News

better business decisions

Posted 4 years ago | 7 minute read

The cryptocurrency conundrum: The energy impacts

Tesla CEO Elon Musk’s recent u-turn over accepting Bitcoin and the crackdown on the currencies from China have once again thrust the energy usage of cryptocurrency into the spotlight.

To understand why and how Bitcoin uses energy, we first need to understand its underlying technology: blockchain. It is important to recognise that Bitcoin is just one cryptocurrency, which is one application of blockchain. Blockchain is the key technology that enables the existence of cryptocurrency. Blockchain is a special technology for peer-to-peer transaction platforms that uses decentralised storage to record all transaction data. The ledger is held, shared, and validated across a distributed network of computers running a particular blockchain software.

Blockchains vary considerably in their design, particularly with regard to the consensus mechanisms used to perform the essential task of verifying network data. But the lack of a centralised authority means that blockchain needs a “consensus mechanism” to ensure trust across the network. In the case of Bitcoin this consensus is achieved by a method called “Proof-of-Work” (PoW), where computers on the network – miners – compete to solve a complex puzzle based on an advanced form of mathematics called “cryptography”. This is why digital coins are called “cryptocurrencies”. Crypto miners like the more traditional ones are spending energy to get resources, here the computing energy and the energy to power the computer to mine and get the coins.

Once the puzzle is solved, the latest “block” of transactions is approved and added to the “chain” of transactions. The first miner to solve the puzzle is rewarded with new Bitcoins and a transaction fee. One of the defining components of PoW systems is the electricity use needed to make the calculations that verify transactions. This is because of the significant computer power needed to solve the puzzles that is increasing more and more as the total number of coins available to mine diminishes.

Consumption and competition

The energy use of the Bitcoin network is a security feature under a PoW system and a side effect of relying on the computing power of competing miners to validate transactions. The high energy use is a result of the way that the cryptographic puzzle is created meaning the only way that it can be solved is by using trial and error. While computers can generate millions of different combinations per second, this requires a large amount of electricity.

Over the recent years there has been an emerging trend for miners to operate in areas where there is an overproduction of green energy and therefore lower electricity prices – the 3rd Global Cryptoasset Benchmarking Study by the University of Cambridge shows that 76% of cryptocurrency miners use electricity from renewable energy sources as part of their energy mix. However, green energy, while not reducing the amount of electricity consumed by PoW blockchains or the need for cooling, does reduce the overall carbon footprint of the industry.

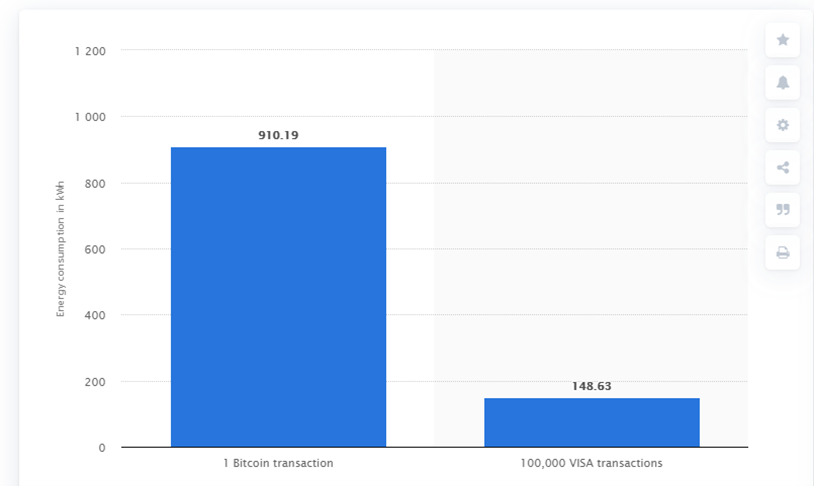

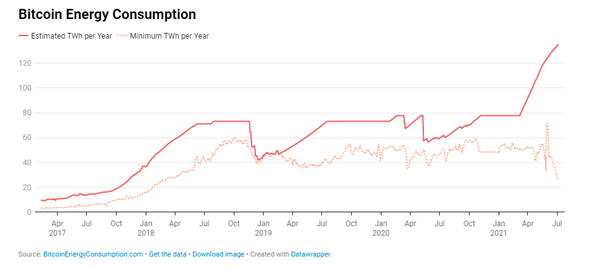

Data from the University of Cambridge estimates that Bitcoin alone has an annualised consumption of 151.16TWh – this compares to the total electricity consumption of the UK at around 325TWh. To put this into perspective we can compare it to another payment system like VISA for example. According to Statista the average energy consumption per transaction for Bitcoin is 910KWh this compares to VISA at 148KWh to process 100,000 transactions.

Intervention from China

In June 2021, the People’s Bank of China, which is the central regulatory authority that regulates financial institutions, issued a statement that it would block access to all domestic and foreign cryptocurrency exchanges and ICO websites. China’s Postal Savings Bank followed up with a statement explaining that it will not allow cryptocurrency transactions in any manner. This follows mandates from government officials that banned bitcoin mining across multiple regions of China due to concerns over its environmental impact.

China accounted for between 65% and 75% of all Bitcoin mining, but the new rules mean an estimated 90% of China’s Bitcoin mining capacity has been ordered to shut down. The result of the renewed crackdown was that more than 54% of bitcoin’s hashrate dropped off the network since its market peak in May and that the bitcoin code re-calibrated to make it less difficult to mine. Fewer competitors and less difficulty means that any miner with a machine plugged in is going to see a significant increase in profitability and more predictable revenue.

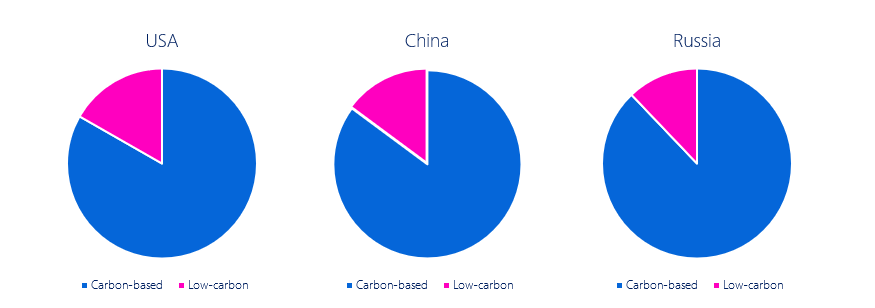

The energy consumption of the network also fell significantly following the announcement from China. But this drop may not be sustained as the miners are expected to land in other countries around the world. This could mean that, in the short term, the carbon impact of the network isn’t likely to decrease, despite the rulings from China. Market commentators are suggesting the USA or Russia are likely to become home to many of the miners. But if you take a look at the energy mix of these countries there is very little difference in levels of low-carbon generation meaning the carbon impact of the network is likely to creep back up as miners re-locate.

Greening up the sector

An alternative to the PoW model is proof of stake (PoS). Examples of blockchains already using PoS are Cardano (ADA) and Polygon (MATIC).

Under this design, instead of miners authenticating individual transactions, the blockchains have validators. Unlike in the PoW model, no energy-intensive computational process to earn the right to validate. Instead of working to solve proofs of work, validators “stake” tokens native to the blockchain to serve as collateral. To validate a transaction block, the system would randomly select a validator to confirm the data. While random to an extent, certain variables can make it more likely for a validator to be chosen, including the number of tokens a validator has staked. When the block is confirmed that validator is rewarded with network transaction fees, and the process begins with a new block.

Unlike a PoW system, where if the value of the network rises, the energy consumed must generally also rise, as it is the cost of that energy that protects the value stored in the network, in a PoS network, there is no such dependence, and the energy consumed is much lower.

In terms of energy use, PoS blockchains are arguably better for the environment than PoW networks. Although the system still uses a cryptographic algorithm, as users are selected rather than competing with each other to solve the puzzle they require significantly less computing power, and therefore consume much less electricity.

But it is not easy to switch a blockchain from one consensus protocol to another. Ethereum is proof of this. Its transition from a PoW protocol to a PoS protocol, which should be fully implemented in 2022, has been the result of several years of research.

Value beyond Bitcoin

Crypto currency miners have significant potential beyond just mining. As with crypto currency markets, energy market prices are volatile. But in some instances, the price/kWh paid can be above the value for Bitcoin/kWh mined.

Using AI and Robotic Trading combined with the expertise of our trading experts and Data Scientists, GridBeyond’s Point Ai. Services open the door for your business to take your energy strategy from passive purchasing and consumption to active energy management and trading.