Insights

better business decisions

Posted 3 years ago | 2 minute read

PJM sets out resource retirements, replacements and risks

The third phase of PJM’s ongoing study of impacts associated with the energy transition highlights potential reliability risks to meeting growing electricity demand.

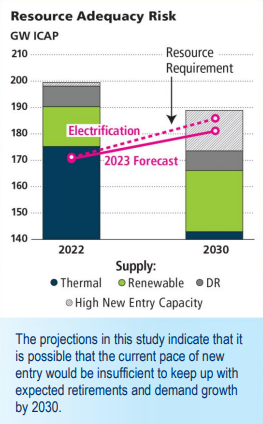

The analysis shows that 40GW of existing generation are at risk of retirement by 2030. Of which 6GW of 2022 deactivations, 6GW of announced retirements, 25GW of potential policy-driven retirements and 3GW of potential economic retirements. Combined, this represents 21% of PJM’s current installed capacity.

Source: PJM

The Energy Transition in PJM: Resource Retirements, Replacements and Risks report, published on February 24, highlights four trends that, in combination, present increasing reliability risks due to a potential timing mismatch between resource retirements, load growth and the pace of new generation entry under a possible “low new entry” scenario:

- The growth rate of electricity demand is likely to continue to increase from electrification coupled with the proliferation of high-demand data centers in the region.

- Thermal generators are retiring at a rapid pace due to government and private sector policies as well as economics.

- Retirements are at risk of outpacing the construction of new resources, due to a combination of industry forces, including siting and supply chain, whose long-term impacts are not fully known.

- PJM’s interconnection queue is composed primarily of intermittent and limited-duration resources. Given the operating characteristics of these resources, we need multiple megawatts of these resources to replace 1 MW of thermal generation.

In addition to the retirements, PJM’s long-term load forecast shows demand growth of 1.4% per year for the PJM footprint over the next 10 years. Due to the expansion of highly concentrated clusters of data centers, combined with overall electrification, certain individual zones exhibit more significant demand growth – as high as 7% annually.

On the other side of the balance sheet, PJM’s New Services Queue consists primarily of renewables (94%) and gas (6%). But it noted that despite the nameplate capacity of renewables in the interconnection queue (290GW), the historical rate of completion for renewable projects has been approximately 5%. This means that the current pace of new entry would be insufficient to keep up with expected retirements and demand growth by 2030.