News

better business decisions

Posted 5 months ago | 4 minute read

Navigating P415: opportunities and challenges for businesses

In October 2023 Ofgem issued its decision on BSC Modification P415, titled “Facilitating Access to Wholesale Electricity Markets for Flexibility Dispatched by Virtual Lead Partners (VLPs)”. The modification was implemented on 7 November 2024, marking a watershed moment for the UK’s electricity market.

In essence, the modification enables independent aggregators to access wholesale markets without the need for a supply license. Flexibility from traditional demand response, distributed energy resources (DERs), electric vehicle (EV) charging hubs, and other behind-the-meter assets can now be sold into the wholesale market through these aggregators.

In this article, we examine the impacts of the changes, how they reshape the landscape of the UK’s electricity market and how businesses can take advantage of the opportunity.

What’s changed?

Virtual Lead Parties (VLPs) are aggregators that work on behalf of electricity generators and consumers to offer balancing services for the electricity system. In the previous arrangement, only suppliers could take physical actions in the wholesale market, with VLPs dependant on Trading Parties (typically an energy supplier) to participate in the wholesale market. This means that VLPs had limited ability to compete in the market with the only accessible markets being ancillary services, Capacity Market and the Balancing Mechanism.

The P415 change effectively delinks the wholesale trading role from a supply license, which can be quite costly to acquire. Independent aggregators and VLPs, are now able to trade in the wholesale market on the same terms as other Trading Parties, opening up new business models and sources of revenue for market participants.

What are the benefits?

This change offers a number of advantages. Firstly, it fosters heightened competition within the wholesale electricity market. Whilst Ofgem accepts that the rule change might disrupt supplier operations, who may be commercially impacted as a result of VLP action, it expects these to be outweighed by the benefits arising from increased competition. Moreover, suppliers who have been commercially impacted by any VLP action would be compensated from the “mutualisation fund” at a price that is meant to closely mirror their sourcing cost. With more VLPs encouraged to participate, competition increases, resulting in a greater abundance of flexibility and lower prices for consumers.

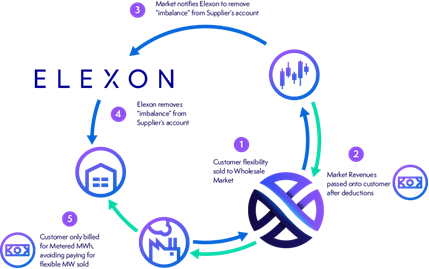

Secondly, it enhances the grid’s flexibility. VLPs aggregate and dispatch Distributed Energy Resources (DERs) in response to market signals. This empowers consumers to adjust their electricity consumption or generation according to price signals, thereby enabling demand-side response. It also allows large end users (through a VLP such as GridBeyond) to access day ahead and intra-day wholesale market without the need for trades to go through the supplier, providing and incremental revenue stream and increases revenue opportunity.

Thirdly, it unlocks a new and lucrative revenue stream for highly flexible behind-the-meter assets like batteries, heat pumps, and EV depots that have traditionally been excluded from wholesale markets. By granting direct access to these markets, behind-the-meter batteries can now capitalize on energy arbitrage opportunities, significantly enhancing their business case and commercial viability. This flexibility bolsters the grid’s resilience, reducing reliance on expensive peak-time generation capacity and supports the UK’s net zero transition as VLPs play a crucial role in integrating renewable energy sources into the grid. Demand response would then add to the wholesale merit order stack increasing competition and driving prices down. But optimising asset requirements for participation can be a challenge that requires the right technology and expertise.

Why working with an experienced partner like GridBeyond makes sense

- complex participation: engaging in wholesale energy markets requires expertise and regulatory understanding, which may be challenging for businesses, so selecting the right partner with complimentary experience is critical for success

- financial risk and market volatility: wholesale pricing fluctuations could create uncertainty so working with a partner that can manage risk to minimise client risk if essential. By forecasting everything from weather conditions to wholesale market prices, GridBeyond helps you manage your energy purchasing and on-site assets in real time. Our AI forecasting solution uses advanced trading strategies, real time forecasting, and analytics-driven decision support to create a solution that will optimise your financial returns.

- operational adjustments: aligning energy consumption with market signals presents challenges, but the key lies in strategic changes that don’t impact overall production. Using AI and digital twins, GridBeyond can unlock cost-saving and revenue generating opportunities while ensuring uninterrupted operations.

By bringing together the trading signals from the AI-generated forecasts and combining them with your site requirements, volumes required and appetite for risk, our technology offers real-time automated trading, making the best available trades for you in real time across all available markets, including the wholesale market.