News

better business decisions

Posted 2 years ago | 12 minute read

Net zero pledges: how to make yours count

For major energy users, getting started on the road to net zero can seem a daunting task. And no wonder, getting to grips with where your carbon emissions come from, let alone reducing them, is a complex process.

But what is a net zero pledge? How can you scope it out? And how best to ensure your business can achieve what you have promised?

The language of net zero

Is ‘carbon neutral’ the same as ‘net zero carbon’? – Carbon neutrality and net zero CO2 emissions are overlapping concepts. Generally ‘carbon neutral’ implies the inclusion of Scope 1, Scope 2 and Scope 3 emissions. In contrast, ‘net zero carbon’ implies Scope 1 and Scope 2 emissions only, i.e. those under direct control of the reporting entity. Context is therefore very important and accounting rules specified by GHG programmes or schemes can have an influence over the meaning.

Use of the word ‘emissions’ – The word ‘emissions’ alone and unqualified by the word CO2 can have a different meaning to ‘CO2 emissions’. ‘Emissions’ tends to mean all greenhouse gas emissions. CO2 is but one of a number of greenhouses gases that includes nitrous oxide, methane and ozone. This means that ‘net zero carbon’ can have a different meaning to ‘net zero’ depending on whether the context implies it is just referring to carbon (or not); and ‘carbon neutral’ can have a different meaning to ‘net zero emissions’ depending again on context.

Use of timeframes – The phrases ‘carbon neutral’ and ‘net zero carbon’ are often associated with time frames. There are (at least) two timeframes to be mindful of. The first is the target timeframe. For example, we will be ‘carbon neutral by 2050’. The second is the accounting period. That is the period over which the assessment of emissions balanced against removals is undertaken. It is most likely over a year. However, it could also be a much longer period.

Use of the word ‘net’ – The word ‘net’ is important as it permits the balance between emissions and removals. This means that there can be a difference between ‘zero carbon’ as opposed to ‘net zero carbon’. Zero carbon implies no CO2 emissions whereas ‘net zero carbon’ implies that there will be a balance of emissions and removals to be ‘net’ zero.

What is a net zero pledge?

In a simple equation, “net zero” is achieved when emissions released minus emissions removed equals zero (i.e. the emissions removed from the atmosphere cancels out the emissions released as far as possible and remaining emissions are offset). Pledges often adopt the following formulation: “X company commits to achieving net zero emissions by Y”.

Exactly what decarbonisation strategy a company should adopt (and commit to through a net zero pledge) will depend on that company’s particular impacts and buy-in from its Board, shareholders and other stakeholders such as its financial and insurance service providers.

Some net zero pledges deal with a company’s direct greenhouse gas (GHG) emissions from their activities (scope 1) and consumption of electricity (scope 2). Others are more all-encompassing and deal with scope 3 emissions generated by whole value chain.

The most common form of net zero pledge commits to cancelling out future emissions, generally by 2050. The mid-century timeframe was based on evidence that net zero emissions needed to be achieved by 2050 to limit the global temperature increase to 1.5°C above pre-industrial levels. At least, for the most part, pledges do not address historic emissions are therefore open to criticism as inadequate in responding to the causes of climate change.

The concept of removing all emissions, including cumulative historical emissions, is known as “historic zero”.

Science-based targets

The Intergovernmental Panel on Climate Change (IPCC)’s Sixth Assessment Report, Climate Change 2021: The Physical Science Basis, published in August 2021, indicates that climate change is occurring much faster than previously predicted. However, the most recent estimates suggest that the global temperature could exceed 1.5°C of warming, relative to 1850-1900, as soon as 2030. Consequently, companies may choose to reconsider their existing pledges and target date to align with the latest IPCC report.

A more robust pledge is one that adopts science-based emissions targets. This means that the emissions reduction aligns with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to well-below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C.

Over 1,000 corporations worldwide are working with the Science Based Targets initiative (SBTi) and setting science-based emissions reduction targets for either under 1.5°C or 2°C. These targets are then validated against science-based criteria including (but not limited to) the following:

- targets must cover company-wide scope 1 and scope 2 emissions and all relevant greenhouse gasses as defined by the GHG Protocol Corporate Standard;

- targets must cover a minimum of 5 years and a maximum of 15 years and cannot have already been achieved;

- at a minimum, scope 1 and scope 2 targets must be consistent with the level of decarbonization required to keep global temperature increase to well-below 2°C compared to preindustrial temperatures; and

- targets must be modelled using the latest version of methods and tools approved by the initiative.

Scoping it out

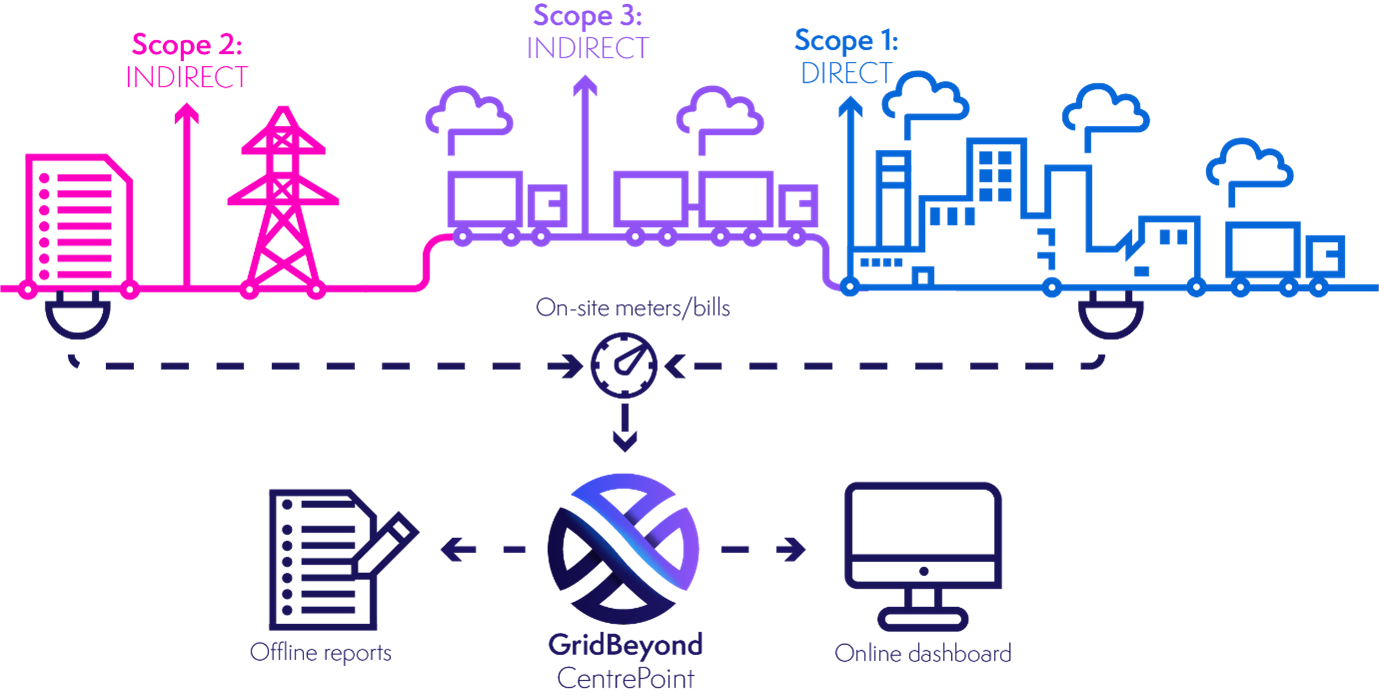

At its most basic, a net zero pledge requires a calculation of the emissions released directly and indirectly by a company. The Greenhouse Gas (GHG) Protocol Corporate Standard classifies a company’s GHG emissions into three scopes:

- Scope 1 emissions are released as a direct result of activity at a facility level, such as emissions from manufacturing or burning of fossil fuels in industrial processes;

- Scope 2 emissions are released from the indirect consumption of energy; and

- Scope 3 emissions are those generated in the wider economy through the corporate value chain.

While reporting on scope 3 emissions is currently voluntary, pledges that take scope 1 to 3 emissions into consideration paint a more realistic picture of a company’s overall contribution to emissions. For many companies, the majority of their GHG emissions and cost reduction opportunities lie outside their own operations. By measuring scope 3 emissions, organisations can identify areas for improvement and possible risks in their supply chain.

But some companies have argued that taking scope 3 emissions into account could lead to double accounting if the country where the scope 3 emissions are generated already accounts for them as part of its Paris Agreement commitments or through an energy intensive emissions trading scheme.

Companies making net zero pledges therefore need to be clear and accurate on whether indirect Scope 3 emissions are being included in any net zero pledge.

Beware of “Greenwashing”

Pledges with faraway goals and without a clear roadmap on how those goals will be achieved will not be considered sufficiently robust and effective. The risk of getting it wrong can lead to reputational damage and financial penalties from inaccurate disclosure.

A company making net zero pledges that are vague and unsupported by plans and/or evidences, may be considered to lack accountability and transparency. “Greenwashing” claims could also become a source of future risk for companies who lack the reporting and data to justify their pledges.

An effective net zero pledge must be supported by interim, short-term and medium targets as well as long-term goals. Companies making net zero pledges should consider the need to have annual progress reports or periodic audits in place measured against a standard methodology.

This would allow for companies to ensure they are on track to meet their targets as well as remain adaptable and responsive, if amendments or updates are required. Crucially, if amendments are made this information should be disclosed appropriately to investors, the supply chain and customers.

The European Commission defines greenwashing as “companies giving a false impression of their environmental impact or benefits” and that states “companies making ‘green claims’ should substantiate these against a standard methodology to assess their impact on the environment”.

The 2020 Circular Economy Action Plan commits that “the Commission will also propose that companies substantiate their environmental claims using Product and Organisation Environmental Footprint methods.”

The USA Environmental Protection Agency (EPA) definition also counts “greenwashing” as when companies make vague or generic claims related to environmental impacts about products or services.

Action on the practice of “greenwashing” is taking place around the globe. For example, in April 2021, the French government introduced an increase of the existing fine for misleading commercial practices to up to 80% of the false promotional campaign cost when it comes to claims related to the environment.

In August 2021 the UK government said it would review how energy retailers market “green” electricity tariffs, amid concerns that some are overstating how environmentally friendly their products are. The UK Treasury has also launched a new expert advisory group called the Green Technical Advisory Group (GTAG) in an effort to deliver the government’s “Green Taxonomy”, a framework for judging how environmentally friendly investments are.

The detail in the data

Measuring carbon emissions is a big task, but one that becomes more manageable if you take a systematic and data-driven approach. Companies also have to ensure accountability at the top, realign their corporate growth strategy with net zero, adapt their operating model and supply chain to support the transformation, invest in innovation, provide the necessary financing, and prioritise transparency and engagement.

Once you’ve determined base level emissions, and with an integrated energy strategy in place, you need to put in measures to move those metrics and to record your progress.

To measure Scope 1 emissions efficiently and accurately, you will need systems in place that can measure the consumption down to the asset and sub-second level. Measuring indirect emissions from the energy you buy (Scope 2 emissions) can be done by having energy bill management systems in place, but a better way is to use your own site metering data to ensure you are confident with its accuracy. For Scope 3 assessments you will need to rely on disclosures from your supply chain, both upstream and downstream.

Making the plan a reality

Actually, achieving a net zero target requires a transformation that touches every part of a company’s business and operating model.

Reducing Scope 1 emissions could include making investments in newer, more energy-efficient equipment which can lower your operating costs and reduce emissions at the same time. Replacing coal or gas-fired assets with electric versions or upgrading your company’s fleet to electric vehicles can also help reduce or eliminate your use of fossil fuels in operations. For corporations whose operations don’t allow them to eliminate all Scope 1 emissions – even with equipment upgrades – carbon offsets remain an option.

The use of offsets has been criticised (particularly if offsets are being used exclusively) as a way of companies re-assigning their environmental obligations and continuing to emit-as-usual. But for some businesses, current technologies available to reduce emissions make meeting net zero a significant challenge within the timescales required making offsetting a legitimate and necessary tool. But companies should ensure they are doing their due diligence into the offset providers they are using so that they can demonstrate that they are genuinely meeting their net zero commitments.

One way to reduce the amount of power you purchase from the grid (Scope 2) is to generate clean power yourself. Purchasing renewable energy though Power Purchase Agreements (PPAs) and managing offtake agreements could also be a viable option.

Collecting data on Scope 3 emissions is one of the biggest barriers to being able to set and achieve emission reduction goals. Addressing Scope 3 emissions hinges on tracking, measurement and strategic sourcing and risk management.

To help businesses measure Scope 3 emissions, the GHG Protocol has developed the Scope 3 Standard, which enables users to account for emissions from 15 categories of Scope 3 activities, both upstream and downstream of their operations. The Scope 3 framework also supports strategies to partner with suppliers and customers to address climate impacts throughout the value chain.

For companies, a key issue is how you are reporting on your emissions as well as your progress in reaching your targets.

Backing it up

Reducing GHG emissions is a vital undertaking that all organisations will need to fulfil over the coming years. For many, it will be a journey rather than a one-off event. Embarking on that journey is challenging, but the rewards for embracing sustainability are tangible – not just for the planet but for the success of your business.

As we have already explored, commitments without a reasonable basis can constitute misleading and deceptive conduct, it is important for a company to consider seriously what targets, and reduction options, can actually be implemented in line with operational strategies and crucially how you are going to prove that your business is on track to meet its commitments.

GridBeyond can support you in setting, achieving, and reporting against your net zero strategy. Using metered data and billing information, GridBeyond’s Point platform supports companies in managing environmental reporting requirements to ensure that activities and operations are aligned with sustainability objectives. This includes the tracking of emissions in conjunction with intelligent climate focused dashboards. We can also help you scope out your reporting requirements and boundaries and support with technical changes and upgrades that could be made to reach your goals.

Benefits beyond reporting

Taking steps to meet sustainability goals can open up a whole new set of revenue streams for businesses. There are a variety of ways you can monetise your energy assets, while at the same time reducing energy costs and supporting the net zero transition.

The opportunities to monetise flexibility will increase as more renewables are integrated with the grid. On the other side of the coin, as we move towards 2050, the costs of not meeting your sustainability goals will rise as carbon taxes become more punitive and customers, supply chains and investors increasingly demand action.