News

better business decisions

Posted 2 years ago | 3 minute read

Britain could face “tight” winter, says National Grid ESO

National Grid ESO has said it remains confident Britain will have sufficient electricity supplies this winter, although it has warned there may be periods of tightness and the ESO may need to use its tools, including issuing margins notices, to manage these periods.

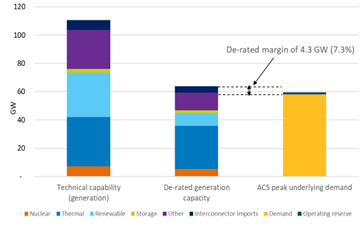

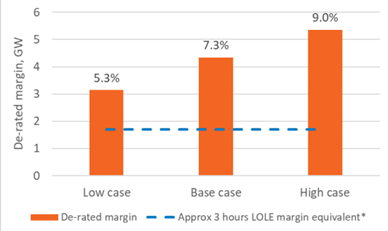

In a report published on 22 July, National Grid ESO said its base case for de-rated margin, which is a measure of the amount of excess capacity expected above peak electricity demand, for the coming winter is currently 4.3GW, or 7.3% of capacity. This is slightly lower than last year but above margin parameters requested by the government.

The base case forecast for underlying average cold spell peak demand is 59.5GW, including operational reserve. This assumes that there is no suppression of peak demand due to the ongoing COVID-19 pandemic.

There is still some uncertainty over available supply. The report noted that one nuclear station has already announced closure ahead of the winter, with a second one expected to shut down during the season. During Winter 2020-21, coal availability decreased compared to the previous years. This creates additional uncertainty as many coal-powered stations approach the end of their operational lives and would need to be taken of the grid in the coming years. As a result, the de-rated margin could drop as low as 3.1GW (5.3%). This would represent a level of tightness that has not been seen in the electricity market since before the Capacity Market delivery years started in 2017-18.

Mark Davis, GridBeyond’s Managing Director UK & Ireland, commented:

“Should Britain experience periods of supply tightness, we would expect power prices to escalate and interconnectors to increase their import But reliance on imports from continental Europe to meet demand cannot be taken for granted.

“Over recent weeks, prices in commodity markets have been high, with day-ahead gas reaching three-year highs on the back of lower-than-average gas storage stocks across Europe. Power prices have also topped £100/MW.

“Businesses that are able to take part in National Grid schemes to reduce demand during peak events could reap the rewards, especially if further plant closures or outages are announced ahead of winter. However, expectations of tight conditions and high prices will be of concern to businesses without interruptible or flexible load. One way businesses can sure up their resilience is through investment in on-site battery storage or generation assets.

“GridBeyond is already working with our clients to create opportunities and support the business case for investment in on-site energy storage and generations. Using our AI-powered technology, we find the flexibility on your site and make it work for your business, reducing operating costs and carbon emissions and securing revenue for your business.”

The full outlook for Winter 2021-22 will be published in October.

Using AI and Robotic Trading combined with the expertise of our trading experts and Data Scientists, GridBeyond’s Point Ai. Services open the door for your business to take your energy strategy from passive purchasing and consumption to predictive analysis and active energy management and trading. GridBeyond’s Point Ai. Services consist of three complementary products: Ai. Terms, Ai. Trade & Ai. Thrive, which together, will transform your energy into opportunity.

If you have any questions around the potential for your business, contact our team, or to learn more about the complimenting services offered by GridBeyond’s intelligent energy platform, our Point Ai. Services brochure.