News

better business decisions

Posted 5 years ago | 3 minute read

Finding secure revenue in the energy markets

Demand response revenues have become less certain for many businesses across the ERCOT transmission network. However, there are ways your business can create a secure income from the energy markets by simply using the right technology…

The changes across the energy landscape have meant that fast-acting services, which hold the most revenue opportunities for C&I and Institutional organizations, are increasingly needed. The issue? Those that are currently using their energy flexibility to participate in slower services are getting left behind. Why? Because the technology on their sites isn’t up to the task.

The trend

Services in the US are becoming faster acting, much like those we see operating in countries like the UK, with Dynamic Firm Frequency Response, and Ireland, with their DS3 services. But it’s not just about managing frequency and the revenues attached to participating in that area. The Lone Star state saw prices in August rocket over the $9,000 per Megawatt hour due to the excessive demand during one of the hottest seasons on record. These costs are also avoidable with the right tech in place.

What’s the answer?

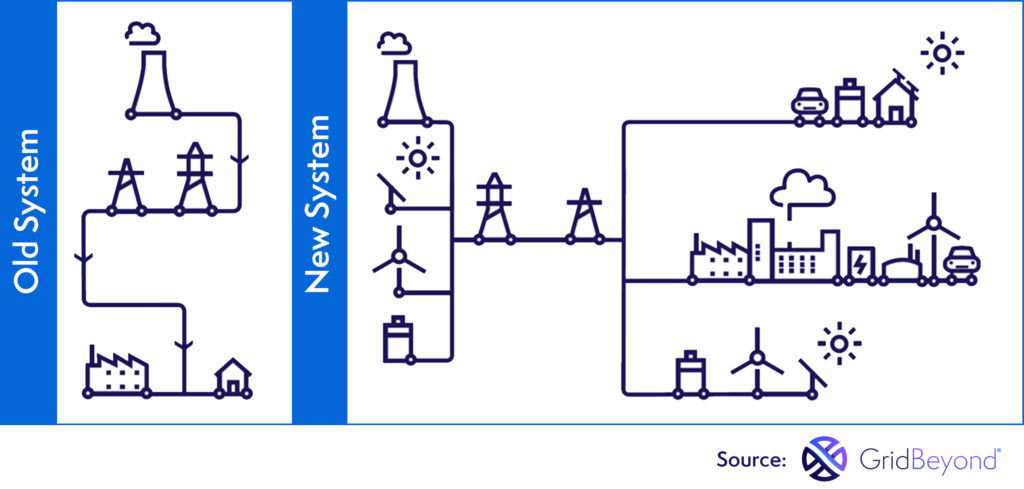

It’s time to reevaluate your energy strategy. The energy landscape is no longer a “one way street”, with energy generated, transmitted, supplied and used in that order. Decentralization and decarbonization have created an interactive, circular energy economy. Demand can be met in many ways, whether that’s increased generation, reduced industrial demand, or use of storage. Generation is no longer the responsibility of just a handful of incredibly large power plants, but of a wide array of distributed resources.

The answer is a new suite of services…

Currently, businesses in ERCOT that are participating in demand response are typically providing a service called ERS. This has a fairly basic requirements – an email is sent to the participating business with 30 minutes notice to turn off elements of their operations. This currently earns businesses around $54,000 per MW per year, and is rapidly decreasing.

New, faster-acting services are emerging and could double that figure to over $100,000 per MW per year.

RRS is the new kid on the block, and there are 3 flavors to choose from depending on a business’s flexibility capabilities. These services can be stacked with additional opportunities, such as smart tariffs and trading.

By participating in RRS, your payments are protected too. Unlike ERS, where the more participants, the further the pot has to be split, RRS has a limited intake so income from participation is more secure.

So, why GridBeyond?

Unlike many demand response providers, GridBeyond has the tried and tested technology to enable your business to participate in these new fast-acting services. And what’s more, we can automate it too. Our highly tailored approach, which often factors in the investment cases for gas generators or battery storage, provides access to significant revenues and savings with minimal risk.

Key takeaways:

- Greater revenues and savings for your business

- Highly targeted flexibility, avoiding whole site shutdown/curtailment

- Greater surety of delivery through automation

- Greater visibility of key consumption and delivered revenues/savings

- Access to new planned ERCOT schemes

- Access to stack multiple schemes simultaneously, including energy markets.

For a no-obligation discussion with one of our experts, request a call back. One of our friendly team will explore your eligibility and talk through how your business can ensure energy strategy longevity today, tomorrow, and for years to come.