Insights

better business decisions

Posted 2 years ago | 2 minute read

PJM Capacity Auction prices fall

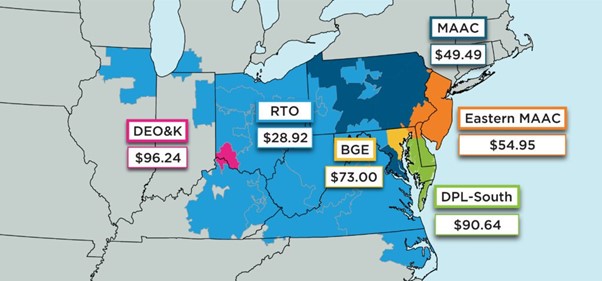

PJM’s capacity auction has secured adequate resources to meet demand for the 2024-25 Delivery Year, with prices down in the RTO and up in areas with local constraints that indicate tightening conditions in certain areas.

The 2024-25 capacity auction, or Base Residual Auction (BRA), was finalized on Feb. 27. The auction produced a price of $28.92 MW-day for much of the PJM footprint, compared to $34.13/MW-day for the 2023-24 auction in May 2022, at a total cost of $2.2B, consistent with the previous auction.

Source: PJM

The PJM capacity auction, called the Base Residual Auction, procures power supply resources in advance of the delivery year to meet electricity needs in the PJM service area, which includes all or part of 13 states and the District of Columbia. Auctions are usually held three years in advance of the delivery year. The 2024-25 auction was originally scheduled to be held in May 2021, but auctions had been suspended while FERC considered approval of new capacity market rules.

This year’s auction procured 140,416MW, excluding Energy Efficiency Resources, for the period of June 1, 2024, through May 31, 2025. The total Fixed Resource Requirement (FRR) obligation is an additional 32,545MW for a total of 172,961MW.

The total procured capacity in the auction and resource commitments under FRR represents a 20.4% reserve margin, compared to a 20.3% reserve margin for the 2023-24 Delivery Year. Overall resources offered into the capacity market, excluding Energy Efficiency Resources, were down 2,198MW, from 151,143MW in the 2023-24 auction to 148,946MW in the 2024-25 auction.

This auction had approximately 2,000 fewer MW offered than the previous auction, continuing a three-year trend of decreasing amounts of MW offered. PJM said if this trend continues, it represents a potential concern for long-term resource adequacy, depending on the rate of replacement of these resources.

The greatest changes among resources clearing (including FRR capacity plans) were increases in natural gas (+1,615MW) along with solar (+1,297MW), as the capacity market continues to facilitate the overall transition to lower-carbon generation resources. The greatest decreases in resources cleared were demand response (-451MW), nuclear (-331MW), coal (-278MW), hydro (-237MW) and oil (-230MW). Energy Efficiency cleared in the auction or committed in an FRR plan was up by 2,198MW.

The next annual Base Residual Auction, for the 2025-26 Delivery Year, will be held in June 2023.

Services in PJM

The energy landscape is changing.Here’s how to play it so you could make $200,000 per MW per year. The electricity […]

Learn more