Insights

better business decisions

Posted 3 years ago | 7 minute read

Four ways to optimise energy spend and risk

The currently volatile energy market has placed pressure on all sectors of the economy, including industrial and commercial businesses. Managing the associated cost and risk challenges requires a comprehensive approach to optimising energy procurement.

But by proactively optimising and managing energy use, in addition to taking action on energy-efficiency measures across your assets, industrials could reduce their energy costs significantly and ensure long-term resilience to energy price volatility.

The case for action

Since late 2021 we have seen unprecedented volatility in the energy markets across the world; an EU-wide gas supply squeeze meant that wholesale gas prices were already hitting record highs before 2022 even began. Russia’s invasion of Ukraine has fuelled further price volatility and raised many questions about the future security of supplies.

From 2019 to the present, international prices for both LNG and coal have tripled, while oil prices have doubled. In Europe in particular, power and gas prices have seen significant surges and volatility. In the first quarter of 2022, for example, the average month-ahead price for wholesale gas surged above €120 per megawatt hour (MWh)—six times the historical average. As European power prices are heavily linked to wholesale gas prices, the prices of both commodities tend to increase in parallel.

In the UK, the gas price had already been steadily rising during the latter half of 2021. Day-ahead contracts increased more than five-fold throughout the year, averaging 115p/th as supply and storage levels remained tight. Prices and volatility increased further in 2022, with a day-ahead average of 198p/th to mid-August. This is 72% higher than the 2021 average and almost eight times higher than 2020 (25p/th).

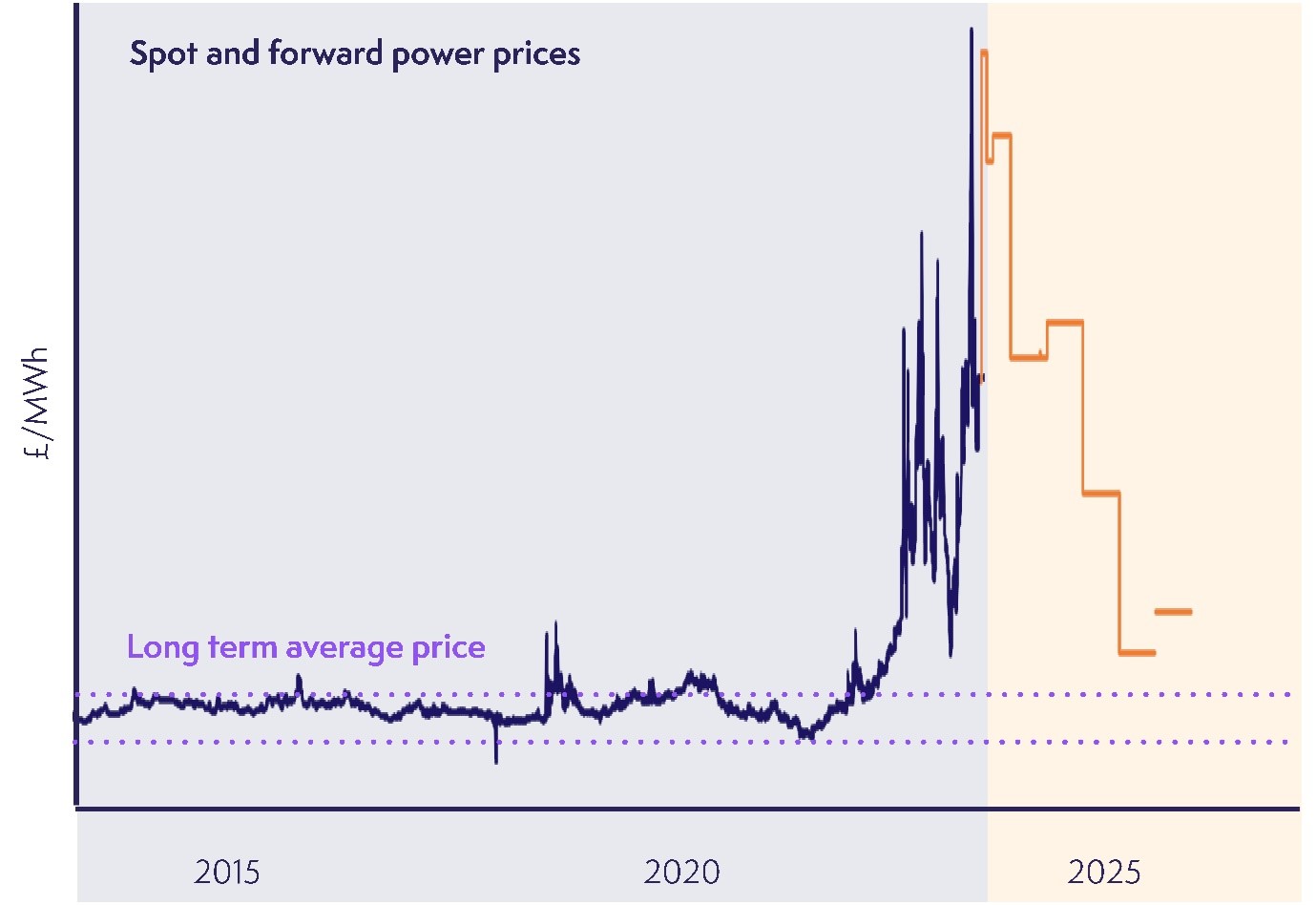

The average real price across the decade 2011-21 was 57p/th, reflecting relatively stable conditions for most of this period. But peak gas prices exceeded 500p/th in March for the first time on record, with some intra-day trades even reaching 800p/th. The weekly average UK electricity price has increased by almost 500% since early 2021, from just over £50/MWh to £258/MWh at the end of June, and forward-looking prices for the coming winter are at a record £750/MWh.

UK power prices

Forward price forecast taken on 06/09

For businesses the rise in energy costs has had a knock-on impact on production costs, which creates new cost and risk-management challenges. Key challenges for businesses, especially those in energy-intensive sectors, include the ability to hedge against energy-price risks, which means businesses must proactively manage risks and energy costs.

But there are five key opportunities for I&C businesses to optimise their energy spend, while managing risks.

- Long term hedging

- CPPA contracting

- Short-term trading and demand response

- On-site generation

Manage Risk & Optimise Price

Our whole of market services to take your business from passive procurement to active energy management and trading powered by AI and deep data science.

Learn more1. Long term hedging

Some businesses can buy energy in advance (known as hedging) to match their site demand.

Hedging, for the most part, is a technique that is meant to reduce a potential loss – not maximize potential gains. Long-term energy procurement can offer commercial and industrial business budget predictability. But the market can be a volatile place, and prices are known for going up and down. But having a fixed proportion of your energy purchased in advance can help protect your business from any unexpected changes in the market.

GridBeyond combine quantitative analysis and market intelligence to determine likely market movements and therefore hedging strategies. Combining AI Smart forecast, Solver, volatility analysis, trading limits, models, and decision algorithms, we review your existing hedging policy and deliver an optimised schedule for flexible load, to ensure optimum procurement efficiency and reduced costs for your business.

2. CPPA contracting

Businesses are faced with a unique opportunity to secure long-term supplies of green electricity via Corporate Power Purchase Agreements (CPPAs) for a tranche of their needs at long-term prices. A CPPA will not only help you increase the visibility of your future electricity costs. But it will also help you on your journey towards net zero.

As CPPAs only ever deal in green energy, you’ll be taking a step towards reducing your company’s fossil fuel consumption. This is more and more important from a sustainability point of view, especially as many businesses are starting to set targets around carbon neutrality.

Our turnkey CPPA service matches your volume requirements with renewable project developments – acting as facilitator for complex contract negotiations. We provide a fully managed service from initial market analysis and risk management strategy through to in-life management of the contract, including ensuring Renewable Energy Guarantee of Origin (REGOs) are received in line with reporting cycles.

3. Short-term trading and demand response

Participate in intelligent load management to achieve cost savings or tap into demand response markets to get paid for reducing your energy consumption upon request.

The opportunity for businesses to be more flexible with consumption has never been greater. Electricity system operators provide a number of opportunities for major energy users to get involved in demand-side flexibility. Demand-side flexibility is the ability to change electricity output or demand in reaction to an external signal. Business customers can benefit financially by offering demand-side flexibility services.

Your business might have some flexibility in your demand, a backup generator or a battery installed onsite to shift your load. With our Managed Flexibility service, you could optimise this flexibility in the short-term energy markets and provide balancing services for maximum value.

GridBeyond uses machine learning technology to enable I&C businesses to participate in a wide range of programmes for enhanced energy automation, insights and benchmarks, savings, revenues and sustainability. But optimising asset requirements for participation in a growing number and fast-changing energy markets can be a challenge without the right technology or expertise. By forecasting everything from weather conditions, the need for balancing actions on the grid to short-term wholesale market prices Ai. Trade helps you manage your flexible energy purchasing and on-site assets.

4. On-site generation

The drop in cost of small-scale energy production, particularly for on-site PV solar, has helped fuel the adoption of on-site generation.

On-site generation offers multiple benefits and businesses could evaluate eligible sites and the associated business cases, with the option to optimise self-use or resale based on market price arbitrages. But when it comes to implementing an energy project, certainty is in short supply. Many good project opportunities fail to secure necessary funding to move forward, and once funded, projects face a multitude of risks.

GridBeyond is a turnkey energy solutions provider. We help our clients manage all aspects of their energy and infrastructure needs, providing a single point of responsibility for everything from financing through commissioning and beyond. We employ an asset-led approach, from renewable generation to load management, to optimise the way your organisation uses energy as a resource.

We can help you increase the value of your generation assets by maximising the revenue-generating opportunities available to you. Our specialists can help you decide when to make your assets available for demand-side participation and develop contracts to suit your preferences. And we can help you identify when it’s beneficial to ramp up generation to sell surplus power into the market. By combining our knowledge of the wholesale markets, demand-side services, remote dispatch technology and asset operation, we can help you choose the right options for your business, at all times.

The way forward

Managing increasing energy prices requires energy sourcing and risk management optimisation. In the face of the volatile energy climate, industrials will need to manage their energy costs proactively. This requires a comprehensive approach that could be implemented alongside energy-efficiency measures to reduce energy consumption. Acting across the five levers detailed above may enable industrials to maintain their long-term competitiveness and resilience.

Our services, your solution

Energy is integral to the running of any business, but because energy prices fluctuate daily, buying energy at the right time and in the right amounts is critical. That’s why we have the solution for every procurement challenge.

Whether your objective is budget certainty, budget improvement, price optimisation or a combination of all three, our team of experts, combined with our world-leading technology can lead you to procurement success, ensuring that your business can be confident when buying energy.

Using AI and Robotic Trading combined with the expertise of our trading experts and Data Scientists, GridBeyond’s services open the door for your business to take your energy strategy from passive purchasing and consumption to active energy management and trading.