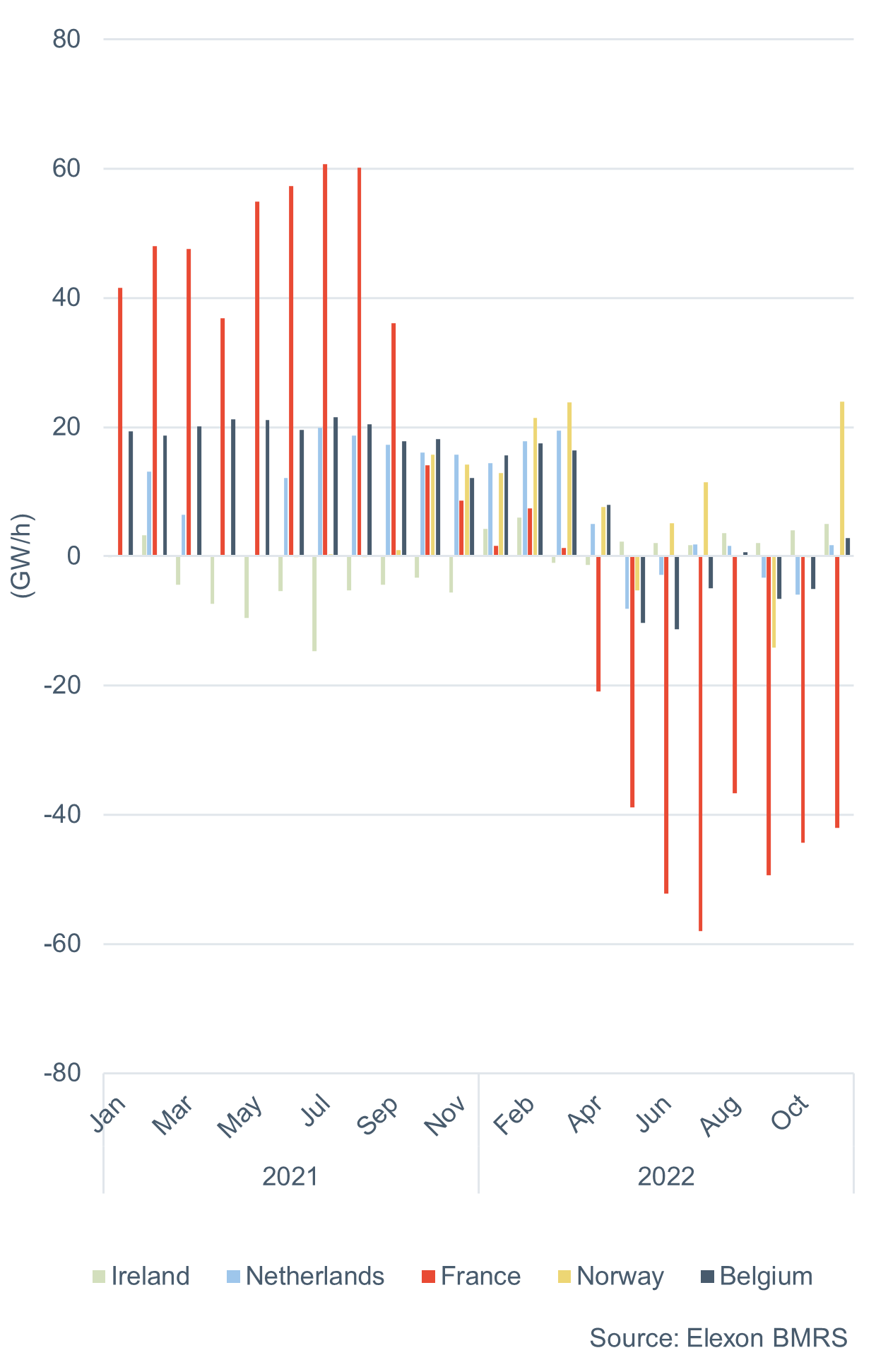

Power exports from the UK to Europe via our eight operational power interconnectors, six of which connect the UK to continental Europe, have also seen a dramatic shift compared with the historic import/export trends. Much like gas, from the beginning of this summer, a shift to the UK being a net exporter of power emerged. The catalyst for this change can be, at least in part, traced back to the Russian invasion of Ukraine. From a wholesale cost of energy perspective, many of the European countries the UK shares interconnection which have seen significant rises in their domestic power prices. The French day-ahead baseload power price has traded at a premium to the UK since the start of 2022, trading ~14% higher on average compared with the UK in £/MWh terms. Power flows will almost always follow the highest price and with French power prices trading at a notable premium to the UK to date, the UK has been incentivised to flow that volume to France. As we show in the chart, the level of exports to France from the UK has been significant this year.

Another key proponent of increased levels of power exports to France has been the significant outages experienced across the French nuclear fleet. Approximately 50% of French nuclear capacity has been offline since February 2022, with 25GW still offline as of the end of October 2022, albeit ~50% of this is expected back online in November. Nevertheless, the heavily depleted and sustained period of reduced nuclear availability has pushed French domestic power prices higher. This has also resulted in the UK exporting power to France in recent months whereas, historically, France would have been sending power to the UK as a net exporter.

Higher power export volumes have not only been isolated to France. Norway has also experienced a significant shortfall in hydroelectric power production. A particularly dry and warm summer period saw hydroelectric power production and subsequent reservoir levels sit at ~20pp below average levels (in market bidding zones NO1, NO2 and NO5). The reduced hydroelectric power production stimulated higher domestic power prices much like France, encouraging higher export volumes from the UK.

The result of this change overall has seen a unique shift in the last ~seven-months in which the UK has transitioned from a net importer to a net-exporter. Undoubtedly, a significant catalyst for this change has been the Russian invasion of Ukraine and the snowball effect on the global supply chain. With that being said, other isolated events to affected markets like France, Norway, Belgium etc. have contributed to a ‘perfect storm’ of market developments and have pushed power prices higher on the continent while positioning the UK uniquely as a net exporter of both power and gas.

As far as future expectations, whilst European wholesale prices remain high and issues over power generation remain, we could expect to see this trend extend throughout the winter into 2023 and possibly beyond.

UK monthly interconnector power flows

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.