News

better business decisions

Posted 5 months ago | 6 minute read

TNUoS tariffs: what NESO’s latest forecast means for your business

The National Energy System Operator (NESO) has published its latest Five-Year View of Transmission Network Use of System (TNUoS) tariffs, it forecasts a steep rise in charges from April 2026. For large energy users, this could significantly impact operating budgets.

In this article GridBeyond’s Head of DSR Services Shawn Duckett explores what TNUoS charges are, why they are rising and the impacts for businesses.

What are network charges?

All users of Great Britain’s electricity network pay to use it. Users include generators, who use the network to transport the electricity they generate to where it is needed, and demand users who use it to obtain electricity when they need to use it. There are four main charges:

- Transmission Network Use of System (TNUoS): these charges recover the costs of installing and maintaining the transmission system and are charged to all suppliers and generators

- Balancing Use of System (BSUoS): recover the costs of the day-to-day operation of the transmission system

- Connection charges: these recover the cost of installing and maintaining connection assets which connect individual users to the GB transmission network

- Assistance for Areas with High Electricity Distribution Costs (AAHEDC): recover costs for the north of Scotland which is currently the only area specified to receive assistance.

How are TNUoS charges calculated?

TNUoS tariffs aim to reflect the cost of using the network, to help network users make efficient decisions about where and when to use it. Charges vary by location, reflecting the costs that users impose on the transmission network to transport their electricity.

Demand users who pay half-hourly tariffs are charged according to what they used at the three highest peaks of system demand (known as triad periods – which cover the highest demand period between November and February each year). These tend to be large businesses.

Generators also pay based on a capacity value agreed between them and NESO, known as Transmission Entry Capacity (TEC). There is also an embedded export tariff for those generators who are connected to the distribution network with TEC<100MWs. This is based on the generators export over the triad periods.

What’s changing?

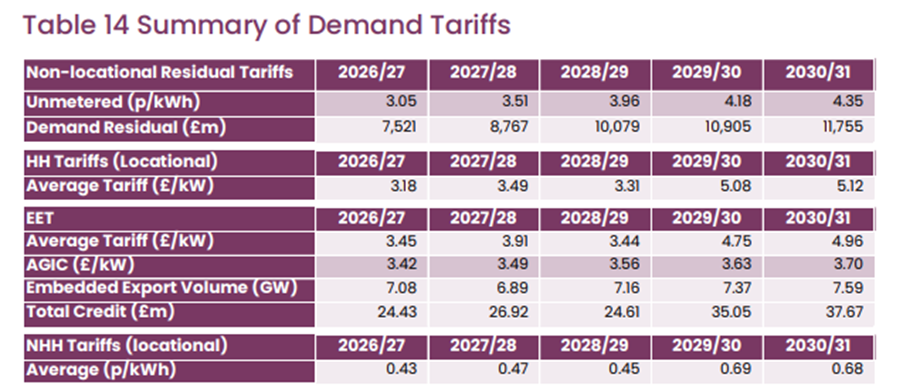

NESO’s latest Five‑Year View on TNUoS tariffs, reveals significant expected increases:

- TNUoS ‘Allowed Revenue’ is set to increase from £5.1B in 2025-26 to £8.9B in 2026-27

- TNUoS ‘Demand Residual’ is set to recover £3.8B in 2025-26 and increasing to £7.5B in 2026-27. This is a notable 94% increase compared to the 2025-26 final tariffs.

Source: NESO

Why are charges rising?

NESO explains that these forecast changes are driven by the transition into the new RIIO-3 price control period. As Transmission Owners begin operating under new revenue allowances and investment plans, the focus is on a major cost driver; network reinforcement resulting from a growing number of renewable generation projects in remote locations.

NESO also updated its transport models, refining key parameters that affect locational tariffs and contributing to the higher-than-expected figures.

What is the impact for my business?

For large electricity consumers, TNUoS costs can make up a significant part of their electricity bills. With sharp increases expected, businesses should reexamine their energy budgets, forecasts, and procurement strategies.

The data from NESO’s report provides a clear picture of the scale of the upcoming changes:

- The average Half-Hourly (HH) demand tariff is forecast to rise to £3.18/kW in 2026-27, increasing to £5.12/kW in 2030-31

- The average Non-Half-Hourly (NHH) demand tariff will increase to 0.43 p/kWh in 2026-27

The next TNUoS tariff publication will be the Draft forecast of 2026-27 tariffs, which will be published in November 2025 and the final tariffs will be published in January, but for energy consumers, particularly large users, proactively understanding your specific site’s geographic zone and capacity is essential. These factors determine your TNUoS banding and your exposure to these charges.

What about CMP440?

The way UK businesses are charged for using the transmission network is set for another change, with significant implications for costs depending on where you’re located and how you use electricity. CMP440 (if enacted) would re-introduce locational demand signals into TNUoS charges by removing the zero-price floor.

The zero-price floor was introduced as part of CMP343/TDR (Transmission Demand Residual) reforms in April 2023 following Ofgem’s Targeted Charging Review, which meant that even when a locational demand tariff would otherwise be negative, it was floored at zero. CMP440 argues that this has significantly reduced or removed locational cost signals for demand, especially in the northern zones of Great Britain (zones 1-8).

Before April 2023, demand tariffs often had an opposite locational effect relative to generation tariffs: in zones with stronger generation and less constraints, demand tariffs would be lower (or sometimes negative), encouraging locating demand where it is cheaper for the grid. The zero floor masks that and concerns have been raised that this loss of locational signals discourages efficient investment (in where demand is located), or incentives to shift load or flexibility in demand, which could help reduce transmission congestion, lower reinforcement costs, etc.

CMP440, if enacted would remove the zero-price floor for negative locational demand components for Final Demand users. That means in zones where locational demand charges would be negative, those negative charges (i.e. credits) can apply, rather than being clipped at zero.

This means that TNUoS charges will reflect the true state of the network more directly, which means greater variation between zones and between customer types. If your sites are close to generation sources or in parts of the network with spare capacity, you may benefit through lower charges. If you’re in constrained areas, expect costs to rise. The change also increases the value of flexibility. Businesses with half-hourly metering, demand-side response capabilities, or the option to relocate high-energy activities will have more opportunity to manage costs strategically.

For many businesses, this re-introduction of locational signals will feel like both a challenge and an opportunity. Those who can adapt by investing in flexible energy use, siting operations more carefully, or making use of distributed energy resources will be better placed to benefit. Those unable to change may face higher costs.

The working group report is expected in November, with implementation targeted for April 2027.

How can GridBeyond help?

At GridBeyond, we help our customers navigate complex market changes. We work with our customers to understand their unique circumstances, offering tailored solutions to help them manage their exposure to rising network costs. We also support our customers and business partners by offering tailored net zero solutions designed to help manage rising network charges and reduce overall energy costs. This includes battery storage solutions that can help businesses shift their energy usage to times when electricity is cheaper, or even avoid peak charges altogether. In addition, GridBeyond offers funded onsite generation, such as solar PV or combined heat and power (CHP) systems, enabling businesses to generate their own electricity, reduce reliance on the grid, and cut carbon emissions. By combining these solutions with expert guidance, GridBeyond can help businesses build resilience against future cost increases and move confidently towards a more sustainable, low-carbon future.