News

better business decisions

Posted 1 year ago | 10 minute read

Crypto: A cure for the power grid?

The North American power grid, a vast and intricate tapestry of interconnected energy systems, faces a multitude of challenges in the 21st century. Aging infrastructure, extreme weather events, and the integration of renewable energy sources are straining its capacity and resilience.

In this context, a controversial potential solution emerges: cryptocurrency. Proponents argue that blockchain technology, the underlying architecture of cryptocurrencies like Bitcoin, can revolutionize the grid by enhancing decentralization, transparency, and efficiency. However, critics raise concerns about its energy consumption, security vulnerabilities, and potential for market manipulation.

In this article, GridBeyond’s Head of Revenue (North America), Joe Hayden, delves into the relationship between crypto and the power grid, exploring its potential benefits and drawbacks.

Energy impacts

A cryptocurrency mining farm typically consists of one or more data centers with thousands of specialized computers. Miners earn token or coins by using computers to solve complex mathematical puzzles in the decentralized database that underpins it, the blockchain.

Blockchain is a technology for peer-to-peer transaction platforms that uses decentralized storage to record all transaction data. The ledger is held, shared, and validated across a distributed network of computers running a particular blockchain software. Blockchains vary considerably in their design, particularly with regard to the consensus mechanisms used to perform the essential task of verifying network data. But the lack of a centralized authority means that blockchain needs a “consensus mechanism” to ensure trust across the network.

In the case of Bitcoin this consensus is achieved by a method called “Proof-of-Work” (PoW), where miners compete to solve advanced forms of mathematics. Crypto miners like the more traditional mining operations, such as oil and gas exploration and extraction, are essentially spending energy to get resources, here the computing energy and the energy to power the computer to mine and get the tokens. Once the puzzle is solved, the latest “block” of transactions is approved and added to the “chain” of transactions. The first miner to solve the puzzle is rewarded with new tokens and a transaction fee. One of the defining components of PoW systems is the electricity use needed to make the calculations that verify transactions. This is because of the significant computer power needed to solve the puzzles that is increasing more and more as the total number of coins available to mine diminishes.

Consumption and competition

Energy use is a security feature under a PoW system and a side effect of relying on the computing power of competing miners to validate transactions. Over the recent years there has been an emerging trend for miners to operate in areas where there is an overproduction of green energy and therefore lower electricity prices – the 3rd Global Cryptoasset Benchmarking Study from the University of Cambridge showed that 76% of cryptocurrency miners use electricity from renewable energy sources as part of their energy mix. However, green energy, while not reducing the amount of electricity consumed by PoW blockchains or the need for cooling, does reduce the overall carbon footprint of the industry.

The industry is also exploring more energy-efficient consensus mechanisms, such as Proof-of-Stake (PoS), which significantly reduce the computational power required for transaction validation. Additionally, directing crypto mining operations towards renewable energy sources could minimize their environmental impact.

Like any evolving industry, cryptocurrency mining companies have sought to streamline their operations and maximize profits. Finding cheap, plentiful energy is a key part of this strategy, and a deciding factor in where mining operations choose to locate. Crypto mining is very sensitive to power prices, to participate in demand response crypto miners will lose value from going offline, but in some instances, the price/kWh paid can be above the value for currency/kWh mined.

Until 2021, China was an attractive location given its energy mix is heavily reliant on cheap coal power. However, in June of that year, the country banned operations. As a result, miners have flocked to other places with cheap power, including Texas.

Risk and rewards

On the surface, adding the demands of crypto mining to the power grid seems counterintuitive, but it rests on an established concept: demand response. The convergence between crypto mining and the power sector is far more complex than the impacts on energy consumption. It is also a matter of potential.

One of the key aspects of the power grid is that it must supply exactly the amount of power demanded at any given time. When power grids were first established, they were designed with coal and big spinning turbines in mind. As a result, the mechanisms keeping the entire system stable relied on the same technology. But increasing integration of increasing levels of volatile renewables is impacting both the stability of the grid and how balancing services are provided. Today, there are three main solutions: peaker plants; demand response; and energy storage.

The advantages of crypto mines in demand response revolves around their high degree of flexibility. Industrial plants can also reduce their power consumption, but not as easily because of the disruption to physical processes. In theory, a crypto miner could run full tilt when power is plentiful and cheap—a sunny morning or a windy afternoon, say—and ease off when the market is tighter, and prices are higher. This would act like the inverse of a power plant, drawing spare power at times of excess and reducing activity at times of scarcity.

Doing so would help level out the extremes at either end of the market, reducing the number of hours when prices are zero or negative and also the number of hours when prices spike due to tight conditions. As a source of extra demand, mining could also encourage developers to build more renewables generation by enabling developers to potentially sell surplus solar and wind generation through a Power Purchase Agreement, providing a guaranteed return on investment for the development of further low-carbon assets.

In the real world

To study how a crypto mining facility could participate in energy markets to earn revenues and make savings against energy prices, GridBeyond models revenues under stochastic (mainly weather driven) conditions. Analysis shows that assets participating in energy and ancillary markets during extreme load months increase income by more than 5x over off season months.

A facility trading across day ahead (DA) and real-time (RT) energy markets as well as ancillary services markets could see a margin uplift of 30-40% above a reserve market only strategy.

Assumptions:

- Mining facility capacity: 1 MW

- Location: Texas, USA

- Mining equipment efficiency: 40 J/TH[1]

- Electricity cost: $80 per MWh

- Average mining revenue: $0.082/TH per day[2]

Assuming a mining efficiency of 40 Joules per TeraHash (per second), a mine with 1 MW output would achieve a hashrate of 25,000 TH/s (1,000,000 W / 40 J/TH). At current BTC prices of $51,600 and network difficult miners current earn approximately $0.082/TH/day before energy, capital, and other operational expenses. Thus this hypothetical mine would generate $2,050 of revenue per day, but the electricity cost would be $80 per hour ($1920/day). In this hypothetical scenario, the mining facility would incur a slim profit of $130/day. Notably, this site would have energy breakeven price of $85.4/MWh—when electricity prices rise above this price it becomes uneconomic to mine.

Let’s consider the scenario where the mining facility in Texas participates in ancillary services, demand response, and production scheduling based on energy prices. In these cases, the facility can potentially generate additional revenue or optimize its energy consumption to reduce costs.

Assumptions (additional):

- Ancillary Services Revenue[3]: $386.9 per day, with an associated down time of 0.25% (21.8 hours per year)

- Demand Response Incentives: $194.2 per day, with an associated down time of 0.14% (12 hours per year)

- Production Scheduling Savings[4]: $535.1 per day, with an associated down time of 4.51% (395.1 hours)

Now let’s recalculate the site’s net revenue after electricity expenses, revenue from participating in ancillary services and demand response, and avoided expenses from ramping down during high prices. Though the site would have an associated down time of 428.9 hours (4.9%) and correspondingly less mining production, it is well worth it.

With the adjusted schedule the mine would achieve a daily average hash rate of 23,775 TH/s and thus a daily mining revenue of $1,949/day. However it would also generate $581.1/day in revenue from ancillary services and demand response for a gross revenue of $2,531. Similarly, electricity expenses plummet from $1,920 to $1,385, effectively lowering electricity expenses by 28.9%. Taken together the site has increased net profit from $130/day to $1,115/day!

These additional revenue streams help offset the electricity costs and contribute to the overall financial performance of the facility.

Source: GridBeyond

Harnessing the power of big data and site-specific information from an extensive network of sensors and controllers, GridBeyond’s optimization model successfully reduced energy consumption in industrial production without affecting quality or production targets, saving our client (a crypto mining facility in ERCOT) $359,525/yr in energy costs.

Challenge: The site was using power to operate throughout the day, despite the cost of power fluctuating across settlement periods. Energy flexibility was found in the assets without impacting overall operations – providing an opportunity to make cost savings on electricity and generate revenue for the business.

Solution: By reducing production and using Robotic Trading, energy flexibility was traded in the highest revenue markets. This meant the site earned revenue from flexibility offered in grid programs in addition to avoiding the peak price power periods and reducing overall production costs.

Results: By forecasting market prices, shifting load, and trading, GridBeyond’s solution saved $359,525 annually, accompanied by a substantial reduction of Scope two emissions per year.

Production scheduling with time-dependent energy prices is an important tool for businesses that want to reduce their energy consumption and costs. While there are challenges associated with this approach, there are also a number of solutions available.

At GridBeyond our AI-powered forecasting, combined with automated control solutions and a smart energy management platform, presents a promising approach to optimize production schedules and minimize energy costs, providing a robust framework for addressing the increasing pressures of energy efficiency and price dynamics.

Harnessing the power of big data and site-specific information from an extensive network of sensors and controllers, GridBeyond’s optimization model is designed to deliver the best economic production schedule for your facility. Our platform employs AI and machine learning, ensuring that hard constraints such as asset capacity and daily production targets are met while optimizing against energy costs, asset load, and any on-site generation or storage technologies.

[1] Average network-wide efficiency as of July 2023: https://www.coindesk.com/consensus-magazine/2023/07/26/the-ever-more-efficient-bitcoin-mining-machine/

[2] Current rate as of Feb 22, 2024: https://data.hashrateindex.com/network-data/btc

[3] Based on a price taker strategy where the mine offers 1 MW of capacity into RRS-UFR, ECRS, and NSRS services and is successfully awarded 80% of all hours offered. Associated downtimes are based on 2023 deployment rates for ERCOT ancillary services.

[4] Based on 2023 5-minute locational market prices for ERCOT North Hub, 70% perfect foresight, a strike price of $85.4/MWh, and 100% curtailment when prices exceed the strike price.

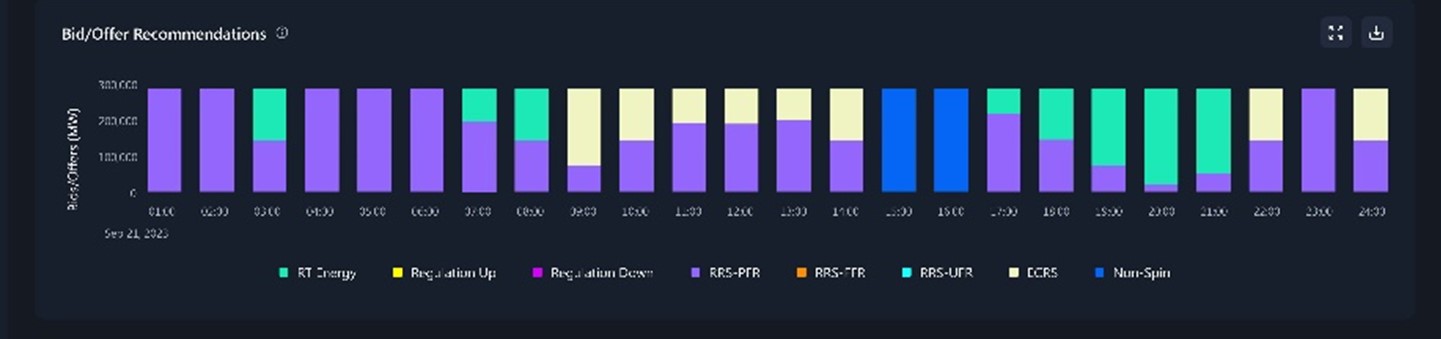

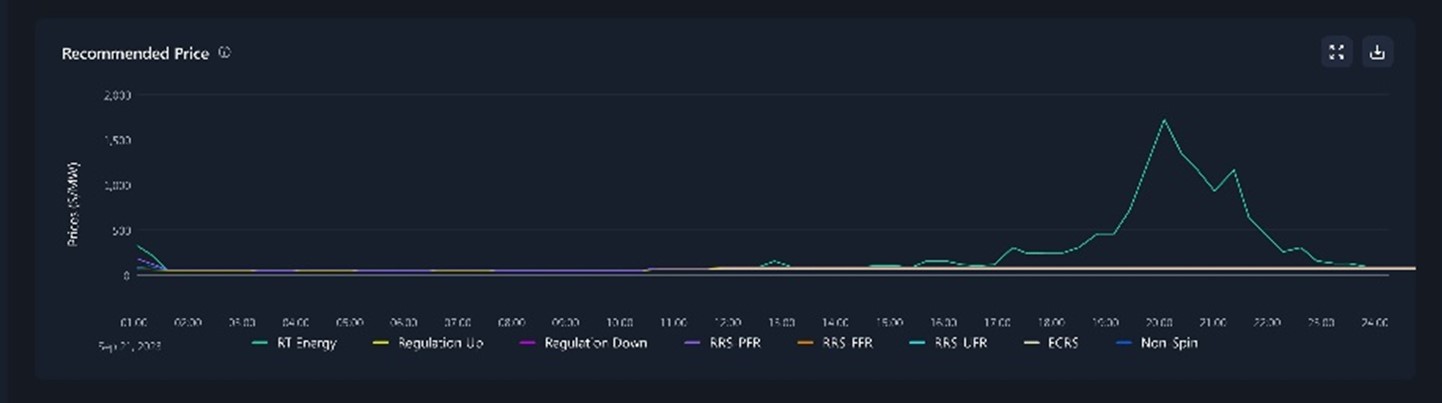

Bid Optimizer – Demo

By leveraging AI, we guarantee optimal bids that go beyond conventional strategies, maximizing your gross margin and overall profit across all forward trading periods. This proven technology empowers merchant generators and energy storage operators by providing them with a strategic advantage in optimizing their energy and ancillary offers, maximizing the profitability of their entire portfolio.

Learn more