Insights

better business decisions

Posted 3 years ago | 5 minute read

FERC highlights gas supply and extreme weather risks this Winter

The US is expected to have sufficient power generation this Winter, but gas supplies remain a concern, according to the Federal Energy Regulatory Commission (FERC) annual winter reliability assessment. But ISO New England (ISO-NE) and Midcontinent Independent System Operator (MISO) regions, as well as Texas (ERCOT) and parts of the Southeast, could struggle with power capacity shortfalls during extreme weather scenarios similar to the winter storm in February 2021, FERC said.

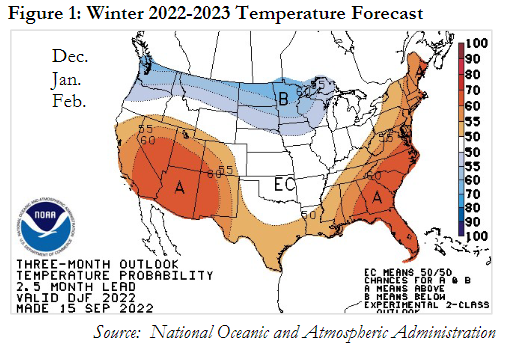

Published on October 20, the 2022-23 Winter Energy Market and Reliability Assessment, focusing on the period of December 2022 through February 2023, notes the National Oceanic and Atmospheric Administration forecasts for above average temperatures this winter for most of the US. Forecasts of above-average temperatures imply lower-than-average electric and natural gas demand, although a prolonged cold weather event nevertheless could cause disruptions and price impacts, even within the context of a warmer winter. But natural gas prices are expected to remain higher than recent years.

Even though gas production growth will likely outpace domestic natural gas demand growth in winter 2022-23, forecasts anticipate that continued growth in net exports, including from liquified natural gas (LNG) export facilities, will place additional pressure on prices this winter. Specifically, the Henry Hub natural gas futures contract price is averaging $6.82/MMBtu for winter 2022-23, up 30% from last winter’s settled price. Prices are expected to be particularly high in New England, which is dependent, in part, on LNG imports. High LNG prices also could lead to scarce gas supplies during peak demand in some areas. FERC also warned that this winter, international markets will likely also affect the US market, as they did at times last winter.

Demand for natural gas is expected to increase 2.4% over winter, driven primarily by growth in demand for natural gas exports. The anticipated greater volume of natural gas exports primarily results from the increase in LNG liquefaction capacity over the last year, as well as increased pipeline exports to Mexico.

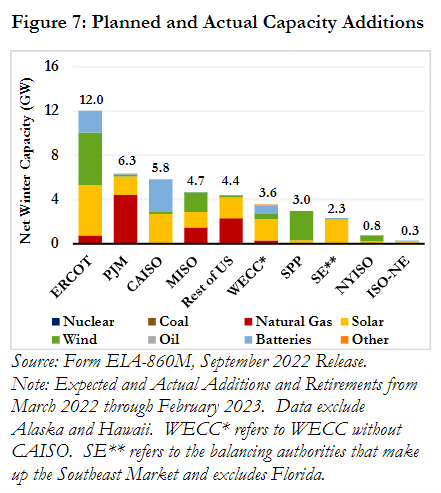

Wholesale electricity markets are expected to see a continuation of the generation capacity addition and retirement pattern seen in the past years through winter 2022-23. Most additions will come from solar and wind, while most retirements will come from coal. In total, the US will add 43GW of net winter capacity between March 2022 and February 2023, mostly from solar and wind generation. Over that timeframe, 15GW of net winter capacity are expected to retire, mostly coming from coal-fired generation.

ERCOT is expected to add 12GW, comprised of over 9GW of solar and wind capacity and over 1.9GW of battery storage additions. ERCOT is also expected to retire almost 500MW of natural gas-fired generation. Among the largest resource additions expected are three 500MW solar projects, five wind projects totaling over 1,700MW, and three battery storage projects totaling 400MW.

PJM expects to add 6.4GW of net winter capacity, mainly from natural gas and solar additions, and generation retirements of 6GW. One notable addition expected this November is the Guernsey Power Station, a 1,250MW gas plant in Ohio. Nearly all of the 6GW of capacity retirements will come from coal.

MISO expects to add roughly 4.7GW from wind, solar, and natural gas-fired generation and to retire 4.2GW from nuclear and coal. Among the capacity retirements is the 816MW Palisades nuclear facility in Michigan.

SPP is expected to add 2.6GW of wind capacity, representing 89% of the total capacity planned or installed (all resources included) in SPP from March 2022 through February 2023. SPP also expects less than 100MW of retirements, from natural gas-fired generation. Most notably, the wind additions include the 999MW Traverse Wind Project that came online in April 2022 in Oklahoma. Solar generation represents nearly all the remaining forecasted capacity additions in SPP.

NYISO is expected to add roughly 800MW of net winter capacity, mostly from solar and wind resources, and ISO-NE is expected to add roughly 300MW of net winter capacity, mostly from solar resources. In NYISO, nearly 450MW of coal retirements are anticipated, and no significant retirements are anticipated in ISO-NE.

For demand response the report notes that PJM procured 7,555MW of Load Management resources and 230MW of Price Responsive Demand through the capacity market for Delivery Year 2022-23. In total, PJM reported 10,149MW of demand response capability from all programs.

MISO procured 7,541MW of load-modifying resources in the Planning Resource Auction for Planning Year 2022-23. NYISO anticipates demand response capability from approximately 693MW of special case resources. ISO-NE reports monthly Active Demand Capacity Resource totals and reported 511MW in December 2021 and 529MW in January 2022. In December 2021, CAISO reported 1,173MW of demand response available from utility operated programs and 139MW from third-party providers for a total of 1,312MW. As of December 2021, SPP reported 176MW from demand response resources.

GridBeyond SVP North America Wayne Muncaster said:

“Although the latest forecast from NOAA suggests we could be headed for a mild winter thanks to the La Nina atmospheric phenomenon, which is returning for the third consecutive winter. Our power grids are becoming stressed more frequently by extreme weather events, which are much less predictable. At the same time, the growing use of intermittent renewable energy sources is changing the way power is being generated and delivered to customers.

“Electricity prices are soaring as prices climb for gas. Higher natural gas prices make renewable energy more cost-competitive but because solar, wind and energy storage projects are stuck in backlogged interconnection queues, they are not getting built fast enough.

“It is good news that capacity additions from battery storage and renewables are increasing. This is a trend that we are expecting to continue as grids move towards a zero-carbon future, there will be an ever-increasing need for technologies that are able to ramp up and down to balance the system. Whether its battery storage, industrial load or crypto miners, there are numerous assets that can, if optimized, can provide these services.”

USA Ai. Services

It begins with data… and ends with benefits The increasing shift away from centralized power generation is bringing big changes […]

Learn more