News

better business decisions

Posted 9 months ago | 4 minute read

FERC anticipates energy price rises this summer

The Federal Energy Regulatory Commission’s (FERC’s) 2025 Summer Assessment has forecast higher wholesale electricity prices this summer in most regions, but said generating resources are adequate to meet expected summer demand.

The assessment, published May 15, notes that if normal operating conditions prevail, all regions of the country will have adequate generating resources to meet expected summer demand and operating reserve requirements. But it warned that margins are getting tighter as generation resources retire and load increases largely due to hyperscale users, such as data centers.

Regions such as Northeast Power Coordinating Council (NPCC)-New England, Midcontinent Independent System Operator (MISO), the Electric Reliability Council of Texas (ERCOT), Southwest Power Pool (SPP) and PJM Interconnection may face a higher likelihood of tight generation availability due to above-normal electricity demand, periods of low wind and solar output, wildfires that disrupt available transfers and generator availability, and retirements of generation capacity.

The report notes that the United States National Oceanic and Atmospheric Administration’s (NOAA) forecast for June through August 2025, shown on this slide, projects a 40% to 60% likelihood of higher-than-average temperatures in the western and southeastern parts of the country, and a 30%-50% likelihood of higher-than-average temperatures in the center of the country and in the Northeast. If warmer-than-average temperatures occur, the grid will likely be challenged with increased uncertainty due to weather events, weather forecasting, and energy demand.

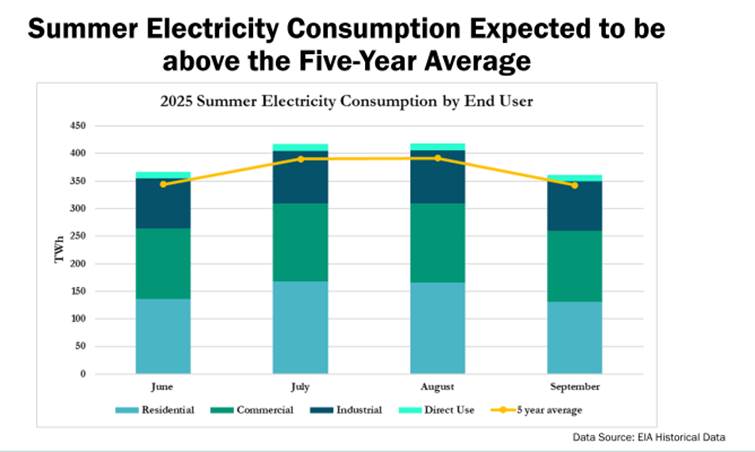

In addition, load is expected to be higher this summer compared to the past four summers. EIA’s electricity consumption data from 2021 to 2025 shows an overall increase of 88TWh covering the months of June through September, or a 6.2% increase, from summer 2021 to summer 2025, with 2025 having the most significant year-over-year growth at 3.2% above the five-year average of 1,469TWh. Monthly electricity usage reaches its highest level in August, and EIA projects 420TWh in August 2025, representing a 3.7% increase from August 2024.

Across all regions, natural gas is expected to provide the largest share of net summer generation capacity. Natural gas-fired resources are expected to represent 40.6% of the total summer capacity in operation this summer, followed by coal at 13.4%, wind at 12.5%, solar at 12%, and nuclear and hydro both at 8%.

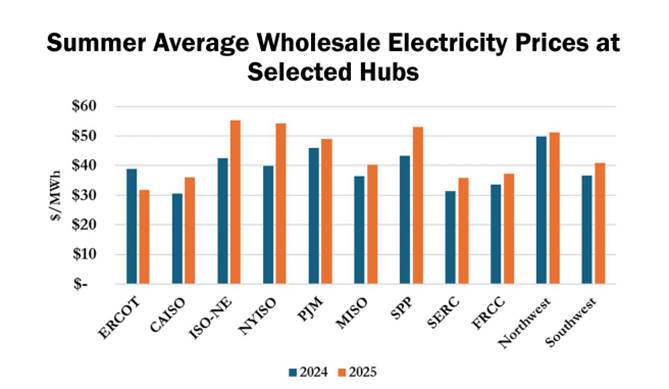

Wholesale electricity prices are expected to be higher this summer in most regions. Average summer wholesale electricity prices for 2025 are estimated to be $43.90/MWh, a 12% increase over prices in summer 2024. FERC said this was a result of higher natural gas prices resulting from lower natural gas storage levels due to a colder winter than previous years.

For businesses across the US the findings of FERC’s 2025 Summer Assessment are a reminder of the growing importance of energy resilience and proactive cost management. As grid conditions become increasingly strained due to rising demand, generation retirements, and the expanding energy footprint of hyperscale users such as data centers, companies must look beyond traditional energy procurement methods and adopt integrated strategies that can buffer them against both price volatility and potential outages.

Participation in demand response programs offers an opportunity for businesses to monetize their flexibility by curbing or shifting usage during peak demand periods, earning incentives while supporting grid stability. For operations that cannot afford downtime, microgrids and backup generation systems offer critical safeguards. These systems enable businesses to operate independently of the main grid during emergencies or periods of extreme price spikes, enhancing reliability and operational control. To further strengthen their energy strategies, many forward-looking C&I enterprises are also deploying advanced energy management systems. These platforms provide real-time data, predictive analytics, and automation capabilities that help optimize usage, forecast needs, and respond dynamically to market signals.

Using a bottom-up approach by understanding your assets, combined with in-depth knowledge of the intricacies of the system, GridBeyond’s AI-powered platform is a powerful combination of high-end energy management technology and data analytics that transforms your energy strategy from passive risk and price management to active participation that utilizes smart technology to enable co-optimization across the PJM energy markets.