Insights

better business decisions

Posted 3 years ago | 8 minute read

The energy crisis affects businesses as well as households

Guest blog from Robert Buckley, Head of Relationship Development at Cornwall Insight

Buckley

Head of Relationship Development at Cornwall Insight

Every week at Cornwall Insight we update our forecast for the Default Tariff Cap through to the end of 2023. They make for grim reading as our predictions continue to rise, with high prices likely to continue unless there is a collapse in the wholesale energy markets. With Russian gas trickling into Europe, low hydro and problems with the nuclear fleet in France, such an eventuality seems unlikely in the in the near-term, and leaves respite in the energy markets at the mercy of geopolitics.

In contrast to households, and other than our own efforts, there has been strikingly little said about the affordability of business energy bills. Business energy prices have been rocketing for 15 months with increases proportionately higher than those experienced by households under the Default Tariff Cap. They also stand on the verge of another significant steep uplift when new contracts come in to place for the period from 1 October 2022. Traditionally this date is the key anniversary for contracting fixed price contracts in the business electricity and gas supply markets and industry bodies are already flagging their worries.

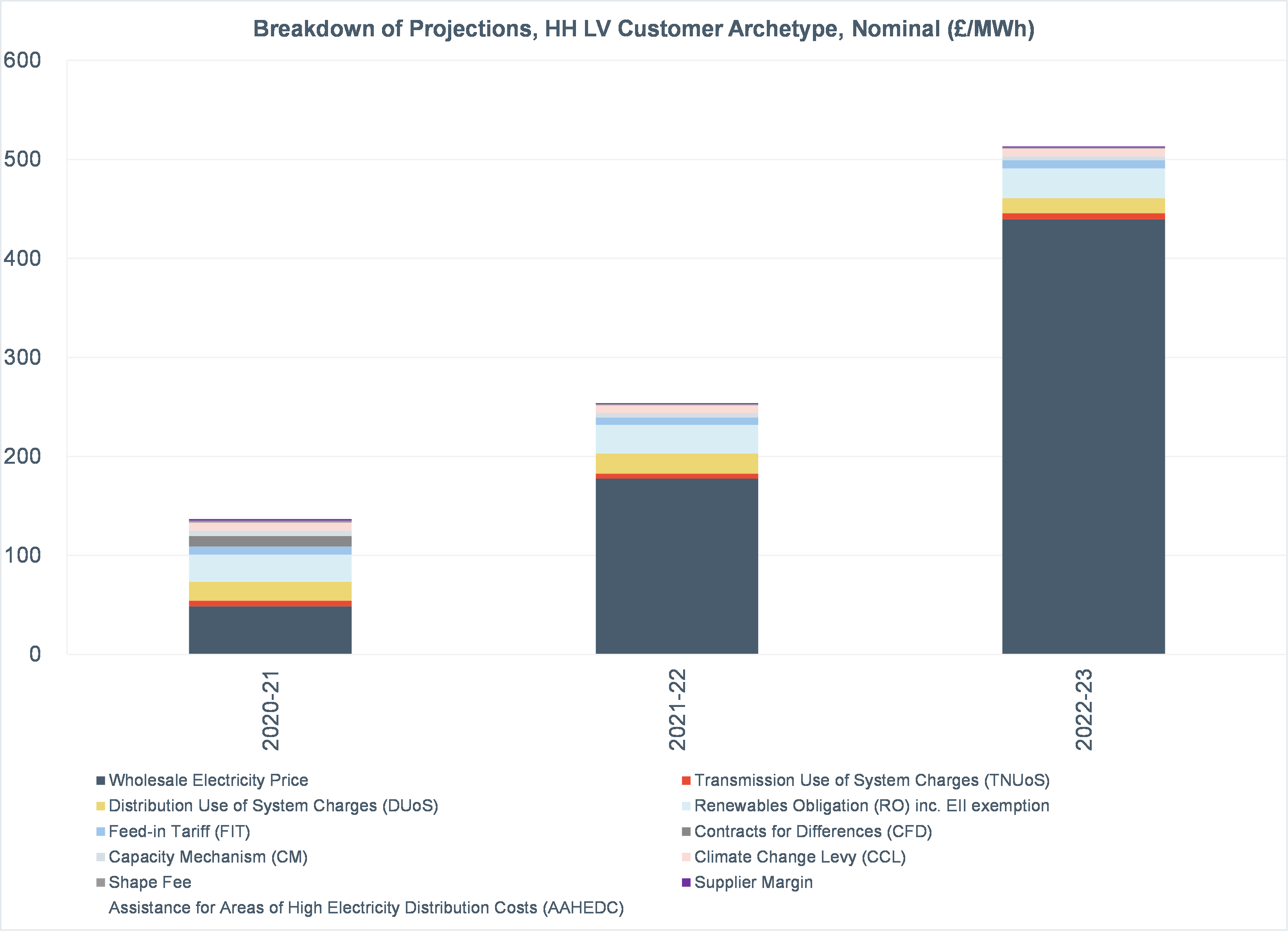

Based on movements in forward curve prices, this anniversary will be particularly challenging: those renewing an annual contract can expect their price next year to have doubled on this year, which in turn was double what had been seen during 2020-21. For those who negotiated their two-year fixed price contracts in the lockdown summer of 2020, the price increase could be as much as fivefold (see Figure 1).

What is striking about the business energy markets is how relatively calm they still seem given the price increases already experienced and the guaranteed further increases to come. But the mood music is changing, from speaking to brokers, intermediaries and suppliers we hear that some suppliers have voluntarily stopped taking on new business in different sectors and may not be actively renewing some contracts if not pulling out of entire sectors. Whilst there has been nowhere near the scale of forced exit by suppliers that we have seen in the domestic market, we are hearing real concern about bad debt from suppliers both about their existing customers and those new customers who may be acquired.

On the flip side, we also hear surprise from suppliers that these problems are, seemingly against reality, not yet playing through into actual bad debts. Customers have been continuing to pay 2022’s high prices in much the same way as they have before. But if businesses generally become overburdened with the weight of financial pressure from broader macro-economic conditions, one wonders if the coming further increases in energy costs could be the rather sizeable straw that breaks the camel’s back? Recognising the heterogeneity of the corporate economy, this is particularly true for certain firms whose profitability is most exposed to energy cost increases by virtue of their cost base and activity. And with credit insurance essential in making the business energy markets work through underpinning confidence in sectoral business risk, can suppliers be confident this service will continue to be available to them on the same terms and for the same types of activity?

Lead indicators in this sector suggest that the calm before the storm may be ending. Suppliers’ reluctance to take on new customers and the struggles of brokers and intermediaries to secure the quantities of quotes for their clients that they have been used to are sign posts of where the business energy sector could be heading. And even in instances where new customers are being taken on, some see a shift to flexible contracts for larger customers as the users or their suppliers refuse to commit for a term to what they perceive to be prices that are simply too high.

Here lies trouble for the economy and the potential to derail the UK Government’s Levelling Up Agenda.

Logic dictates that there can only be so long that so many businesses can pay so much more for their energy without knock-on consequences for themselves, their suppliers, and the wider economy. If we at Cornwall Insight are correct there will be no return to 2020-21 wholesale prices before 2030, as our experts recently set out in their medium-term price view (add link). And if we get a price spike this winter, we could see profound shocks to business.

What might cause such a spike? We already note a very difficult Russian gas supply situation, tight electricity markets in Europe as traditionally reliable forms of generation have issues, and a global LNG market running very hot. Add in a cold, still snap and we could see even higher prices or worse. In Germany they are talking about the potential for rationing energy and taking energy savings measures now.

We are not really having conversations in Great Britain on relief for or of structured energy savings from businesses. Existing measures in place cover energy intensive industries only and cover some non-wholesale costs, rather than the record high wholesale prices that are causing the increase in bills. Should we be having those conversations as they are in Germany? Time is very tight if we are to act on any conclusions for this winter, but it looks like we will have at least another winter in which such conversation might be relevant if Cornwall Insight’s experts are right.

The firms that will be most exposed to these very high prices will be spread across the economy. Hospitality, leisure, and retail have long been seen as poor credit risks by suppliers, especially since the lockdowns, but are characterised by high levels of employment and many small businesses. Likewise, some industrial sectors are seen as being poor credit risks due to their exposure to competition from imports. Some of these sectors are concentrated in regions that have been positioned in the UK Government’s Levelling Up Agenda. What if they are very vulnerable to extremely energy prices or, worse, effective disconnection because they cannot afford their bills? What if such circumstances lead them to shutter or permanently close, offshoring to other economies? Where would this leave Levelling Up and how would this flow through to households already under pressure?

The economy is not defined by isolated islands, and in particular businesses and households are not two continents of economic activity separated by vast distances. Instead, as we saw in last autumn’s carbon dioxide supply problems, they are part of an integrated organism with pressures and challenges in each, influencing the outcomes and prospects of the other. One other tiny example: the owner of the coffee shop where my son works is now baking at home because of energy prices.

In light of businesses facing an energy price environment as we now forecast, we really do need to think much harder about what this energy crisis is doing to them. This is not only to ensure we don’t see loss of output, but so we don’t see companies with heritage, roots in their communities and otherwise good prospects washed away. Such an outcome would have consequential impacts on real people and families not just company balance sheets and GDP statistics. Old assumptions about businesses responding to market prices won’t wash when prices are 10 times normal. When written down this seems self-evident. Yet the level of action by government is surprisingly small given their wider economic agenda could be at stake.

Opening a scheme where businesses could bid in their energy savings from peak load switching would be a start. After all we know what triggers winter demand peaks even if we do not know exactly when they will occur. Not only could such a scheme properly value demand response but there would be significant carbon savings too as fossil fuel generation would not need to run. Perhaps a crisis of this kind, coincident with the Government’s Review of Electricity Market Arrangements, presents the opportunity to implement the functioning demand side element of the power market that has been so lacking since 1990.

Figure 1: Indicative breakdown of business electricity costs

Source: Cornwall Insight

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.