News

better business decisions

Posted 5 months ago | 2 minute read

Price arbitrage remains key use case for batteries: EIA

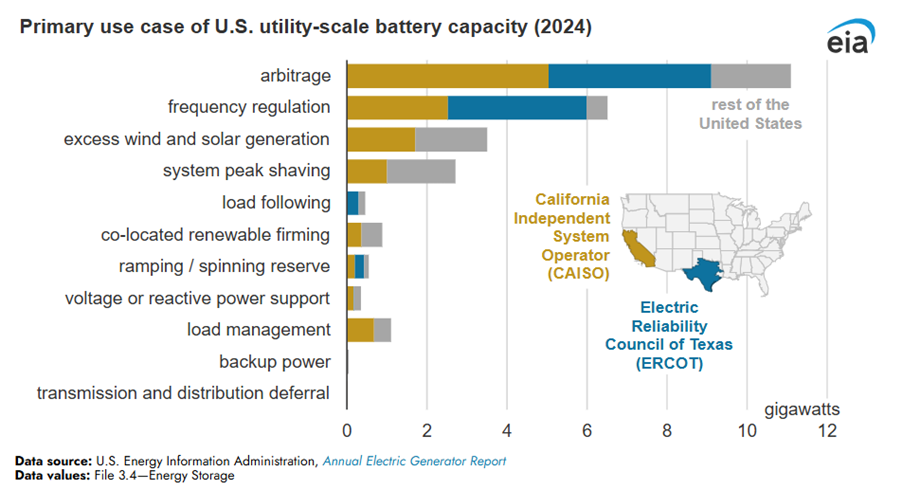

Across the US, in 2024 utility-scale batteries were more commonly used for price arbitrage, the US Energy Information Administration (US EIA) annual survey of power plant activity has found.

Published on September 22, the report notes that in the 2023 survey, operators utilised about 11GW of capacity for arbitrage out of the total 16GW recorded. Of this 11GW, roughly 6GW was primarily dedicated to arbitrage activities. In 2024, the total capacity was around 27GW. Of this, about 18GW was utilised for arbitrage, with an estimated 11GW mainly dedicated to this purpose. Arbitrage led over frequency regulation by approximately 4.5GW, and frequency regulation meanwhile, led over excess wind and solar generation by about 3GW. CAISO reported a total of 11.7GW of battery capacity, with 43% mainly dedicated to arbitrage while ERCOT reported 8.1GW of battery capacity, with half mainly used for arbitrage.

But as GridBeyond noted in our recent whitepaper Where is alpha? battery storage operators must transition from basic arbitrage strategies to highly optimized, integrated solutions that capture returns that outperform the benchmark when adjusted for risk (what the financial world calls alpha). In the context of battery storage, alpha represents the added value achieved through intelligent asset management, real-time forecasting, multi-market bidding and seamless operational co-ordination.