News

better business decisions

Posted 1 year ago | 2 minute read

Unlock new revenue with P415

Flexibility from demand response, distributed energy resources (DERs), electric vehicle (EV) charging hubs, and other behind-the-meter assets can now be sold into the wholesale market.

In the past, independent aggregators managed flexibility but were unable to participate directly in wholesale markets. With the implementation of P415 “Facilitating Access to Wholesale Electricity Markets for Flexibility Dispatched by Virtual Lead Partners (VLPs)” a wider range of participants are now able to optimise flexibility across the entire value stack of services in both energy and ancillary markets.

The implementation of P415 provides an opportunity for these consumers to access day ahead and intra-day wholesale market without the need for trades to go through the supplier, providing and incremental revenue stream and increases revenue opportunity. But optimising asset requirements for participation can be a challenge that requires the right technology and expertise.

By forecasting everything from weather conditions to short-term wholesale market prices, GridBeyond helps you manage your energy purchasing and on-site assets in real time. Our AI forecasting solution, uses advanced trading strategies, real time forecasting, and analytics-driven decision support to create a solution that will optimise your financial returns.

With potential revenues of £7-20k/MW/year, now is the time to monetise your flexibility and take full advantage of P415.

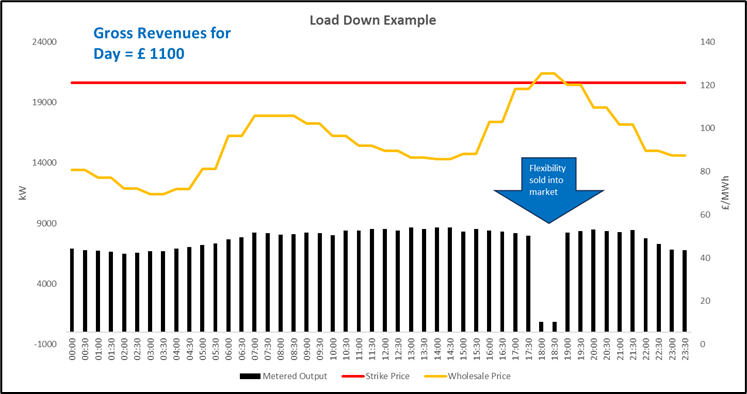

In practice: Load Down (Demand Response)

Site characteristics:

- Cement Mill with a strike price

- Production Flexibility available through capacity in silos

Results:

- Site loaded down at peak prices for an hour

- For 2023, selling average flexibility of 3.5MW every weekday equates to Gross Revenues of £104k

- Additional savings on DuOS and other non-commodity charges can be realised depending on supply contract along with savings on commodity cost of operating the plant during the high priced period

Price responsive load loading down over peak priced periods, when the wholesale price is over the strike price of the asset

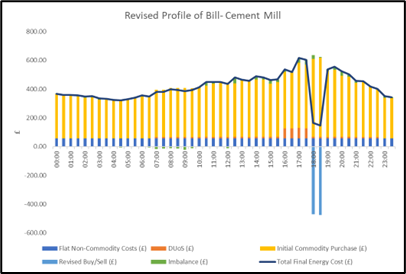

Estimated breakdown of electricity bill costs based on new consumption profile for site

Savings & Revenue profile of site

GB| Whitepaper | In brief BSC Modification P415

In this paper, we examine the impacts of these changes and explore how they reshape the landscape of the UK’s electricity market.

Learn more