News

better business decisions

Posted 1 month ago | 5 minute read

Taking part in the Capacity Market: what are the benefits

The Capacity Market scheme was introduced in 2014 as part of the Electricity Market Reform scheme. It is the government’s principal mechanism for securing sufficient electricity supplies to meet future peak demand. The scheme ensures security of electricity supply by providing a payment for reliable sources of capacity, alongside their electricity revenues, to ensure they deliver energy when needed.

In this article we explore the benefits of taking part in the Capacity Market.

About the Capacity Market

The programme has an annual delivery cycle. Two auctions are held each year with the auction targets set in July and later updated just ahead of the auctions. Capacity can apply to prequalify for the auctions from July to September, with auctions taking place a minimum of ten weeks from the Prequalification Assessment closing.

The programme secures electricity capacity through competitive auctions held four years ahead of the delivery year, known as the T-4 auction; and one year ahead of the delivery year, the T-1 auction, to effectively “top up” capacity closer to the delivery year (based on the latest information available such as the latest electricity demand forecast, and any commercial information).

Capacity providers receive regular payments in exchange for their capacity being available when consumers need it most i.e., when consumer demand is high compared to available electricity supplies. Capacity providers may face financial penalties if they fail to deliver against their agreements.

The auctions are a competitive process therefore it is not possible to precisely know what the costs of each auction will be in advance. The costs depend on the number of entrants/ volume of capacity bidding into each auction, which can drive the clearing price up or down, though this is limited to what is proportionate and necessary through the parameter setting process and various controls embedded into the scheme.

Value of participation

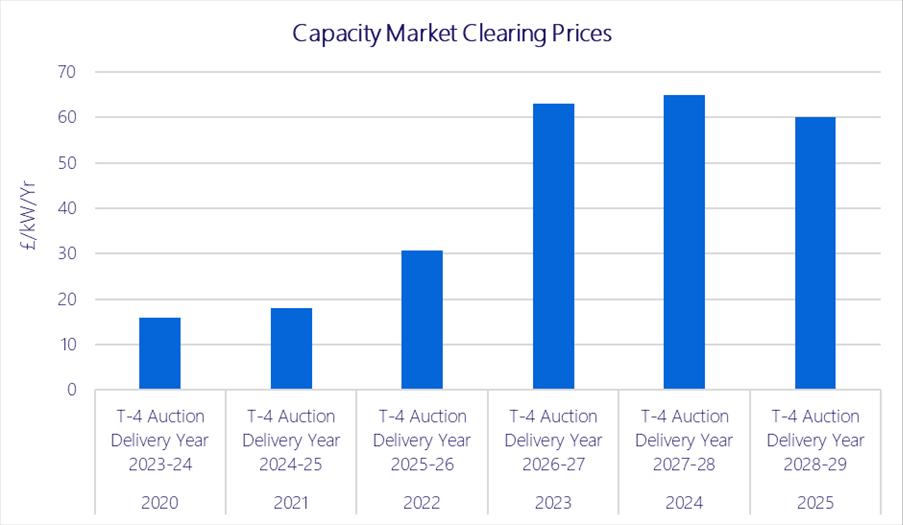

In last year’s auctions the T-1 Capacity Market auction for 2025-26 Delivery Year cleared at £20.00/kW/year, a 44% drop from the £35.79/kW price seen at auction for the 2024-25 Delivery Year. Clearing in Round 11 on 4 March, the price was broadly in line with expectations. The Capacity entering the auction is 9,122.961MW of de-rated capacity (86.99% awarded an agreement) of which GridBeyond had 298MW of qualified capacity.

The T-4 Capacity Market auction for 2028-29 Delivery Year cleared at £60.00/kW/year. Originally clearing at a range of £60/kW to £65/kW in Round 3 of the auction, 43,055.073MW of capacity was procured across 669 CMUs of which 3.8GW was from new build generators, compared to the target of 43,700MW.

2026 Capacity Market auction parameters set

In a letter to National Grid ESO, published on 15 July 2025, the government confirmed the parameters for the next Capacity Market auctions (the T-1 and T-4 auctions planned to take place in March 2026).

These include a total target capacity of 40.1GW for that Delivery Year, of which I 1GW is to be set aside for the associated T-1 auction, leaving a target capacity of 39.1GW to be procured through the T-4 auction. For the T-1 auction for 2026-27 Delivery Year target capacity is set at 5.8GW.

This followed a report by the Department for Energy Security and Net Zero (DESNZ) independent Panel of Technical Experts (PTE) that considered the target capacity recommendations by NESO.

The March 2026 auctions are expected to clear at relatively subdued levels in the T-1 auction, but the T-4 auction could clear at materially higher levels, reflecting tighter long-term capacity margins driven by plant retirements, rising demand from electrification, and increasing reliance on a smaller pool of dispatchable and dependable capacity.

This is reinforced by the £60/kW clearing price observed in recent T-4 auctions, which appears to have reset market expectations, and by emerging policy signals indicating a greater willingness to pay for enduring capacity to maintain security of supply.

Upcoming changes

In October 2025 the government set out a consultation on reforming the Capacity Market to ensure continued security of supply, align the scheme with the government’s decarbonisation goals, and improve the functionality of the scheme.

The consultation sought views on the following areas:

- multiple price Capacity Market: implementing targeted price-related reforms to ensure security of supply is cost-effectively maintained. This will be achieved by introducing a second, higher, price cap into the auction that could, if needed, secure new build dispatchable enduring capacity that can generate power over prolonged periods of tight supply.

- ensuring efficient bidding in Capacity Market auctions: a package of interventions to reduce information provided to participants before and during auctions that will increase uncertainty relating to the expected gains and losses from bidding strategically and thereby ensure efficient bidding that maximises value for money.

- consumer-led flexibility: implementing additional delivery assurance processes in relation to consumer-led flexibility assets entering the Capacity Market, both from an operations perspective and the Capacity Market value attributed to diverse consumer-led flexibility technologies in providing system response.

- self-nomination of connection capacity for battery storage technologies: allowing battery Capacity Market Units to self-nominate their connection capacity below their full network connection capacity to mitigate the risk of failing extended performance testing due to degradation.

- determining appropriate means for non-fossil fuel generation to access low carbon Capacity Market mechanisms: introducing appropriate sustainability criteria for biogenic sources to evidence against, which could enable them to access low carbon benefits in the Capacity Market.

- further improvements to Capacity Market administration and delivery assurance: ensuring clarity of the Rules by proposing policy clarifications, amendments and revocations, as well as introducing a Termination Fee for Termination Events that currently have no fee associated. These proposals also seek to improve value for money by suspending payments for Capacity Market Units that are subject to an Insolvency Termination Event.

The government will consider feedback from industry and other stakeholders before finalising the rules, with changes expected to be implemented ahead of the 2026 pre-qualification window.

Capacity Market Auctions 2025-Winners and losers

In this paper we take a look at results from recent Capacity Market auctions and examine which technologies emerged as the winners and how the mechanism could change in future auctions.

Learn more