News

better business decisions

Posted 22 hours ago | 4 minute read

Ofgem and NESO consult on market reforms: what large energy users need to know

Consultations from Ofgem and the National Energy System Operator (NESO) signal changes to how large electricity users connect to and operate within the power system. Together, the proposals aim to reform the demand connection queue and reshape balancing, settlement and dispatch arrangements under the Reformed National Pricing (RNP) framework.

For large energy users the changes could materially affect project timelines, connection costs, operational flexibility and imbalance exposure. In this article we look at what’s being proposed.

Reforming the demand connections queue

Ofgem’s Call for Input (CFI), published on 13 February notes that between November 2024 and June 2025, the demand connections queue increased by 84GW. It identified three interrelated challenges:

- the demand queue is large and growing and contains a significant number of projects that are likely non-viable

- the demand queue contains a significant number of well-progressed projects that cannot progress to connection quickly enough, due to the time required for network or generation build, and the presence of non-viable projects

- there are no mechanisms to prioritise strategically important demand projects

For large users awaiting connection dates, these issues translate into uncertainty, delay and rising security requirements.

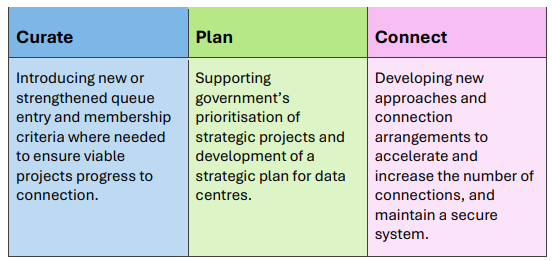

Ofgem proposes a three-pillar reform:

Source: Ofgem

Curate: strengthen the entry and membership requirements to strengthen the viability of projects entering the queue. Ofgem has proposed introducing a Curate Advisory Group to achieve this. Ofgem has proposed introduction of data centre-specific financial mechanisms, updates to the securities regime (for transmission connection projects) and strengthened readiness requirements for data centres. Views are being sought on three types of financial mechanisms with the aim of deterring non-viable projects, encouraging projects that are non-viable to exit the connection queue and ensuring timely progression of remaining projects.

Plan: ensuring strategically important connections, with those most likely to drive economic growth are given priority. Ofgem is also considering the implementation of auctions for both reservation and reallocation of capacity. Initial proposals will be prioritisation mechanisms to reserve and reallocate capacity for strategic projects as well as developing strategic plans to support networks.

Connect: accelerating and increasing the number of grid connections for demand projects available. The reforms under this pillar will work in conjunction with similar aims for the connection of generation, storage and interconnector projects, and will be developed by Ofgem’s new connect task and finish group.

The call builds on the update on demand connections that Ofgem published in November 2025. Responses are invited before 13 March 2026.

NESO’s Balancing, Settlement and Dispatch (BSD) Reforms

Separately, NESO has launched a Call for Input on proposed reforms to balancing, settlement and dispatch as part of Reformed National Pricing (RNP), following confirmation in the 2025 REMA summer update that RNP will replace zonal pricing.

RNP aims to increase the operational efficiency of the electricity system, better manage constraints and reduce related costs, optimise resource deployment through stronger locational signals, enhance data quality and facilitate the delivery of innovative technologies.

The main themes:

- lowering the mandatory Balancing Mechanism (BM) participation threshold to 1MW

- aligning the market trading deadline with Gate Closure

- requiring Final Physical Notifications (FPNs) to match traded positions

- introducing unit-level bidding

- shortening the Settlement Period to either 15 or 5 minutes

Responses are invited by 14 April.

Implications for large energy users

Taken together, these reforms mark a structural shift in how large electricity users connect to and interact with the GB power system.

The demand queue reforms aim to ensure only viable, strategically aligned projects progress; potentially accelerating serious developments but increasing upfront commitments. The BSD reforms under RNP will increase operational precision and market discipline, while opening new value streams for flexible and sophisticated energy users.

For large energy users, the message is clear:

- strengthen project readiness

- align with strategic growth priorities

- invest in flexibility and real-time capability

- prepare for tighter accountability

Those who adapt early may not only secure faster connections but also unlock new commercial opportunities in a more dynamic electricity market.

GB and IE Regional Outlook | Global Energy Trends 2026

Energy systems across Great Britain and Ireland are under unprecedented pressure. In 2025, record-breaking summer temperatures pushed electricity demand to new highs, intensified power price volatility, and exposed the urgent need for more resilient and flexible grids.

Learn more