Insights

better business decisions

Posted 3 years ago | 4 minute read

“Challenging” outlook lies ahead for Ireland

This year’s Generation Capacity Statement (GCS) by EirGrid and predicts a challenging outlook for Ireland, with capacity deficits identified during the 10 years to 2031.

In the short term, the report, which was published on 6 October, notes that the deficits will increase due to the deteriorating availability of power plants, resulting in their unavailability ahead of intended retirement dates. In later years the deficits are expected to reduce as new capacity comes forward through the Single Electricity Market (SEM) capacity auctions.

Since last year’s GCS, 365MW of previously awarded capacity has been withdrawn and the developers have paid termination charges. This is in addition to the previous 266 MW which terminated. This means that most new capacity that was expected to come online over the coming years has now withdrawn.

Trends in the data centre sector show demand levels around 140 MW higher by 2030 than previous forecasts. There is very strong growth in this sector out to 2024, with continued growth towards the end of the decade. In its median forecast, the report estimates that demand for electricity will increase 37% by 2031. The largest growth comes from the data centre and new large energy users, and an increased uptake of electric vehicles and heat pumps, particularly later in the decade.

Meanwhile in the latest Winter Outlook report, Eirgrid and Soni noted there “is no risk of a system-wide “blackout” (a total loss of control of the electricity system) solely due to insufficient generation in Ireland or Northern Ireland under any circumstances this winter”. Other conditions would have to be present or multiple and significant failures occur to cause a system wide blackout.

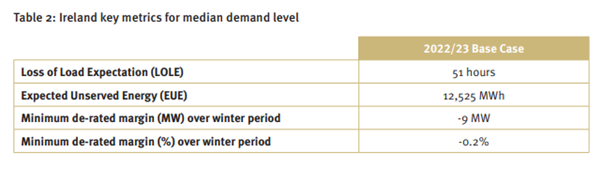

The Loss of Load Expectation (LOLE) in Northern Ireland for the winter period is 1.5 hours. This is within the 4.9 hours per year standard meaning the system will operate within the acceptable level of risk that is set by the Department for the Economy. But it said there remains a risk of the system entering the Alert State, most likely at periods of low wind and interconnector imports.

The Loss of Load Expectation (LOLE) in Ireland for the winter period is 51 hours. The LOLE has increased from 17.4 hours last winter and is outside the 8 hours per year standard. There is an expectation that the system will enter the Alert State at times of low wind and low interconnector imports. There is also a high probability of the system entering the Emergency State at times, due to insufficient generation being available to meet the demand. The report noted that electricity consumers could potentially be without supply for approximately 4 hours over the winter period.

Source: EirGrid

Late November to mid-December and early-January to mid-February are expected to be the most onerous periods from a capacity margin perspective.

To address the overall challenge, the Commission for the Regulation of Utilities (CRU), has developed a programme of actions that will be delivered over the coming years. These include:

- The delivery, through the all-island capacity auctions, of over 2,000MW of enduring flexible gas-fired generation capacity by 2030

- Procurement of 700MW of temporary emergency generation

- Extending the operation, on a temporary basis, of older generators to delay the loss of up to 1,200MW of capacity

- Actions to enhance demand side responsiveness

- The introduction of tariffs to reduce electricity demand at peak times

GridBeyond Managing Director UK and Ireland Mark Davis said:

“Since 2016, EirGrid have been warning of increasing tightness between demand and supply. This year’s forecasts significant supply issues are on the horizon. The number of system alerts will increase as our economy grows, fossil-fuel generators exit the market and demand increases, with additional demand from new assets and sectors as these are electrified.”

“This is a trend we have already started seeing. But this presents opportunities for businesses. During system alert events GridBeyond’s customers are already earning revenues from grid schemes, supporting the network operators and helping prevent outages on the system for the benefit of all consumers across Ireland.

“With our DS3 integration services, GridBeyond can help your business participate in this electricity market through the integration of generators and the commissioning and verification of DSU systems.

“Our award-winning technology platform connects energy intensive assets and automatically adjusts power consumption in real-time to balance the Grid – all with minimal impact to operations.

But in addition to payments for demand response, a partnership with GridBeyond can support your business to:

- increase resilience with our CapEx free battery solutions

- manage energy procurement and prices

- cost-effectively electrify assets, such as vehicles and

- put your business on the road to net zero“

Hedging your bets this winter

If you are not hedging your electricity, you may have seen your electricity bills rise by 30-35% over the last few months and wondering what the outlook could be for the winter ahead and crucially how to manage your cost of operations.

Learn more