Insights

better business decisions

Posted 3 years ago | 3 minute read

ESB releases capacity market blueprint

Australia’s Energy Security Board has proposed introduction of a capacity market that offers longer-term contracts for new back-up capacity, such as batteries and gas-fired generation to fill the gap as coal-fired plants are retired and smooth the transition to cleaner energy.

In a consultation paper, published on 20 June, ESB is seeking comments on its latest plan for a capacity mechanism designed to encourage investment in energy flexibility.

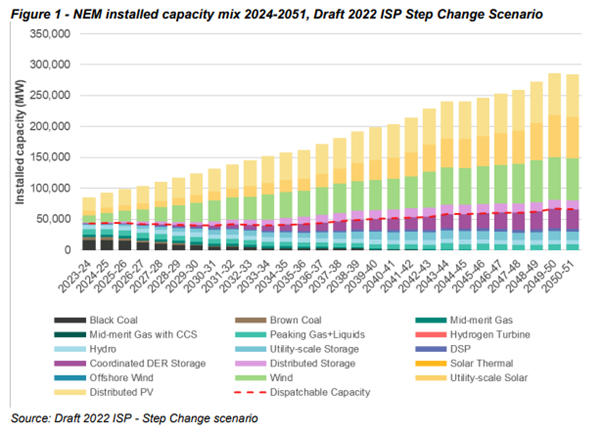

Coal generators, which currently account for over half generation output in the National Electricity Market (NEM), are reaching the end of their technical lives. At the same time, AEMO has forecast that electricity demand could at least double by 2050. AEMO’s Step Change scenario estimates approximately 122GW of new wind and solar firmed by approximately 45GW of new dispatchable storage capacity, 7GW of existing dispatchable hydro and 9GW of gas fired generation will be required by 2050 to meet demand as coal-fired generation withdraws. But as levels of renewables generation increase, flexible technologies that can provide a backup in times of volatile generation will be required.

Currently the NEM is an energy-only market. Generators are paid only for their energy, without a formal mechanism valuing their ability to produce energy (their capacity). To incentivise investment in new generation capacity, ESB has detailed plans to provide payments for not just supplying power but also retaining the capacity to do so, which it said is one of the most viable options to reform the energy market after 2025.

The ESB proposes that all resources contributing to capacity requirements be eligible to participate in the capacity mechanism. This would include demand-side resources. It said it would consider longer duration contracts for new capacity only, while existing capacity providers, such as coal plants, would be eligible only for one-year contracts, allowing for different capacity prices for old and new sources. It also recommends that states be able to pick technologies suited to their emissions reduction targets but said this would need careful consideration to ensure the market design allows this.

A centralised approach has been proposed to forecasting capacity requirements and purchasing what is required. AEMO would hold capacity auctions, award contracts, and make payments to capacity providers. It would then need to allocate these costs to consumers. ESB considers that cost allocation through retailers using actual demand is the preferred approach.

To ensure delivery of capacity when required, ESB proposes that the performance obligation should be principally tied to availability across the delivery year and bidding during periods of system stress (such as lack of reserve (LOR) 2 or LOR3) with weighted payments tied to both these obligations. This means that the capacity obligation covers all periods of system stress throughout the year, rather than just peak periods.

Submissions are open until 25 July. ESB will set out a draft detailed capacity mechanism design by December 2022, which will be put to stakeholders for further consultation. Following this, the ESB will present its final detailed capacity mechanism design to Energy Ministers in February 2023.The capacity mechanism is expected to be operational by 1 July 2025.

Australia Brochure Ai. Services

Using AI and Robotic Trading combined with the expertise of our trading experts and Data Scientists, GridBeyond’s Point Ai. Services open the door for your business to take your energy strategy from passive purchasing and consumption to active energy management and trading.

Learn more