Insights

better business decisions

Posted 3 years ago | 3 minute read

Average power prices will reduce, but it won’t be a quick journey

Guest blog from Saliw Cleto, Modelling and Analytics Manager at Cornwall Insight Australia

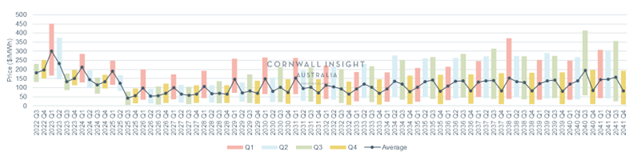

Australia is going through a rapid energy transition, and the move over to more sustainable sources of energy will have both medium and long-term benefits to Australia’s energy prices. Cornwall Insight Australia’s Benchmark Power Curve (BPC), which forecasts power prices up until 2042, has shown that from 2026, power prices in a neutral/base scenario will be, on average, ~$60-$100/MWh across all states in the National Electricity Market (NEM). This aligns with ~$40-80/MWh levels last seen during 2021 – showing that Australia will hopefully start to see stabilisation of its energy prices. However, while this will be of some comfort to the government and consumers, it is unlikely to come quickly.

The Australian energy market has seen significant volatility over the past two years and power prices up to 2026 are still relatively high, with the BPC forecasting that the annual median prices will remain above ~$100/MWh over the next three years. These predictions have decreased from our previous update, reflecting the recent rebalancing of fuel prices across the energy markets after the domestic energy crisis peaked in June 2022. While volatility will continue to play a part in the market, our forecasts show this rebalance, and new generation developments will dampen the impact.

As coal becomes less prominent in energy generation, the intermittent nature of output from variable renewable energy will make the supply-demand balance more volatile. Another aspect is the lack of energy generation at evening peak times as solar output subsides, which will result in higher prices during that time of day and more volatility across all states. If we want to ensure the benefits that Cornwall Insight Australia’s BPC have forecast, Australia will need to invest in ways to compensate for the variable output of renewable energy generation. Increasing storage capacity could be key to getting a grip on power prices as the country transitions to a less emissions-intensive future.

Figure 1: Average quarterly price and volatility forecast – Queensland (Neutral case)

Source: Cornwall Insight Australia neutral case from our BPC Q3 launched 30 October

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.