Insights

better business decisions

Posted 3 years ago | 4 minute read

Texas plans to prevent blackouts may not encourage investment, finds ICF

Proposals to improve grid reliability in ERCOT could cost much more than alternatives and still fail to prevent winter blackouts, according to a report published by consultancy ICF on behalf of the Texas Consumers Association.

Unlike the rest of the US, Texas does not have a capacity market or resource-adequacy structure in which it pays power plants and other energy resources for simply being available to serve the grid if power demand outstrips supply. Instead, it has a unique energy-only market structure, where generators rely solely on spikes in energy prices to earn enough money to invest in building new power plants. But following the severe impacts resulting from Storm Uri in 2021, Texas regulators are considering an overhaul of the market intending to prevent disasters like the widespread blackouts of winter 2021.

But in its Assessment of ERCOT Market Structural Changes report, published on 26 October, ICF suggested that Texans should expect, on average, approximately five outages every ten years, or a 0.5 Loss of Load Expectation (LoLE). Reliability is forecasted to further deteriorate by 2030 if no further policy measures are taken. It also suggested that none of the planned market change proposals, by themselves, would improve reliability enough to yield one outage every ten years (0.1 LoLE, a generally accepted industry standard).

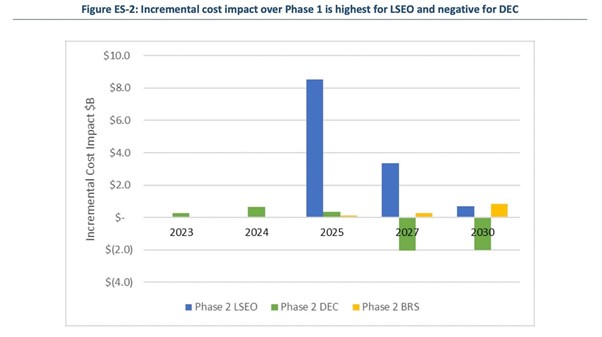

The report examined the cost implications of the Load-Serving Entity Obligation (LSEO) proposal made by power plant owners NRG Energy and Exelon. It suggested that the LSEO would likely increase wholesale electricity costs by $8.5BN in the year 2025 alone, and $22.5BN from 2025-2030 but that the mechanism would still result in between 4-5 outages per decade.

The LSEO plan is the most costly of the three options being considered by the Public Utility Commission of Texas, as it will create a market in which all retail electricity providers and municipal and cooperative utilities will be forced to pay generators.

But two other market devices that have also been proposed would provide about the same reliability benefits while making less dramatic changes to the ERCOT market, according to the ICF report. They would also come with much lower costs.

Another option being considered is a “Dispatchable Energy Credits” construct that would require load-serving entities to pay a premium for energy purchased from “fast, flexible” resources. Those include fossil gas generators that can quickly ramp up their output and batteries that can store at least two hours of energy and discharge it to the grid nearly instantaneously. ICF’s analysis showed that it would increase wholesale electricity costs by a total of about $1.3BN through 2025, but then lead to lower overall costs over time.

The final option being examined is the Backstop Reliability Service, which would in essence pay coal and gas generators that would otherwise be expected to cease operations to remain available for emergency operations. The ICF report forecasts that the Backstop Reliability Service plan would cost about $2.6BN between 2025 and 2030. ICF also suggested the Backstop Reliability Service plan could also be more valuable for providing extra power during the longer peaks in electricity demand that are common in winter.

Source: ICF

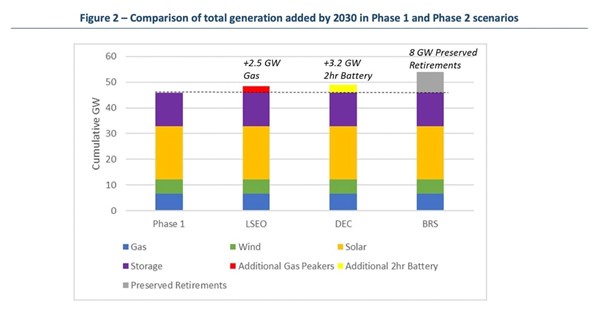

The ICF forecasts that a relatively small amount of new generation would likely be built in response to the market signals proposed in the LSEO plan. But that new generation would be slightly less than the amount of new battery storage encouraged by the market structure proposed in the Dispatchable Energy Credits plan, and quite a bit less than the amount of generation that the Backstop Reliability Service structure would encourage to stay open rather than close down.

Source: ICF

A complementary report, to be released in November, will assess the cost and reliability impacts of using high levels of demand-side resources to improve reliability in ERCOT and will compare those impacts to the supply-side changes assessed in this report.