Insights

better business decisions

Posted 3 years ago | 9 minute read

Crypto: A cure for the Texas power grid?

In recent months, Texas Governor Greg Abbott has made concentrated efforts to bring the crypto industry to his state. Besides seeing it as lucrative, he believes the growth of miners could help stabilize Texas’ electricity grid, which has struggled to keep up with demand. But why would they choose to locate in Texas? And what will the impacts be of an influx of crypto miners?

Regulatory landscape

Bitcoin mining has often been criticised for being energy-intensive, as we noted in a previous article, mining cryptocurrencies requires ever more computing power and, therefore, energy. While many argue that it is not worth the environmental cost, a growing number of Texas politicians, including Senator Ted Cruz and Austin Mayor Steve Adler, are viewing it as a solution to other energy-related issues.

To do this, a number of key policies and regulations have been set out, which Abbot hopes will draw crypto mining to the state:

- Abbott signed into law the Virtual Currency Bill, recognizing the legal status of virtual currencies. The bill provides a definition of “cryptocurrency” in the commercial code and provides basic legal rules for crypto companies.

- Last summer the state’s Department of Banking issued an industry notice to let state-chartered banks know that they have the authority to provide custody services for virtual currencies

- HB 3608, SB 1859, which were signed by the governor late 2019 relate to business entities; include a distributed electronic network or database employing blockchain or distributed ledger technology in definitions.

- HB 4214, which was passed in 2019 creates programs and requirements for state agencies and local governments to assess cybersecurity risks. Requires each state agency and local government would be required to consider using next-generation technologies, including cryptocurrency, blockchain technology, and artificial intelligence

- HB 4517 establishes the Texas blockchain working group.

Energy costs are key

Miners earn coins by using computers to solve puzzles in the decentralized database that underpins it, the blockchain. Mining is a highly competitive business, with large, climate-controlled facilities that house tens of thousands of computers operating around the clock. Like any evolving industry, cryptocurrency mining companies have sought to streamline their operations and maximize profits as they’ve scaled up. Finding cheap, plentiful energy is a key part of this strategy, and a deciding factor in where mining operations choose to locate.

Until recently, China was an attractive location given its energy mix is heavily reliant on cheap coal power. However, in June 2021, the People’s Bank of China, issued a statement that it would block access to all domestic and foreign cryptocurrency exchanges and ICO websites. China’s Postal Savings Bank followed up with a statement explaining that it will not allow cryptocurrency transactions in any manner. This follows mandates from government officials that banned bitcoin mining across multiple regions of China due to concerns over its environmental impact. As a result, miners have flocked to other places with cheap power, including Texas. The state’s a combination of high renewable generation and light touch regulation results in some of the lowest electricity rates in the US.

However, the pursuit of cheap power is what (in part) left Texas without enough insurance against 2021 winter storm Uri. Widespread blackouts resulted from a scarcity of weatherized spare generating capacity and natural-gas supply, along with high demand. Texas’ surge pricing for power, designed to encourage more capacity to be built as a cushion against emergencies, proved inadequate to mitigate the impacts.

In its report on the incident, FERC identified three primary causes of the outages, derates, or failures to start: freezing of generator components, fuel availability, and mechanical/electrical issues. Freezing equipment represented the primary cause of unplanned outages, derates, and start-up failures, accounting for 44% of these unplanned events. Mechanical and electrical issues due to the extreme cold, other than frozen equipment, caused another 21% of unplanned outages, derates, and start-up failures. While the severe cold was unusual for Texas, which typically sees its peak demands in the summer months, the impacts of climate change are expected to bring further severe weather events in the future.

Summer 2022 expectations

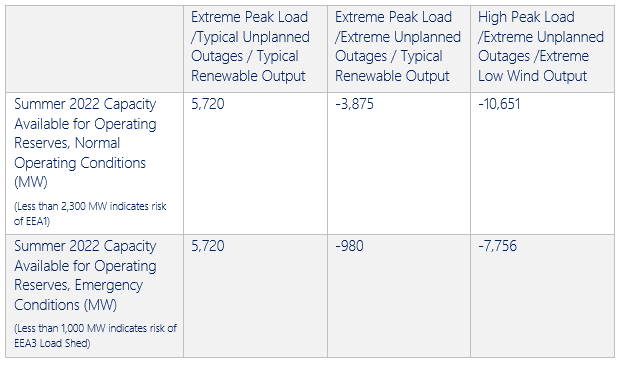

In its most recent Seasonal Assessment of Resource Adequacy (SARA) for Summer 2022 (June through September), published on 16 May, ERCOT said it anticipates a summer 2022 peak demand of 77,317 MW. This would be a new system-wide peak demand record for the region. It maintained that there will be “sufficient installed generating capacity to serve peak demands in the upcoming summer season” if system conditions remain as expected. However, under its “Extreme Reserve Capacity Risk Scenarios” the picture looks less positive. Under the most extreme scenario (extreme peak load, widespread outages, low wind and solar output) capacity available for operating reserves under normal operating conditions ERCOT has forecast that the grid could fall short by 10,651MW

Source: ERCOT

ERCOT takes action

ERCOT has recognised the risks. Effective from March 25, 2022, it began requiring documentation from large electrical loads including cryptocurrency miners before allowing them to connect to the grid. ERCOT established an interim process requiring transmission service providers (“TSPs”) to submit interconnection studies that meet the requirements of the National Electric Reliability Council’s Reliability Standard FAC-00202 for interconnection of certain large loads.

Specifically, TSPs will be required to submit the studies for interconnection of the following types of loads:

- New loads not co-located with a Resource with total demand within the next two years of 75MW or greater;

- Existing loads not co-located with a Resource increasing total demand by 75MW or greater within the next two years;

- New loads co-located with a Resource with total demand within the next two years of 20MW or greater; or

- Existing loads co-located with a Resource increasing total demand by 20MW or greater within the next two years.

ERCOT will review the studies and identify any issues prior to allowing these loads to be included in its Network Operations Model, register as Load Resources, and/or receive approval to energize.

These requirements are not specific to cryptocurrency miners, and any load meeting these is subject to the study. Nevertheless, it is believed that the growth in cryptocurrency mining operations has motivated ERCOT to institute these requirements, and cryptocurrency miners working to develop facilities in Texas that will rely on TSPs to connect them quickly to the Texas grid should factor these standards into their plans.

Options for ERCOT

On the surface, adding the power demands of crypto mining to this situation seems counterintuitive, but it rests on an established concept: demand response. As we noted in a previous article (The cryptocurrency conundrum: the renewables convergence), the convergence between crypto mining and the power sector is far more complex than the impacts on energy consumption. It is also a matter of potential.

One of the key aspects of the power grid is that it must supply exactly the amount of power demanded at any given time. When power grids were first established, they were designed with coal and big spinning turbines in mind. As a result, the mechanisms keeping the entire system stable relied on the same technology. But increasing integration of increasing levels of volatile renewables is impacting both the stability of the grid and how balancing services are provided. Today, there are three main solutions:

- Peaker Plants: grid operators can turn on natural gas “peaker plants” for peak hours.

- Demand Response: grid operators pay end users to shut down assets during peak periods, decreasing the total amount of energy needed on the grid.

- Storage: As the cost of batteries continues to fall, utilities are increasingly looking at grid-connected storage.

A unique asset

Crypto mining is very sensitive to power prices, to participate in demand response crypto miners will lose value from going offline, but this may be offset by rewards from the grid operator and savings made on power price peaks. The advantages of crypto mines in demand response revolves around their high degree of flexibility. Industrial plants can also reduce their power consumption, but not as easily because of the disruption to physical processes.

In theory, a crypto miner could run full tilt when power is plentiful and cheap — a sunny morning or a windy afternoon, say — and ease off when the market is tighter, and prices are higher. This would act like the inverse of a power plant, drawing spare power at times of excess and reducing activity at times of scarcity. Doing so would help level out the extremes at either end of the market, reducing the number of hours when prices are zero or negative and also the number of hours when prices spike due to tight conditions. As a source of extra demand, mining could also encourage developers to build more generation.

Last year, ARK Invest, released a study arguing that Bitcoin could incentivize renewable energy adoption. According to the document:

“Without bitcoin mining, solar – an intermittent energy source – could supply only 40% of grid power before utilities would face the need to fund significant investments with higher electricity prices.

“With bitcoin mining integrated into a solar system however, energy providers – whether utilities or independent entities – would have the ability to play the arbitrage between electricity prices and bitcoin prices, as well as potentially sell the “surplus” solar and supply almost all grid power demands without lowering profitability.”

Where GridBeyond adds value

Crypto currency miners have significant potential beyond just mining but there are several variables at play, including the price of the cryptocurrency itself. As with crypto currency markets, energy market prices are volatile. But in some instances, the price/kWh paid can be above the value for currency/kWh mined.

Using AI and Robotic Trading combined with the expertise of our trading experts and Data Scientists, GridBeyond opens the door for your business to take your energy strategy from passive purchasing and consumption to active energy management and trading.

Here’s how to play it so you could make $185,000 per MW per year in ERCOT

The electricity landscape is changing, which is significantly increasing costs and risks for businesses. The complexity of the ERCOT market is a challenging landscape. But with any challenge comes opportunity…if you have the right technology.

Learn more