News

better business decisions

Posted 8 months ago | 2 minute read

ERCOT markets remain competitive: State of the Market Report

The ERCOT energy markets performed competitively in 2024, according to the latest State of the Market Report by Potomac Economics. Published in May, the report highlights significant advancements in Texas’s energy landscape, particularly in demand response, flexibility markets, and battery storage.

Peak demand declined by 0.3% due to less extreme temperatures in the summer, but average demand increased by 3.5%. New monthly peak demand records were set for January, April, May, October, and November. An increase in new supply contributed to a lower frequency of tight system conditions in 2024. In 2024, approximately 14 GW of new capacity entered commercial operation, including 7.5GW of solar, 5GW of energy storage, 1.1GW of wind, and 500MW of combustion turbines.

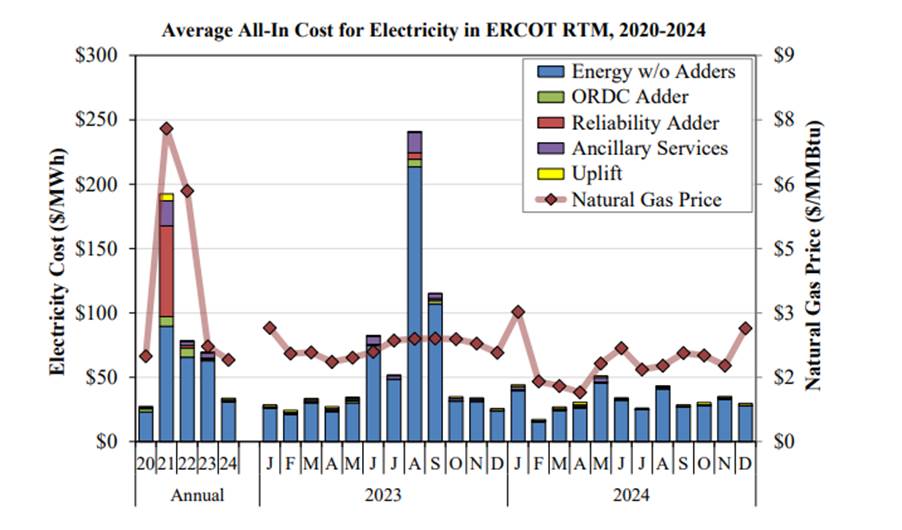

The ERCOT Contingency Reserve Service (ECRS) was less impactful because of increases in supply and less extreme weather conditions, but procurement and deployment practices still contributed almost $1B in excess real-time market costs. Average real-time prices fell to $32/MWh in 2024, a 52% drop from 2023, despite a 14% decline in natural gas prices. This was attributed to less frequent artificial shortages caused by ECRS deployment practices. Prices in the day-ahead market averaged $1.46/MWh higher than in real-time, and the average absolute difference in prices was only $17.35/MWh, the lowest since 2020.

Ancillary services costs dropped to $0.98/MWh of load from $3.74/MWh in 2023. This drop in the cost of ancillary services corresponds to a decrease in the average price for all products, but especially for ECRS, whose average price dropped from $76.77/MWh in 2023 to only $9.62/MWh in 2024. This drop was caused by an increase in supply, particularly from energy storage resources (ESRs), which contributed a substantial share of all ancillary service volume in 2024.