News

better business decisions

Posted 1 year ago | 3 minute read

What causes high prices and how can we better predict them?

Price forecasting is increasingly valuable for optimizing asset performance in energy markets. Here, machine learning models are overtaking previous methods, but a common question we often get is why we make the predictions we do.

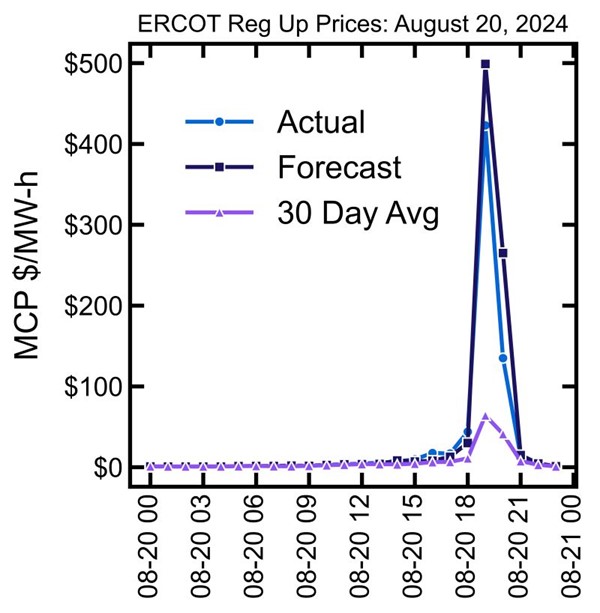

In this article GridBeyond Senior Product Manager Ben Sigrin and Head of Platform Architecture Dr. Tahir Rabbani look at some recent forecasts we made for Regulation Up prices in ERCOT during the August 20th heatwave last month. First, Reg Up prices were much higher than average—average Reg Up prices over the last 30 days in 19:00 were $64.1/MW-h and actual prices cleared at $423/MW-h.

Also, and this is often underappreciated, but RegUp, like all other ERCOT ancillary services, are procured day ahead, which means price forecasts are only actionable if they’re forecasted more than 24 hours in advance.

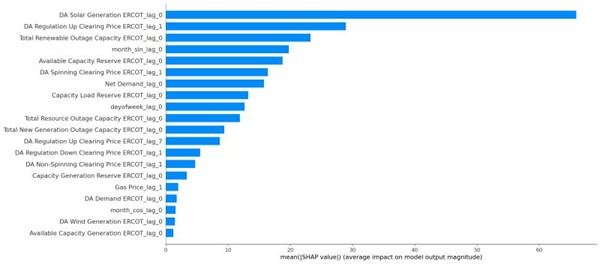

First, let’s look at the feature importance plot. This shows which variables were most important in the prediction, but not the direction or magnitude of the effect. The three most important factors were the amount of solar generation predicted at the day ahead point, the Reg Up price the previous day, and the amount of renewable generation capacity experiencing outages. You can also see some feature engineering we do to find more signal in the noise, like lagging variables (how yesterday effects today) or treating months not as numbers but cyclically like a face of a clock.

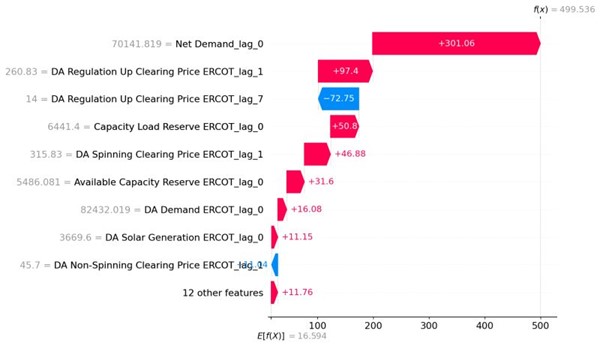

Next, we can see the actual effect of each variable on the price forecast. We can think of this as adding up the contribution of each variable to the total price predicted. For example, the forecasted net demand of 70,141 MW contributed +$301/MWh of influence whereas the mean Reg Up price 7 days previous of $14/MWh decreases the prediction by -$72.8/MWh. These are all in relation to what the model considers the “expected” price of $16.6/MWh absent any deviations from normal conditions.

All of GridBeyond’s forecasting models continuously gather data, re-train, and provide new forecasts without our actions. Our day ahead forecasts are available up to 7 days in advance and real time models up to 48 hours in advance. Please ping me if you’d like to learn more. We provide price forecasting as a data product or bundled with our asset management services.

At GridBeyond we use advanced forecasting, digital twin modeling, and real-time optimization to help our clients maximize their market revenue, whether for FTM or BTM resources.

Ai. Forecaster – Demo

Our AI powered VPP platform offers a comprehensive approach to managing and monetising your energy assets. From accurate forecasts, advanced trading strategies, and real-time analysis, through to robotic trading and asset optimisation and control, our services helps you increase margins,optimise financial returns, and navigate the complexities of the energy market with confidence.

Learn more