News

better business decisions

Posted 4 years ago | 4 minute read

Forwards, futures and real-time energy markets | Benefits of robotic trading

In the pursuit of net-zero, energy markets around the globe are growing in both speed and complexity. Market volatility is the “new normal”, and the accelerating growth of renewable generation makes the planning, trading and optimisation of energy increasingly challenging. While many “solutions” are being examined and tested worldwide, the key to many of them is to design a market that places an appropriate value of flexibility. To support this, we need better price signals that are more reflective of the short-term market conditions and robotic trading to maximise opportunity.

In a recent interview GridBeyond’s Head of Trading and Optimisation, Paulo Sobral, said:

“Real-time trading can be as short as 30 minutes, 15 minutes, or five minutes, depending on the market you are operating in. A lot of adjustments are made in real-time, mostly by ancillary services. But increasing volatility is likely to put more pressure for systems to shift further towards real-time, possibly down to one minute in advance or even less if technology continues to evolve.”

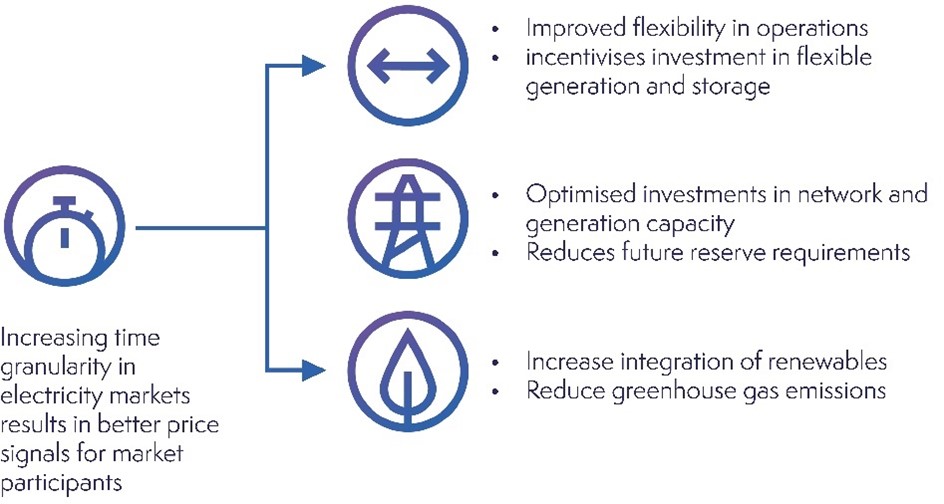

Benefits of real-time markets

Increased time granularity in electricity markets, both with regard to market time units and nearer to-real-time gate closure times, helps system operators to manage the grid more effectively. The challenge is that in volatile and real-time markets, the market signals occur in intervals that are too short for human traders to keep up and respond effectively to. The solution? Robotic trading.

But what is robotic trading?

Robotic trading is a process whereby fully automated trading software is able to buy and sell on the market. Trading robots are developed with a set of parameters that help them to make intelligent decisions. The way they work varies, although generally, the software will consider the market position and opportunities for trading, then match this with your strategy, accepted level of risk and your ability to shift load. If an opportunity is identified that fits within your predefined strategy and rules, automated trading can be used to place trades at a high frequency, much faster than is possible through manual trading.

But key to maximising on every opportunity is forecasting how markets are going to move. This is made possible by using artificial intelligence (AI) and machine learning to conduct in-depth analysis of multiple factors, benchmarks, and historical data such as weather forecasts that affect volumes of renewable generation, operations of interconnectors, and demand patterns.

By doing that, your trading robot can accurately predict market movements and take full advantage of its volatility in as close to real-time as possible.

GridBeyond Chief Technology Officer and Co-founder, Padraig Curran, said.

“Once you have a good view of what is going to happen, this insight helps power your robotic trading strategy. AI powered-technology helps you predict where the price will go in the market, enabling a trading robot to conduct the transaction in the most optimal circumstances and at the best price.”

Successful application of robotic trading requires deep industry knowledge. Having the personnel with the right expertise to create algorithmic trading strategies, refine these continuously, and understand, manage and process the data sets used for predictive analysis is crucial.

GridBeyond’s advanced trading platform provides direct access to the markets. By using robotic trading, AI and machine learning algorithms, consumers are able to purchase their power at its cheapest in the intra-day and day-ahead markets, whilst monetising their flexible demand and excess generation and better managing the financial risks.

If you have any questions around the potential for smart trading on your site, contact our friendly team, or to learn more about the complimenting services offered by GridBeyond’s intelligent energy platform, download the energy services brochure.