News

better business decisions

Posted 1 year ago | 4 minute read

Heatwaves and battery revenues | explained

Amidst a heatwave on August 20th 2024, real-time prices cleared several times near the system cap of $5,000/MWh – the highest real-time prices since May 8th 2024.

August 19th and 20th were the hottest days of the year for much of Texas and as a result demand peaked. On the 20th, a new record for instantaneous demand (85,931MW) was set going into the evening (4:45PM). While solar power generation also hit a near-record level of 20,799MW on August 20, wind generation was relatively low going into the evening peak, which meant that higher-priced generation was needed.

It’s a saying that resources make or break their annual revenue goals on days like these, making it critical for asset operators to be in market and in the right services during these few hours. It’s certainly true that energy storage played a significant part in ensuring the reliability of the grid over the period, with energy storage discharged to the grid also hitting a record of 3,927MW at 7:35p.m. on August 20, well above the prior record of 3,283MW just the day before.

Now that the dust has settled a bit, let’s take a deeper look at market operations from August 18 -20 for battery energy storage systems (BESSs) optimized by GridBeyond.

Since it is difficult to anticipate load demand for the next day, one critical decision that BESS operators must make is whether to commit part or all of their energy to ancillary services, which are offered day-ahead in ERCOT, or to commit to offer it in the day-ahead, or real-time energy markets – identifying which market is going to be the most lucrative.

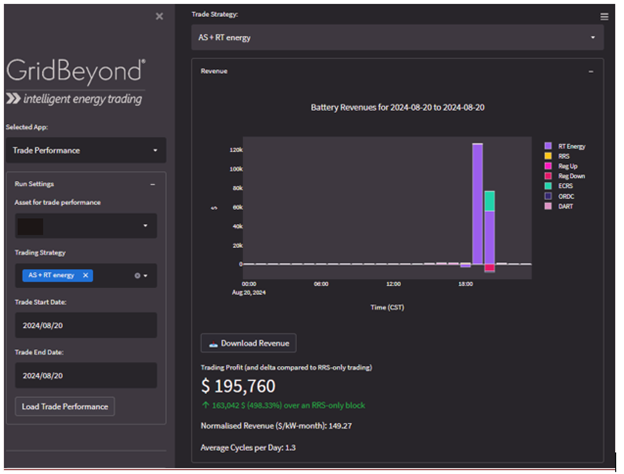

Using our forecasts, ahead of the August 20 peak, we advised our clients to leave their open their capacity for HE20. One 63MW BESS asset that we manage is on track to settle almost $195,760 over HE20 and HE21, mostly from real-time energy sales and ERCOT Contingency Reserve Service (ECRS). If you’re counting that’s over 4x what they would have earned from the classic low-risk Responsive Reserve (RRS)-only strategy. Although this type of strategy ensures the resource is always in market and minimizes cycling, it does not always maximize revenues.

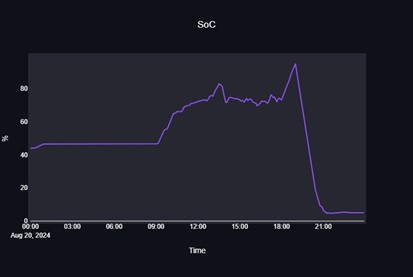

This asset had nearly 20% SOC left due to our dynamic cycling management, so it should have enough state of charge to ride through the elevated prices. These were the forecasts we made of RT prices 24 hours ahead (Day ahead forecast of Real Time).

While we didn’t exactly nail the magnitude–we predicted a price of $2,000 MWh vs an actual of $4,750/MWh, our forecasts of when the peaks would occur was accurate.

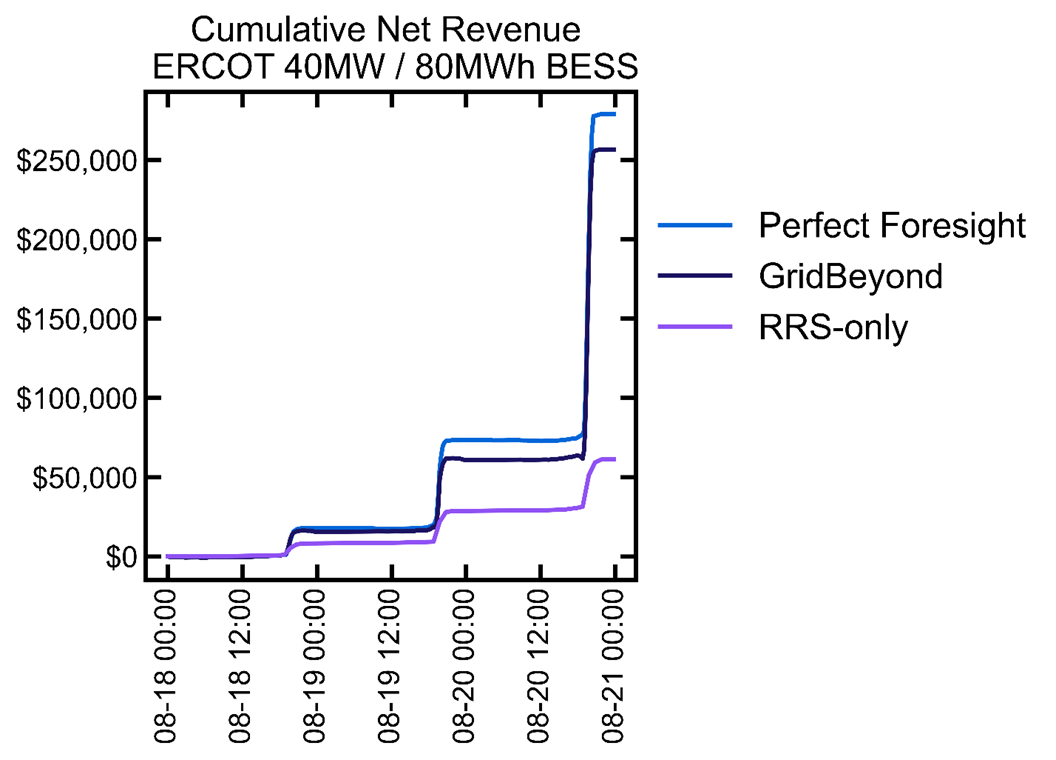

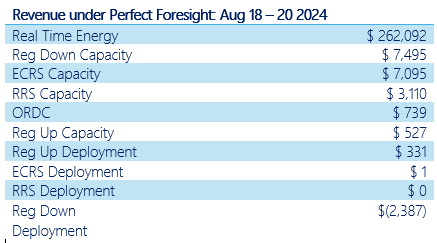

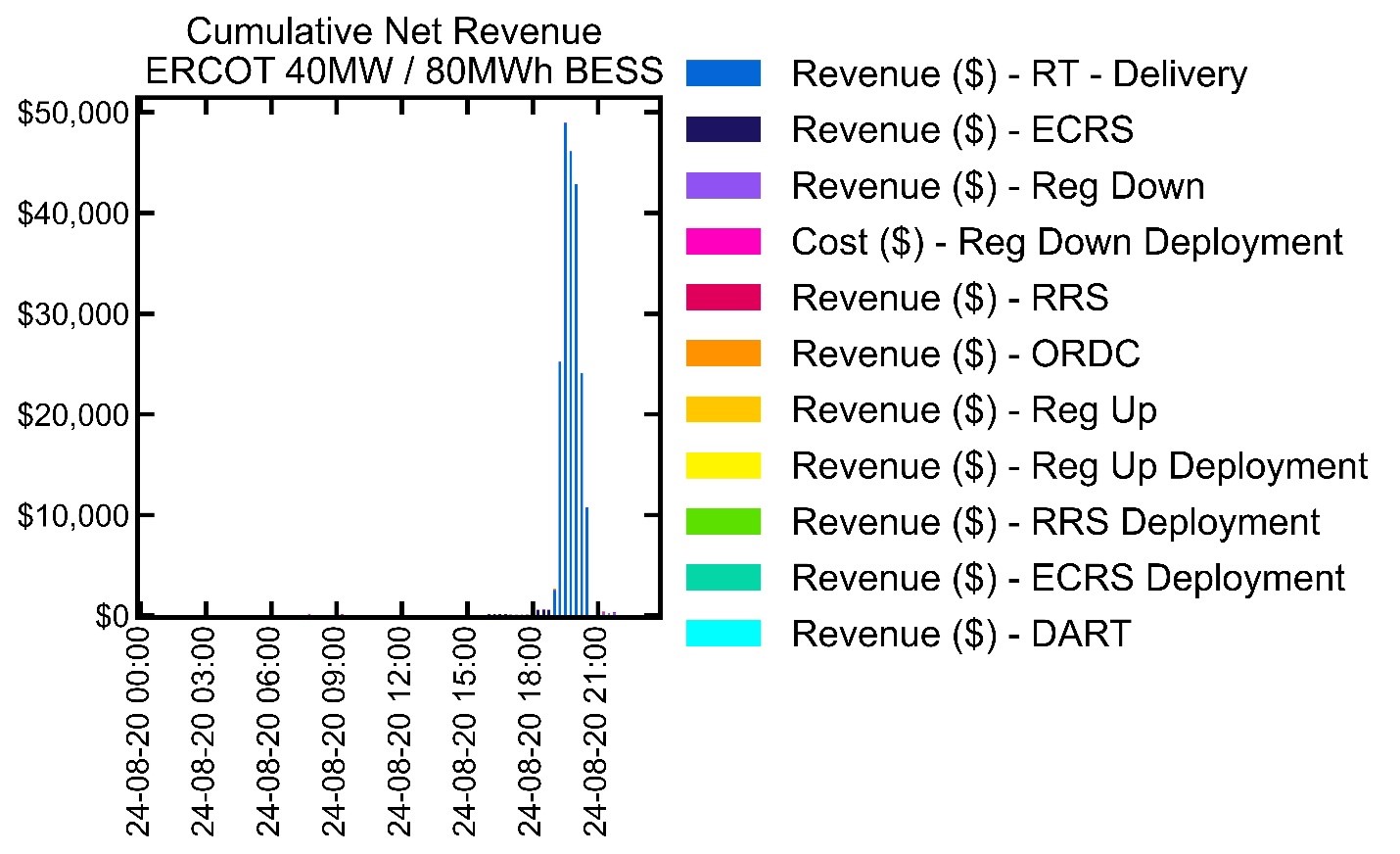

Looking back at the same three day period (and using the example of a for a 40 MW/80 MWh battery) with perfect foresight this resource could have earned up to $279,004 in cumulative net revenue. Using our ML forecasting and real-time optimizations, our recommendation led to net revenue of $256,660, or 92.0% of perfect foresight. Not bad and certainly better than the classic “RRS-only” strategy. Although this type of strategy ensures the resource is always in market and minimizes cycling, during this period the asset would have only earned $61,485 or 22.0% of perfect foresight.

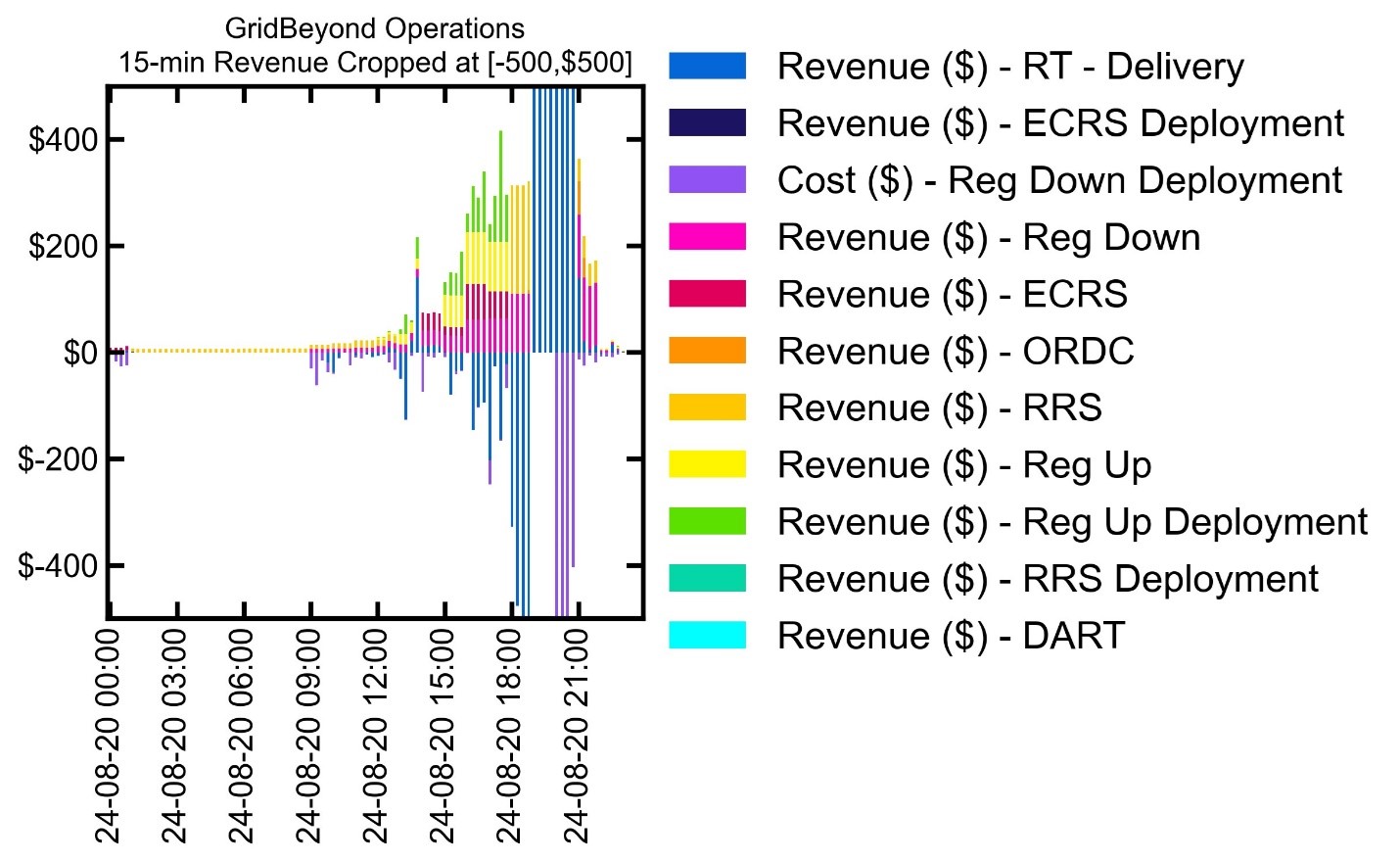

Of that 3-day revenue, the vast majority (94%) was real time energy sales but there were other meaningful sources too. Most of the non-energy revenue came from ECRS and Regulation Down capacity.

Though real time energy revenue dominated during this three day event, we really worked hard to get that last 6% of revenue. Cropped at -$500 to $500 you can see the detailed orchestration of trading with energy arbitrage, charging during Reg Down deployments, and stacking multiple services.

At GridBeyond we use advanced forecasting, digital twin modeling, and real-time optimization to help our clients maximize their market revenue, whether for FTM or BTM resources.

Request a callback to find out more or view our demo of Bid Optimizer

Bid Optimizer – Demo

By leveraging AI, we guarantee optimal bids that go beyond conventional strategies, maximizing your gross margin and overall profit across all forward trading periods. This proven technology empowers merchant generators and energy storage operators by providing them with a strategic advantage in optimizing their energy and ancillary offers, maximizing the profitability of their entire portfolio.

Learn more