News

better business decisions

Posted 9 months ago | 3 minute read

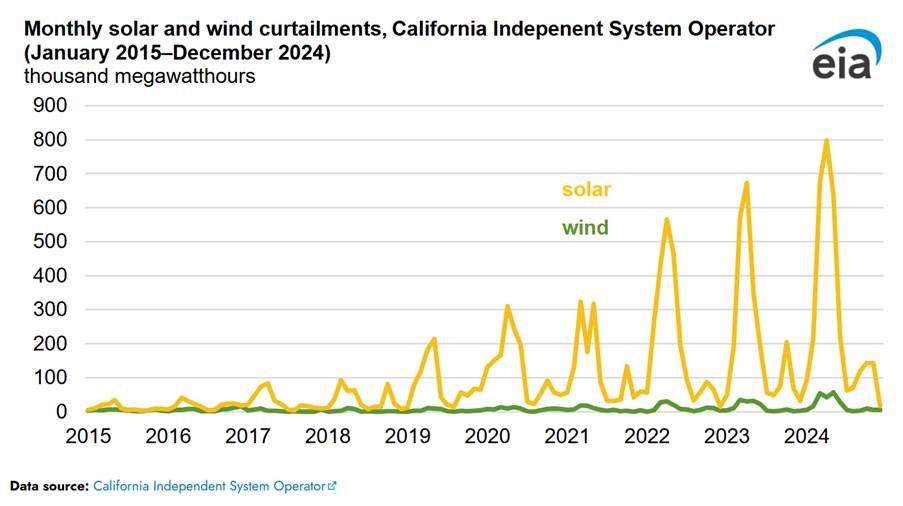

California solar and wind curtailments increasing

In 2024, CAISO curtailed 3.4M MWh of utility-scale wind and solar output, a 29% increase from the amount of electricity curtailed in 2023.

In its analysis, published on May 28, the US Energy Information Administration (EIA) noted that solar accounted for 93% of all the energy curtailed in 2024. CAISO curtailed the most solar in the spring, when solar output was relatively high and electricity demand was relatively low, because moderate spring temperatures meant less demand for space heating or air conditioning. In 2014, a combined 9.7GW of wind and solar photovoltaic capacity had been built in California. By the end of 2024, that number had grown to 28.2GW.

How do we fix it?

One of the answers to this question is to increase demand and either use or store this excess electricity during times of peak generation.

CAISO is trying to reduce curtailments in several ways:

- promoting the addition of flexible resources that can quickly respond to sudden increases and decreases in demand

- trading with neighboring balancing authorities to try to sell excess solar and wind power

- incorporating battery storage into ancillary services, energy, and capacity markets

- including curtailment reduction in transmission planning

In addition, starting this year, companies are planning to use excess renewable energy to make hydrogen, some of which will be stored and mixed with natural gas for summer generation at the Intermountain Power Project’s new facility scheduled to come online in July.

Batteries can soak up cheap renewable energy when it’s abundant, and discharge it when congestion has eased. In some cases, there are tangible commercial benefits for business owners having battery storage on site.

Energy storage can be used to lower consumption from the grid at peak times and the grid also financially rewards those who can reduce consumption and/or feed into the grid within a short space of time. Battery storage can help a business become more energy resilient and, if linked to generation on site, it helps the business to operate in a greener way.

A range of grid-balancing services provide opportunities to earn revenue by supplying stored energy to the grid. There are also opportunities to trade energy from battery storage on the wholesale market to capitalize on fluctuating prices. But with multiple markets on which to trade, the investment landscape for battery storage is a complex arena. However, financial viability, understanding how and where you can stack revenues and provide an automated response is the key to proving the business case.

The landscape for battery storage is a complex arena as trading is already a big part of the value stack and, for some projects, represents the majority of income generated. This means real-time and continual modelling, that takes into account variables including weather variability and overall demand uncertainty is required to assess the most likely range of returns, allowing you to place your asset into the best available market.

GridBeyond’s smart trading solution combines machine learning, AI and data solvers with a trading team. We have long standing experience managing state of health and State of charge for battery assets, and significant investment in data science and accurate forecasting tools, our traders optimize all opportunities with high levels of confidence. This ensures that project owners are able to maximize the value not only from the renewables project, but from the battery storage asset.

Designer – Demo

Designer helps energy professionals and project developers plan, design, and analyse prospective investments.

Learn more