Insights

better business decisions

Posted 1 year ago | 4 minute read

National Grid ESO “cautiously confident” of adequate margins for winter

Under a “highly unlikely” scenario of a gas shortage in Britain, there could be disruption in energy supplies, the National Grid ESO has said, but it remains “cautiously confident” of adequate margins for winter

This year, the National Grid ESO Winter Outlook report, published on 6 October notes that, since last winter the world has fundamentally changed with the invasion of Ukraine by Russia, and the knock-on effects in the European and global energy markets.

The Base Case scenario suggests there will be adequate margins of 3.7GW (6.3%) throughout the Winter. Its reliability standard is less than three hours of Loss of load expectation (LOLE) and its modelling informing will be within 0.2hr this winter according to the report. But National Grid ESO is still expecting to utilise a range of its tools to keep the system balanced, including Electricity Margin Notices (EMNs), Capacity Market Notices (CMNs). This would lead to higher balancing costs, given these actions will be linked to the wholesale price of electricity as bid into the Balancing Mechanism or offered for trades on interconnectors.

It also noted the new tools that have been implemented this year including the Demand Flexibility Service (expected to be launched on 1 November), which it said adds potentially around 2GW, while delaying the closure of coal units provides around 2.5GW. But the system operator warned that despite these measures it is “highly likely” that the wholesale price of energy (both gas and electricity) will remain very high throughout the winter.

National Grid ESO has however warned that if importing electricity was not possible, the weather was cold and the wind generation low, there may be the potential to need to interrupt supply to some customers.

While the Base Case assumes that capacity across all providers (generation, storage, interconnection etc.) is available in line with commitments secured under the Capacity Market, the ESO have also modelled a scenario whereby the energy crisis in Europe results in electricity not being available to import into GB from continental Europe.

In this alternative scenario, the ESO would deploy its mitigation strategies – dispatching the retained coal units and the Demand Flexibility Service. By securing approximately/up to 4GW through these actions, the ESO would expect to maintain adequate margins and mitigate impacts on customers. The ESO sees particular potential from commercial organisations who can shift their load from peak hours and have had positive feedback from British companies on this.

Without the deployment of the additional coal generation units or the new Demand Flexibility Service, the ESO would expect to see a reduction in margins. In this scenario on days when it was cold, with low levels of wind, there may be the potential to need to interrupt supply to some customers for limited periods of time in a managed and controlled manner. However, the ESO expects the mitigations outlined above to be effective.

This report builds on the Early View of Winter, published in July, giving early warning about the expected tight margins.

GridBeyond Managing Director UK and Ireland Mark Davis said:

“The latest Outlook report shows just how challenging this winter could be. The government, Ofgem and National Grid are already looking to use every tool available to ensure reliable energy supplies and avoid paying excessive prices for imported gas. Businesses should adopt the same approach of looking at all the levers at their disposal, including energy efficiency, interruptible contracts, demand side response and onsite generation.

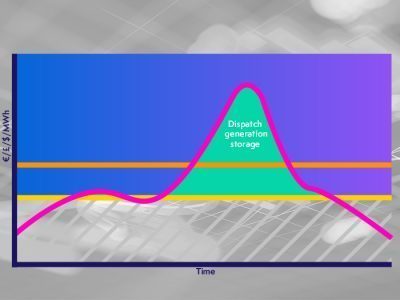

“At GridBeyond we help companies do just that. By bridging the gap between distributed energy resources and electricity markets, our technology means every connected asset, whether its utility-scale renewables generation, battery storage or industrial load, can be utilised to help balance the grid. The benefit?

“By intelligently dispatching flexibility into the right market, at the right time, asset owners and energy consumers unlock new revenues and savings, resilience, manage price volatility, while supporting the transition to a net zero future.”

Hedging your bets this winter

If you are not hedging your electricity, you may have seen your electricity bills rise by 30-35% over the last few months and wondering what the outlook could be for the winter ahead and crucially how to manage your cost of operations.

Learn more