News

better business decisions

Posted 5 months ago | 5 minute read

BESS revenue: tolls, floors and merchant models

Battery energy storage systems (BESS) already play a critical role in balancing grids and capturing market opportunities. But behind every successful storage project lies a key decision: which revenue model to adopt?

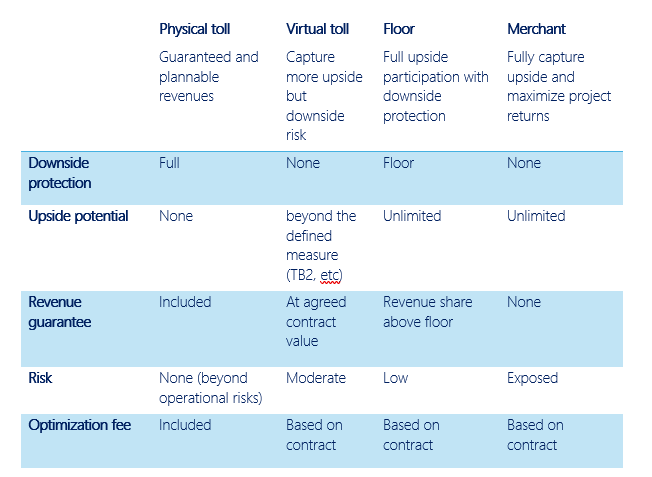

Choosing the right structure can make the difference between predictable cash flow and high-risk exposure. Revenue models for BESS range from low-risk tolling agreements to high-reward fully merchant strategies, with floor pricing and hybrid combinations offering a middle ground.

In this article we explore each model, the pros and cons, and how asset owners, developers, and investors can align risk with reward.

What is tolling?

Tolling refers to a contractual model where the asset owner is paid for making the battery available, while another party (the “toll off-taker”) takes on some or all of the responsibility for operating, dispatching, and managing the commercial risks of the asset.

There are two types of toll: physical and virtual (synthetic).

Key features:

- Physical tolling: stable, low-risk, no upside for the owner

- Virtual (synthetic) tolling: more risk for the owner but potential for higher rewards

Physical toll

A physical toll gives the operation to the toll off-taker, and the toll off-taker is in charge of trading and optimizing the battery.

The tolling off-taker pays a fixed fee to the battery owner in return. There are no risks and extra rewards for the asset owner beyond making sure asset meets the minimum availability requirements set in the contract as the toll off-taker controls and operates the battery (trading, optimization, and dispatch decisions). The asset owner faces little to no market risk but also has no upside if the battery earns more than expected, the benefit goes entirely to the toll off-taker

Virtual (aka synthetic) toll

In a synthetic toll, toll offtaker gets paid a value based on the realized energy prices as defined in the contract. These contracts usually define the pay-off based on the energy prices at the same node as the project or at the hub.

The asset owner is exposed to more market risk. If revenues from trading are lower than the payments owed to the toll off-taker, the owner could lose money. However, if trading generates higher revenues, the owner keeps the upside beyond what must be paid to the toll off-taker.

What is a floor price model?

The floor price model involves setting a minimum price for the energy stored in the battery. This ensures that, regardless of market fluctuations, there is a baseline revenue guarantee for the asset owner.

This model is particularly attractive to risk-averse investors as it provides a degree of financial security, shielding them from extreme market volatility. Floor prices provide a method of securing fixed income for flexible assets, such as batteries, in a market where long term contracted revenues are increasingly unavailable. Whilst floor prices can provide a limit to downside risk, it is key to understand if they come at a fair cost and the impact on overall project economics. Floor agreements may enable getting debt into a project, which can reduce the cost of capital and boost equity returns. However, this depends on the level of the floor. If a floor is set too low, the risk is that investor is giving away upside for only a small debt ratio and limited downside protection. But, depending on the floor price set, in some cases it is extremely unlikely that these floors would be enacted, questioning whether they represent good value for money.

Key features:

- Guarantee: asset owner receives a fixed minimum (“floor”) payment

- Upside: owner keeps a revenue share above the floor

- Risk level: moderate, partial protection plus upside potential

What about merchant models?

In a fully merchant model, the battery is completely exposed to the market. The owner captures both maximum upside potential and full downside risk.

Key features:

- Unlimited upside: if the battery outperforms, revenue potential is highest

- No safety net: losses are possible during weak market conditions

- High risk / high reward: revenue varies with volatility

How to choose?

The ideal revenue model balances security, flexibility, and return expectations, while aligning with your project’s technical and financial realities.

Your BESS revenue model depends on:

- Risk appetite: preference for predictability or market upside

- Financing needs: lenders often prefer tolling or floor models

- Asset characteristics: size, warranty, and technical specs all impact feasibility

- Market outlook: volatility and price forecasts influence returns

At GridBeyond, we eliminate the complexity from investing in and running a battery energy storage system with our end-to-end solution that encompasses project development, operational optimization, and long-term maintenance. GridBeyond is also able to provide revenue floor insurance, and tolling agreements (physical tolls and virtual/TB2) for power storage assets across the US.

Are you considering BESS investment but unsure which model fits your project? Book a meeting to discuss your structured revenue strategy.