Insights

better business decisions

Posted 2 years ago | 4 minute read

US faces elevated risk of blackouts this summer

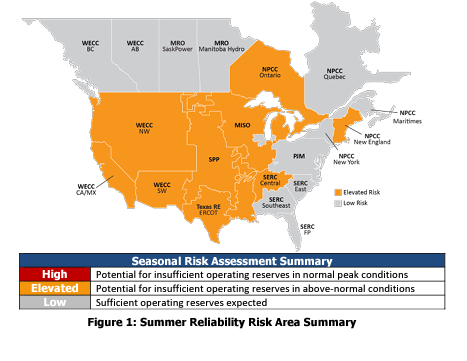

NERC’s 2023 Summer Reliability Assessment has warned a significant portion of North America faces potential energy shortages during periods of high demand this summer.

Published on May 17, the assessment does not identify any areas as high-risk, but it does highlight an increased number of regions at elevated risk.

Source: NERC

According to the assessment, although the available resources are sufficient to meet normal summer peak demand, seven areas could experience supply shortages if there is a surge in summer temperatures and demand levels:

- Texas (ERCOT): The area is experiencing strong growth in both resources and forecasted demand. ERCOT added over 4 GW of new solar PV nameplate capacity to the ERCOT grid since 2022. Additionally, load reductions from dispatchable demand response programs have grown by over 18% to total 3,380 MW. ERCOT’s peak demand forecast has also risen by 6% as a result of economic growth. Resources are adequate for peak demand of the average summer; however, dispatchable generation may not be sufficient to meet reserves during an extreme heat-wave that is accompanied by low winds.

- Midcontinent ISO (MISO): The risk of being unable to meet reserve requirements at peak demand this summer in MISO is lower than in 2022 due to additional firm import commitments and lower peak demand forecast. MISO is expected to have sufficient resources, including firm imports, for normal summer peak demand. Wind generator performance during periods of high demand is a key factor in determining whether there is sufficient electricity supply on the system to maintain reliability. MISO can face challenges in meeting above-normal peak demand if wind generator energy output is lower than expected. Furthermore, the need for external (non-firm) supply assistance during more extreme demand levels will depend largely on wind energy output. Results of MISO’s capacity auction have not been released at the time of this assessment, and these could change MISO’s firm resources for the summer.

- NPCC-Ontario: Planned nuclear outage for refurbishment have reduced the electricity supply resources serving the province. Additionally, load growth is contributing to a constrained transmission network during high-demand conditions that may not be able to deliver sufficient supply to the Windsor-Essex area in the southwest part of the province. Additional generator outages or extreme demand can lead to reserve shortages and a need to seek non-firm imports. Ontario could potentially see a significant increase in reliance on imports this summer under both normal peak and extreme demand scenarios.

- NPCC-New England: Anticipated resources in New England are projected to be lower than in 2022 but are expected to remain sufficient for meeting operating reserve requirements at normal peak demand. Operating procedures for obtaining emergency resources or non-firm supplies from neighboring areas are likely to be needed during more extreme demand or low resource conditions.

- SERC-Central: Compared to the summer of 2022, forecasted peak demand has risen by over 950 MW while growth in anticipated resources has been flat. The assessment area is expected to have sufficient supply for normal peak demand while demand-side management or other operating mitigations can be expected for above-normal demand or high generator-outage conditions.

- Southwest Power Pool (SPP): Reserve margins have also fallen in SPP as a result of increasing peak demand and declining anticipated resources. Like MISO, the energy output of SPP’s wind generators during periods of high demand is a key factor in determining whether there is sufficient electricity supply on the system. SPP can face energy challenges in meeting extreme peak demand or managing periods of thermal or hydro generator outages if wind resource energy output is below normal.

- US Western Interconnection: Resources across the area are sufficient to support normal peak demand. However, wide-area heat events can expose the WECC assessment areas of California/Mexico, Northwest and Southwest to risk of energy supply shortfall as each area relies on regional transfers to meet demand at peak and the late afternoon to evening hours when energy output from the area’s vast solar PV resources are diminished. Within the Western Interconnection, entities are planning to install over 2GW of new battery energy storage systems, which can help reduce energy risks from resource variability. Wildfire risks to the transmission network, which often accompany these wide area heat events, can limit electricity transfers and result in localized load shedding.

Manage Risk & Optimise Price

Our whole of market services to take your business from passive procurement to active energy management and trading powered by AI and deep data science.

Learn more