News

better business decisions

Posted 4 years ago | 5 minute read

Hedging your bets this winter

Introduction

If your electricity supply is currently un-hedged, you may have seen your electricity bills rise by 30-35% over the last few months and wondering what the outlook could be for the winter ahead and crucially how to manage your cost of operations.

While the current energy crisis is undoubtedly having a negative impact on many, it does provide an opportunity for businesses. Those that take stock of the way they produce and consume energy and create a future strategy that not only can reduce operating costs, but also generate revenues that can be further invested in new techniques and technologies that can support decarbonisation and sustainability.

Market metrics

The energy crisis is a consequence of several unrelated factors – global demand for gas has picked up rapidly, gas and power facilities have been offline, gas storage levels have been lower than normal, and weather conditions have resulted in a lower-than-average output from renewables.

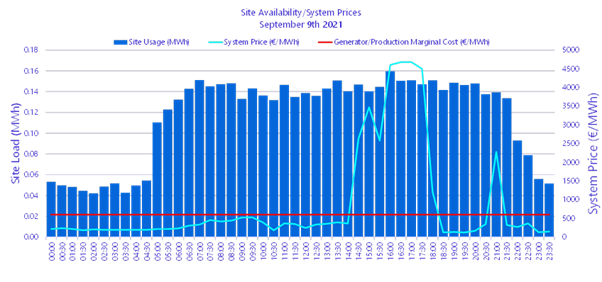

In September power prices exceeded €4,500 per MWh, coinciding with a Demand Side Unit (DSU) event. For businesses with unhedged energy contracts, these high prices would have been passed through and in turn impacting your cost of service. But looking ahead this scenario looks likely to repeat itself this winter.

In the latest All-Island Generation Capacity Statement, Eirgrid and SONI have noted that low power plant availability for this year continues to be a concern with an expectation that the coming winter period will be challenging. According to the latest All-Island Generation Capacity Statement, Eirgrid and SONI estimate a deficit of 280MW for winter 2021-22. This means its highly likely this winter is expected to see some historic high prices and Demand Side Units (DSUs) will play an important role in keeping the lights on.

In the short term, the grid has seen more strain than ever with three power stations closed in recent days due to technical problems. The generating stations subject to “forced outages” were Tarbert in Kerry (530 megawatts), Great Island in Wexford (460 megawatts), and Moneypoint 2 in Clare (285 megawatts). Added to that Aghada in Cork (425 megawatts) has recently been operating at a reduced capacity. Although these generators may only be down for a short time, two other significant sites have been out for most of the year. Whitegate in Cork is expected to return this month and Huntstown in North Dublin returned to operation last week after a long maintenance period.

Smart energy procurement

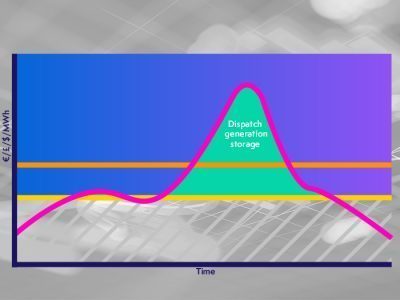

Having the right energy procurement strategy in place can save you money. Such a strategy puts you in control of your company’s approach to energy.

There are three main types of procurement strategies. There are benefits and disadvantages to each:

- Fixed procurement contract – A set price for gas and electricity. The quoted unit prices remain fixed for the duration of the contract and are charged at a premium rate.

- Hybrid (fix/flex) procurement contract – Opportunity to change how much of your energy consumption is fixed in advance to take advantage of downward market movements.

- Flex procurement contract – Full control of your energy procurement. Wholesale energy is purchased in smaller sets throughout the length of the contracts. You can choose when to buy your energy, and in what quantities, taking advantage of downward markets and monetising your position when market prices rise.

- Corporate Power Purchase Agreements (PPAs) – A PPA is a long-term contract where a business agrees to purchase electricity directly from a renewable generator. Like a fixed procurement contract with a utility, a PPA gives the option to lock in prices in advance, but this type of contract is generally more complex to set up and may have longer terms than a traditional fixed contract.

Choosing the contract

To get the most from energy markets this winter, book a meeting with our experts to find the right electricity procurement strategy for your business.

We’ll discuss the following questions with you to find the best fit:

- How sensitive are your operating costs to changes in energy prices?

- How actively do you engage with the wholesale market?

- Does your company have net-zero targets in place as part of your energy strategy?

- Do you actively manage your non-commodity costs? (i.e. network cost management)

- Are you exploring cost-saving opportunities, such as demand response?

Unleash your flexibility

Demand flexibility refers to the inherent ability of certain loads to be shifted in response to economic or environmental objectives. Businesses can shift certain loads to better align with the carbon intensity of the electricity grid or based on the availability of renewable energy or enrol in demand response programs and often receive revenues for reducing their energy demand during peak periods of demand and undersupply on the grid. Alternatively, buyers can bid demand-side services into utility programs or wholesale energy markets.

In Ireland, DS3 System Services are grid revenue programmes available to industrial and commercial energy users. Unlike the traditional DSU programmes, DS3 manages frequency fluctuations which can last from under a second, up to a few minutes. DS3 is suited to a wide variety of businesses and industries, with many different assets. GridBeyond’s highly experienced engineers recognise the parameters of your assets to ensure operational integrity, so you can participate on your terms.

DS3 enables access to a number of programmes with varying values and response requirements.

It is possible to use the DSU controls on your site to switch to on-site generation if you are exposed to market rates. This will hedge your market risk exposure once you’re the market approaches your onsite generations marginal cost. While this will limit your price risk exposure, your operations will not be impacted.