Insights

better business decisions

Posted 3 years ago | 3 minute read

PJM capacity auction prices near lowest in a decade

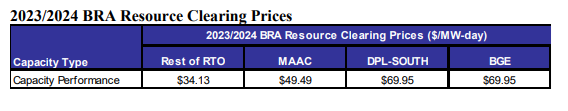

PJM Interconnection has procured resources in its capacity auction for 2023-24 at an average of $34.13/MW per day, the lowest since 2013-14.

Announced on 22 June, PJM said the auction results “reflect a reliable and lower-carbon resource mix achieved at a low cost to consumers”. The total procured capacity in the auction represents a 20.3% reserve margin, compared to a 14.8% required reserve for the 2023-24 Delivery Year. The total Fixed Resource Requirement (FRR) obligation is an additional 31,346MW.

Prices for the 2023-24 Delivery Year were lower than in the previous auction for the 2022-23 Delivery Year. The auction produced a price of $34.13/MW-day for much of the PJM footprint, compared to $50/MW-day for the 2022-23 auction in June 2021. Prices are higher in some regions due to constraints on the transmission system. As a result, sufficient resources plus robust reserve levels were procured at a cost of $2.2B, compared with approximately $4B for the 2022-23 Delivery Year.

Source: PJM

This auction procured 144,871MW of resources for the period of June 1, 2023, through May 31, 2024. The auction saw a growth of more than 5,000MW of carbon-free resources, led by an increase of 5,315MW from existing nuclear units that did not clear in the previous auction. Solar resources increased 25%, from 1,512MW to 1,868MW, while the number of wind resources clearing was down 434MW to 1,294MW.

Natural gas resources clearing the auction increased by 1,685MW. Cleared capacity of steam units (primarily coal) was down 7,186MW to 27,682MW. A 660MW increase in Energy Efficiency resources, to 5,471MW, was offset by a 716MW decrease in Demand Response to 8,096MW. Hydro decreased slightly, from 4,157MW to 3,677MW.

PJM has compressed its auction calendar to return to a three-year-forward basis. The next annual Base Residual Auction, for the 2024-25 Delivery Year, will be held in December.

GridBeyond SVP for North America Wayne Muncaster said:

“It is disappointing demand response capacity procured has dropped as much as it has, especially given the ability of the demand side to not only provide a support to the grid, but also to encourage businesses to optimize their energy use.

“It is unsurprising that the clearing prices were significantly lower than in previous auctions. But it’s a direct hit to companies’ income statements and as a result, many businesses will be left wondering what they could do to fill the gap.”