Insights

better business decisions

Posted 3 years ago | 3 minute read

EIA expects significant increases in US wholesale electricity prices this summer

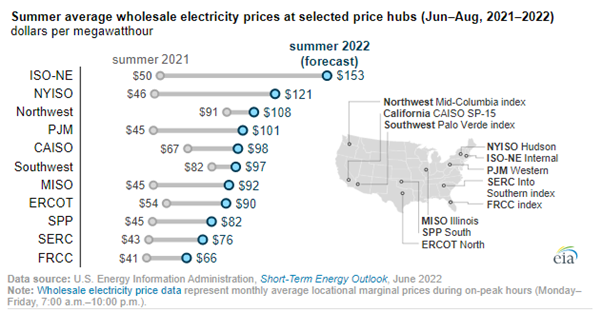

The US Energy Information Administration (EIA) has forecast that prices in US wholesale electricity markets this summer will significantly increase over last summer’s prices.

In its Short-Term Energy Outlook, published on 16 June the EIA forecasts that electricity prices in the Northeast regions (ISO New England, New York ISO, and PJM markets) will exceed $100/MWh between June and August 2022, up from an average of about $50/MWh last summer. Summer electricity prices are expected to average $98/MWh in California’s CAISO market and $90/MWh in the ERCOT market in Texas.

Various factors determine wholesale electricity prices, but the cost of fuel for fossil-fuel generators is an important driver. Wholesale prices are especially tied to natural gas prices because natural gas-fired units are often dispatched to supply power. The natural gas price at the Henry Hub averaged $8.14/MMBtu in May 2022, compared with $2.91/MMBtu in May 2021. EIA expects the price of natural gas to average $8.81/MMBtu this summer.

In past years, the power sector has substituted natural gas-fired generation with coal-fired generation when natural gas prices have risen. However, in recent months, coal power plants have responded less than in the past as an alternative source of generation, most likely as a result of continued coal capacity retirements, constraints in fuel delivery to coal plants, and lower-than-average stocks at coal plants. EIA forecasts that the share of US generation from coal-fired power plants will decline from 25% last summer to 23% this summer, and natural gas’s share will remain flat at 40%. Renewable energy is expected to provide 22% of US generation in 2022 and 24% in 2023, up from a share of 20% last year.

Other industry conditions that could lead to higher wholesale electricity prices this summer include the extended drought in the western US. Although EIA expects a slight increase in hydroelectric generation in California this summer compared with year ago levels, the forecast of summer hydropower output remains low.

GridBeyond Vice President of Revenue for North America Joe Hayden said:

“The US market has enjoyed a very stable utility grid over the years, but since the push to add intermittent renewable assets to the mix, while very positive for the obvious environmental and times of favourable weather period reasons, every time we add a new renewable MW of generation, it is adding complexity to the reliability and cost equation for consumers. There is truly a transformation of the grid’s makeup like never before that needs to be managed and navigated with the assistance of demand flexibility and demand response

“Reducing reliance on fossil fuels will not be simple, and efforts will be needed across multiple sectors, alongside international cooperation on energy supply and security, which over the short to medium terms could lead to further pressure on energy prices. However, by investing in energy efficiency and accelerating the roll-out of green technologies there may be longer-term benefits for businesses to reduce their operating costs and deliver carbon neutrality in a cost-effective way. At GridBeyond, we work with C&I businesses, grid operators, generation, and storage asset owners through our AI software and hardware system to maximize revenue opportunities while navigating around price spike avoidance not only today, but into the continued transformation the grid is going through into the future.”

USA Ai. Services

It begins with data… and ends with benefits The increasing shift away from centralized power generation is bringing big changes […]

Learn more