Insights

better business decisions

Posted 3 years ago | 5 minute read

SEC proposes greenhouse gas emission disclosure rules

This article originally appeared in the May 2022 issue of EEnergy Informer, published and edited by Dr Fereidoon Sioshansi, who can be reached at fpsioshansi@aol.com or website http://www.menloenergy.com

Apparently oblivious to the turmoil in the energy markets, the Securities and Exchange Commission (SEC) in late March proposed rule changes that would require listed companies in the US to include certain climate-related disclosures in their registration statements and periodic reports, including information about climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition, and certain climate-related financial statements to their audited annual reports. The required information would include disclosure of a registrant’s greenhouse gas emissions, which have become a commonly used metric to assess exposure to such risks. It is the strongest signal to date from the US stock market regulator and a significant milestone for those who have been advocating for the new disclosure details for many years.

In a prepared statement SEC Chair Gary Gensler said,

“I am pleased to support today’s proposal because, if adopted, it would provide investors with consistent, comparable, and decision-useful information for making their investment decisions, and it would provide consistent and clear reporting obligations for issuers.”

“Our core bargain from the 1930s is that investors get to decide which risks to take, as long as public companies provide full and fair disclosure and are truthful in those disclosures,”

“Today, investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies, and investors need reliable information about climate risks to make informed investment decisions.”

“Companies and investors alike would benefit from the clear rules of the road proposed … I believe (that) the SEC has a role to play when there’s this level of demand for consistent and comparable information that may affect financial performance.”

The proposed rule change would require to disclose information about

▪ How any climate-related risks identified have had or are likely to have a material impact on its business and consolidated financial statements;

▪ How any identified climate-related risks have affected or are likely to affect the company’s strategy, business model, and outlook; and

▪ The impact of climate-related events (e.g., severe weather events and other natural conditions) and transition activities on the consolidated financial statements and on the financial estimates and assumptions used in the financial statements.

Specifically, SCE’s proposed rules would require the disclosure information on

▪ Scope 1 or direct greenhouse gas (GHG) emissions;

▪ Scope 2 or indirect emissions from purchased electricity or other forms of energy; and

▪ Scope 3 or emissions from upstream and downstream activities in the value chain.

The proposed rules – consistent with broadly accepted disclosure frameworks, such as the Task Force on Climate-Related Financial Disclosures and the Greenhouse Gas Protocol – would provide a safe harbor for liability from Scope 3 emissions disclosure and an exemption for smaller companies. They are expected to be phased in over time. No more emit and forget will be allowed.

The rule change was inevitable – Ukraine crisis notwithstanding. The time for emitting unlimited quantities of GHGs without reporting it and/or ignoring the effects of climate change on a listed company’s operations, assets and investments had to come to a close. It is amazing that it has taken so long. Clearly, this is Biden’s SEC, not Trump’s.

But will it make a difference, and how soon, is another question.

▪ First, savvy investors and especially insurance companies already consider climate-related risks as part of their investment strategy. SEC’s rules allow less-sophisticated investors to also consider the risks before making investments. Pension funds and others will have no excuse to say they were not aware of the risks. They will be pre-warned.

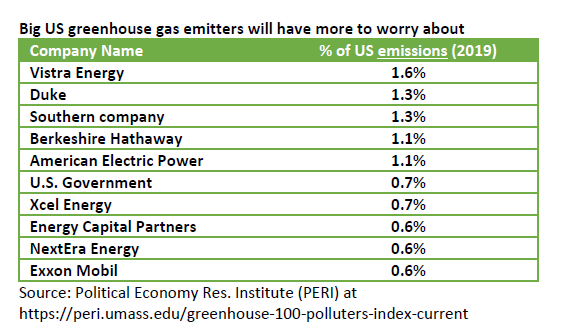

▪ Second, more than half of the top 20 global GHG polluters (visual) are non-listed, hence not subject to the regulation. Saudi Aramco, the top polluter, is now listed and hence will be forced to release what would be rather embarrassing statistics if it wishes to trade in New York, London or European exchanges. The pressure is clearly on. Eventually, everyone will have to disclose and be transparent. Some investors will probably not care, others do and will shun those at risk or emitting significant carbon.

About

Dr. Sioshansi is President of Menlo Energy Economics, a consulting firm based in San Francisco, California, advising clients on the rapid transformation of the electricity sector and emerging business models. He has over 4 decades of experience covering all aspects of the electricity power sector. He is the editor and publisher of EEnergy Informer, a monthly newsletter with international circulation, now in its 29th year of continuous publication.

Dr. Sioshansi’s professional experience includes working at

- Southern California Edison Company (SCE);

- The Electric Power Research Institute (EPRI);

- National Economic Research Associates (NERA); and

- Henwood Energy, now part of ABB.

Dr. Sioshansi has degrees in Engineering and Economics, including an MS and Ph.D. in Economics from Purdue University.

EEnergy Informer covers the significant news and developments in climate change, renewable energy, energy efficiency, smart metering and smart grid, nuclear energy, clean coal technology, natural gas, energy supply and security issues – and much more – in ways not found anywhere else.

Dr. Sioshansi can be reached at fpsioshansi@aol.com or via http://www.menloenergy.com