News

better business decisions

Posted 5 months ago | 5 minute read

Australia’s energy markets in transition: AER

Australia’s energy markets are in the midst of a major transition driven by decarbonisation, the decentralisation of energy services, and new technology, the Australian Energy Regulator’s (AER) has said.

Published on 26 August the State of the Energy Market Report 2025 provides a detailed review of Australia’s electricity and gas markets. The report noted that 2024 was a notable year in many regards. New records were set for rooftop solar output, the highest number of negative-priced 30-minute periods, minimum daily electricity demand and entry of new registered generation capacity. Increased price volatility is evidence that the wholesale electricity market is now increasingly driven by the complex relationship between weather conditions, shifting demand profiles and the diverse shifting mix of generation types in the NEM.

Changing generation mix

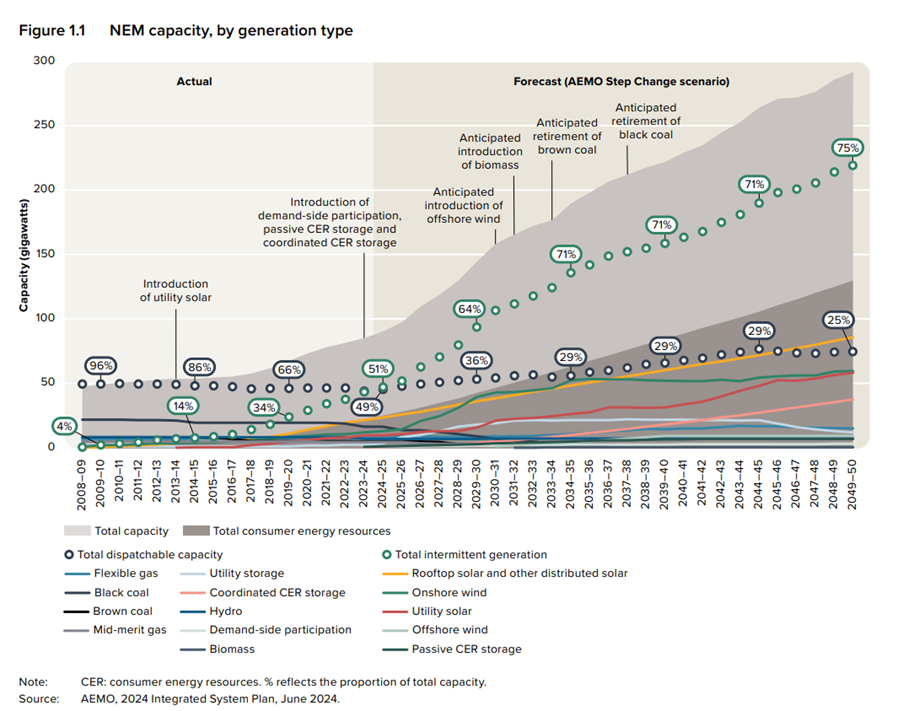

Between 2014 and 2024, more than 6.6GW of coal-fired and gas-powered generation left the market. Over this same period, around 18.5GW of large-scale wind and solar capacity and 18.2GW of rooftop solar capacity came online. By the end of 2024, total generation capacity in the NEM was 86,945MW. Rooftop solar had the highest capacity, totalling 25% of registered capacity, followed by black coal at 19%. The installed capacity of renewable technologies (rooftop solar, solar farms, wind and hydro) represented 60% of total capacity in 2024.

Around 90% of the NEM’s coal generators are scheduled to retire by 2035 as plants reach the end of their economic lives. As such, by 2030 the share of electricity requirements met by coal-fired generation is forecast to decline to 17% of the grid and 14% of total electricity. By 2050, there is forecast to be zero coal-fired generation in the NEM. Grid-scale wind and solar are forecast to meet 65% of grid electricity requirements by 2030 and 88% by 2050. Gas-powered generation, hydro-generation, battery storage and consumer energy resources (CER) are forecast to meet the balance of demand. CER’s share of generation capacity is expected to increase with AEMO forecasting it to reach 130GW of capacity by 2050. This is expected to represent about 45% of total NEM generation capacity.

Negative pricing rises

Since 2020, the frequency of both negative prices and prices above $300/MWh has increased significantly. Negative prices made up 15% of all prices in 2024, up from 3.5% in 2020. Prices above $300 per MWh increased from 0.4% to 1.8% of all prices over the same period. There have also been changes in the timing of these prices. The frequency of negative prices between 3am and 4am has increased from 4.1% of the time in 2020 to 5.8% in 2024. But the frequency of negative prices between 11am and noon has increased from 8.5% to 41.9% of the time. Meanwhile, the frequency of prices above $300/MWh increased at all times of day but especially during the evening peak. Between 6pm and 7pm, the frequency of prices above $300/MWh rose from 1.3% to nearly 10%.

FCAS values falling

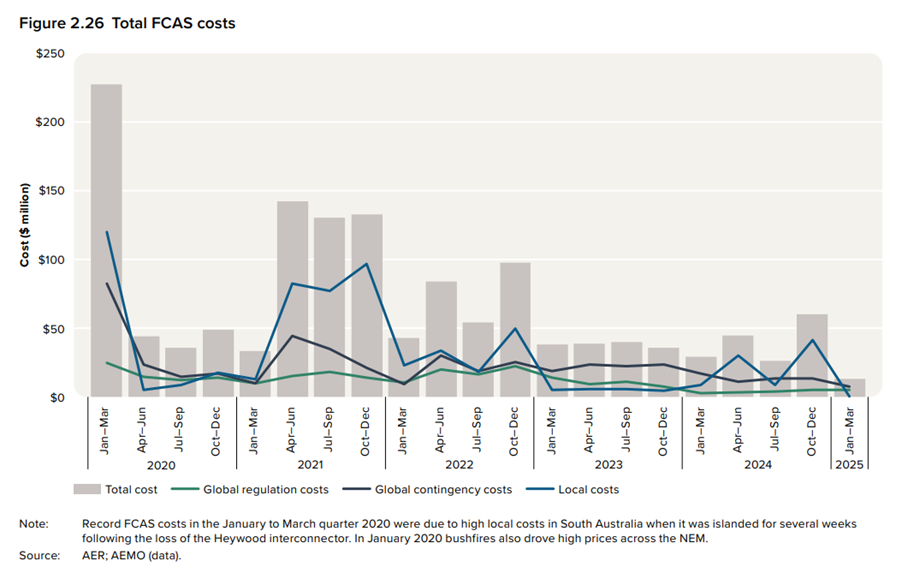

As at 1 January 2025, 46 participants were registered to provide Frequency control ancillary services (FCAS) across the NEM. Total FCAS costs increased by 5% in 2024 compared with 2023. Global FCAS costs decreased by 45% and local FCAS costs increased by 315%, compared with 2023. The decline in global costs in 2024 continued a longer-term trend and reflected lower costs for both regulation and contingency services. This likely reflects increased competition, due to the increase in the number of participants registered to provide FCAS services.

Demand-side flexibility remains a valuable asset. Even if FCAS participation is no longer financially compelling, businesses can still unlock value by optimising when and how they use energy.

Wholesale demand response (WDR) is a key mechanism now available in the NEM, allowing large users to reduce consumption during high price periods and be paid for it. Many retailers and aggregators also offer demand response programs tied to peak load management or network incentives. By working with these providers, I&C businesses can turn operational flexibility into a new income stream or reduce exposure to volatile electricity costs. Battery storage is quickly becoming a commercially viable tool for many businesses. On-site batteries can serve multiple roles: reducing peak demand charges, storing cheap off-peak or solar energy, and participating in markets, including energy arbitrage and even FCAS (albeit at lower prices). The key advantage here is value stacking. A battery that lowers network tariffs while enabling market participation and increasing self-consumption of solar energy offers a compelling financial case, even without high FCAS returns. Using advanced solver-based optimisation and digital twins GridBeyond helps unlock 57% more revenue than other demand response providers, maximising value for your flexibility.

How does GridBeyond bring value?

As markets evolve, success increasingly depends on precision, speed, and the ability to prove performance under stricter rules. This is where GridBeyond’s combination of automation and digital twin technology gives our partners a clear advantage.

Our AI-powered platform connects directly to your energy-intensive assets, enabling fully automated dispatch in response to grid signals, often within seconds. This removes the risk of manual delays, ensures compliance with tighter performance standards, and maximises every revenue opportunity, even as dispatches become more frequent and requirements more demanding.

By creating a digital twin of your site, we can model and simulate asset behaviour across different market scenarios without disrupting operations. This allows us to:

- Test response strategies before they go live

- Predict the financial impact

- Optimise asset use across multiple programmes simultaneously; balancing DSR, wholesale market trading, capacity market commitments, and ancillary services to extract maximum combined value

This advanced visibility means we can continuously adapt your participation strategy, making sure revenues are not only protected but grown over time.

As grid services transition toward faster, more dynamic markets, the combination of real-time automation and digital twin optimisation is key to future-proofing DSR income while supporting operational resilience and decarbonisation goals.