Insights

better business decisions

Posted 3 years ago | 3 minute read

USA energy prices set to rise this winter

Wholesale prices for on-peak power are expected to rise in all areas of the country during the winter months as the weather becomes colder, according to the US Energy Information Administration’s latest Short-term Energy Outlook report.

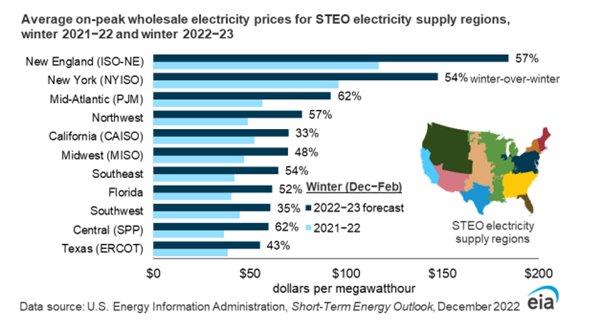

The report forecast wholesale prices for on-peak power to rise in all areas of the country during the winter months as the weather becomes colder. Increases in wholesale electricity prices this winter (December–February) range from 33% higher than last winter in California (CAISO) to more than 60% higher in the mid-Atlantic (PJM) and central (SPP) regions.

Forecast on-peak wholesale prices for most regions generally average between $60/MWh and $80/MWh between December and February. The highest wholesale prices are expected in New England, where prices could average in excess of $180/MWh, with winter peaks of more than $200/MWh. High prices are also expected in New York (NYISO) and in mid-Atlantic (PJM) markets. However, the report noted that if significant market stressors occur, such as periods of extreme cold weather or fuel supply problems, wholesale prices could be significantly higher than forecast.

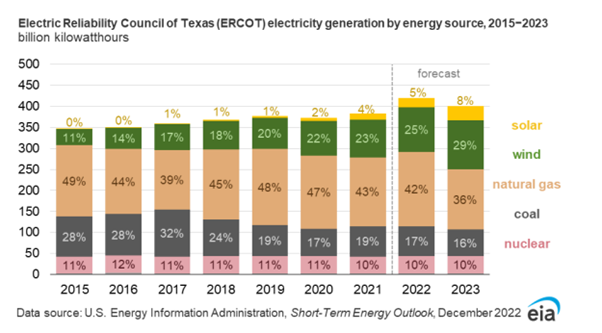

Overall, the US is forecast to generate 16% of electricity from wind and solar power in 2023, up from 14% in 2022, while natural gas generation will fall to 37%, from 39% this year. Texas, meanwhile, “is likely to experience the largest shift in generation mix in 2023”.

The share of electric power generation from wind in ERCOT is forecast to grow from 25% in 2022 to 29% in 2023 and that the solar share will grow from 5% to 8%. ERCOT’s share of generation from coal in the forecast falls from 17% this year to 16% in 2023. But growing generation from renewables, especially during peak hours, will cause the natural gas share to fall from 42% in 2022 to 36% in 2023.

In its Q3 2022 Clean Power Quarterly Market Report the American Clean Power Association noted that over the period developers brought 3.4GW of new capacity online, bringing 2022 installations to 14.2GW. Year-to-date installations are down 18% compared to the same period in 2021, while comparable third quarter additions fell 22%. Quarterly wind installations fell 78%, while solar installations dropped 23%. Only battery storage, which commissioned 1.2GW this quarter, increased installations compared to the third quarter of 2021. Storage is having its best year on record, with 2022 installations already nearly even with total 2021 volumes.

By state, with 1,404MW commissioned, California led for new installations in Q3 2022, accounting for almost half of all installs. Texas ranked second with 1,272MW installed, followed by Virginia (255MW), and Iowa (105MW).

GridBeyond launches a new hedging service to support businesses manage risk in high cost and volatile energy markets

GridBeyond launches a new energy trading and hedging service to support businesses navigating the energy crisis, as market volatility and prices increase. This is part of a whole of market service to Manage Risk & Optimise Price, alongside procurement and trading services. The service aims to take businesses from passive procurement to active energy management and trading powered by AI and deep data science.

Learn more