News

better business decisions

Posted 1 year ago | 4 minute read

FERC sets out Winter expectations

This winter, slightly colder temperatures are expected compared to last winter, potentially contributing to higher domestic natural gas and electricity demand, the latest Winter Energy Market and Electric Reliability Assessment has found.

Published on November 21, the report noted that a prolonged cold weather event could affect prices and availability of natural gas and electricity. Drought and wildfire conditions are forecast to continue into this winter season in multiple regions and are expected to have a range of potential impacts on grid operating conditions and reliability.

In electricity markets, generators are projected to add 62GW of net winter capacity nationwide between March 2024 and February 2025 (mainly from solar), which is 84% higher than the average net winter capacity additions seen in the last five years. This compares to 7GW of net winter capacity retirements over the same period (mainly from gas and coal plants).

Across all regions, natural gas is expected to provide the largest share of net winter capacity. Gas-fired resources are expected to represent 42% of the total winter capacity in operation this winter, followed by coal at 14%, wind at 12%, and nuclear and hydro both at 8%.

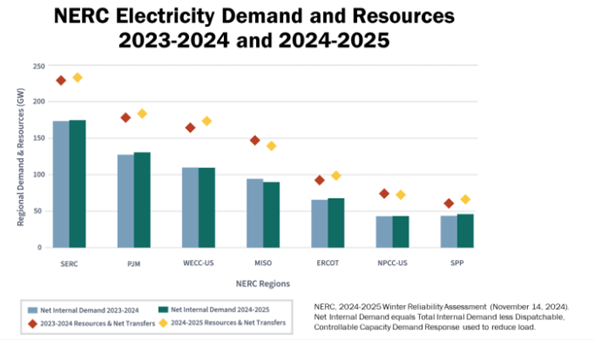

Electricity demand is expected to be higher this winter compared to last winter. It is forecast that net internal electricity demand to increase by approximately 0.7%, or 4.4GW, from 658GW in winter 2023-24 to 662GW in winter 2024-25.

Source: FERC

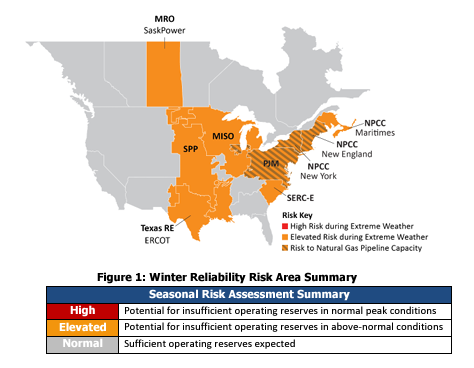

Overall, FERC expects all regions will have adequate generating resources to meet expected winter demand and operating reserve requirements under normal operating conditions. But regions such as MISO, ERCOT, SPP, and SERC-East may face a higher likelihood of tight generation availability under extreme weather conditions.

Source: NERC

According to the NERC Winter Reliability Assessments, published earlier in November, in the upcoming 2024-25 winter season, ERCOT will continue to face reserve shortage risks during the peak load hour and high net load hours. ERCOT winter peak demands typically occur when solar generation is not available, making the system dependent on wind generation and dispatchable resource availability. ERCOT states that shortage risks this upcoming winter are greater than last winter primarily due to load growth along with insufficient new dispatchable resources to serve the higher net peak loads. However, ERCOT also said that new battery storage resources are expected to help mitigate this risk.

MISO faces some risk for the upcoming winter season under a scenario of extreme outages and extreme 90/10 load forecasts. MISO states that generating capacity is 10GW lower compared to the prior winter as generators have retired, withdrawn or received lower winter accredited capacity.

SPP is forecasting that peak demand will rise for this winter by 1.8GW from the previous year while total existing generation capacity has fallen by more than 4GW. However, of the decline, nearly 2 GW come from adjustments in wind and solar capacity contributions. At the same time, natural gas generation capacity has expanded by 2.6GW year-over-year. Wind resources can alleviate firm capacity shortages under the right conditions; however, energy risks emerge during periods of low wind.

For ISO-NE, a standing concern is whether there will be sufficient energy available to satisfy electricity demand during extreme conditions, without considerable effort to replenish stored fuels. ISO-NE currently has sufficient resources to meet its demand, however if an extreme cold period were to occur, the region may have to rely on external ties and Emergency Procedures to operate reliably. ISO-NE will also continue the second year of the Inventoried Energy Program (IEP) for the upcoming winter. IEP is designed to provide incremental compensation to resources that maintain inventoried energy during the winter months.

PJM states that it does not anticipate any issues for the upcoming winter season, but that rising demand and retiring resources are tightening reserves and heighten reliability risk under extreme weather conditions.