Insights

better business decisions

Posted 3 years ago | 3 minute read

Renewable energy to become the world’s top source of electricity by 2025

Renewable energy will become the world’s top source of electricity within three years, according to the International Energy Agency’s (IEA) Electricity Market Report 2023.

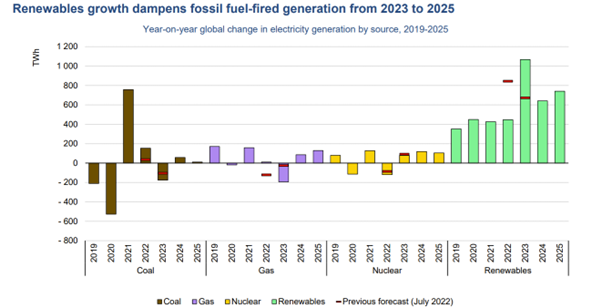

Published on 8 February the report noted that renewables saw a year-on-year rise of 5.7%, making up almost 30% of the generation mix globally. Looking ahead the IEA forecast that 90% of new demand between now and 2025 will be covered by clean energy sources like wind and solar, along with nuclear energy. This growth in output means that renewables will become the world’s largest electricity source within three years – providing 35% of the world’s electricity and overtaking coal. This trend is supported by government pledges to increase spending on renewables as part of economic recovery plans such as the Inflation Reduction Act in the United States.

Battery systems are expected to play a growing role by providing frequency control and operational reserves as well as for wholesale arbitrage, while helping reduce grid integration costs. The deployment of stationary battery systems is speeding up. The United States, Europe and China are leading the latest annual capacity additions. Compared with 2021, capacity additions in 2022 rose by over 80% in the United States, roughly 35% in Europe, 90% in OECD Pacific (i.e. Japan, Korea, Australia and New Zealand). In 2022, the largest fleet of cumulative battery systems installed remains in the United States.

The energy crisis sparked by the Russia’s invasion of Ukraine has been characterised by record-high commodity prices, weaker economic growth and high inflation.

Of the countries surveyed, the UK saw the sharpest rise in average wholesale electricity prices.

In the United States, the average wholesale price in H2 2022 stood at about $91/MWh, more than twice the 2019-2021 second-half average, and 65% higher than the price in H2 2021. This increase was driven by exceptionally high gas prices. Japanese wholesale prices in H2 2022 averaged almost YEN 22 000/MWh, three times higher compared to H2 2021 because of the tight supply situation. However, the majority of the imported LNG volumes is contracted under oil-indexed long-term contracts which alleviated some of the effects of soaring spot prices. In 2022, Australian wholesale prices averaged AU $170/MWh, more than double the H2 2021 levels.

Higher fuel prices increased the cost of electricity generation around the world, putting downward pressure on consumption in many regions. Comparing the first three quarters of the years, both the UK and Spain experienced the lowest industrial electricity consumption in over 20 years in 2022. Spain saw a decrease of more than 10% compared to 2019, while the UK posted a drop of almost 15% in 2022 versus 2019. As the energy crisis abates, global electricity demand growth is set to rise from 2.6% in 2023 to an average 3.2% in 2024-2025. This stronger growth is well above the pre-pandemic rate of 2.4% observed in the 2015-2019 period. The relatively higher increase in natural gas and LNG prices prompted a wave of fuel switching in the world to coal for use in power generation. Global coal-fired generation rose by 1.5% in 2022.