Insights

better business decisions

Posted 1 year ago | 2 minute read

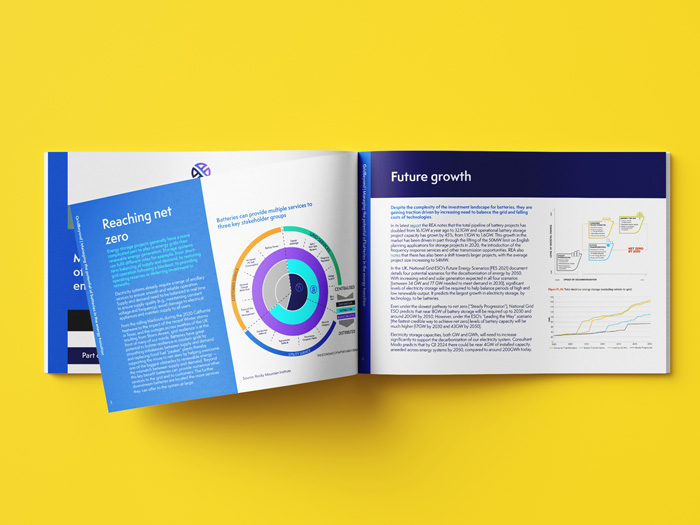

Stacking value and optimisation is the key to keep battery investment attractive, new GridBeyond and Thrive Renewables paper says

Electricity storage will need a significant increase to support the decarbonisation of the grid by 2050, but stacking value and optimisation is the key to keep the investment attractive, new GridBeyond and Thrive Renewables paper says

Key paper findings:

- Energy storage has grown by 45% and will need to increase significantly to support the decarbonisation of the electricity system by 2050

- There is a risk for the energy storage market to become oversupplied, causing lost of interest from investors

- Battery optimisation and stacking value are crucial to keep the investment attractive

The energy sector is currently going through many changes due to several factors. The last Capacity Market auctions cleared at record highs, while the introduction of new frequency response services has resulted in a significant commercial appetite for energy storage. However, to make strategic decisions to ensure maximum return on investment for these assets and a successful transition to net zero is quite complex, according to GridBeyond’s latest publication Managing the potential of batteries in the energy transition.

In recent years, the share of variable renewables source is increasing compared to fuel generation. As we face out fossil fuels to achieve the 2050 net zero target, the role of energy storage will become increasingly important to grid resilience and flexibility.

Electricity storage capacities will need to increase significantly to support the decarbonisation of our electricity system, which according to Bloomberg will require an investment of $262B in battery technology.

However, there is a risk because if the market becomes oversupplied with batteries, investors could lose interest, but optimisation and stacking value could keep the investment attractive. Storage assets could stack values across different markets with optimisers and use AI and trading capabilities to extract long-term value.

Mark Davis, MD at GridBeyond commented:

“We are experiencing very difficult times in the energy sector due to various factors. As we move away from fossil fuels, renewables and storage assets are becoming increasingly relevant.

AI-powered technology becomes crucial to manage storage assets according to company’s strategies and business objective. AI together with a suite of trading services, allow businesses to generate revenues allowing full access-to-market and to the most lucrative balancing services”.

Managing the potential of batteries in the energy transition

balancing prices reaching over £4,000/MWh and in 2022 to-date we have seen Capacity Market auctions clear at record highs. Together with the introduction of new frequency response services, this has resulted in significant commercial appetite for energy storage. But making strategic decisions to ensure maximum return on investment for these assets has never been more complex.

Learn more