Managing Energy Price Risks

Surging energy prices globally bring challenges for energy buyers that can be managed with hedging, trading, and procurement strategies.

Across the world energy prices started increasing in 2021 as global demand recovered after the pandemic, while supply remained tight following years of subdued investment in the energy sector.

Upon Russia’s invasion of Ukraine, energy prices in many jurisdictions soared to historically high levels, given the risk of disruptions to trade in energy commodities and concerns over future supply.

The energy crisis: where we are now

The energy crisis is impacting us all; it’s predicted that some businesses’ costs could rise by 250%, and that energy prices will remain significantly above average until 2030 and beyond. Energy-intensive industries in particular are facing a host of overlapping challenges:

Energy price rise causes & what’s next

Prior to Russia’s 2022 invasion of Ukraine there was an increase in demand for oil and gas as economies around the world. The price rise has several causes. An important factor is the return of global gas demand as economies restarted after pandemic-related restrictions. Demand has been particularly high in some areas due to cold weather and supply has not been able to keep up; for example, global liquified natural gas (LNG) production has been lower than normal due to several unexpected outages and delayed maintenance. Increased gas prices fed through to increased electricity prices.

The Russian invasion of Ukraine in early 2022 caused oil and gas prices to jump further due to concerns about disruption to supply. Sanctions on Russia and embargo on Russian oil and gas pushed oil and gas prices up further still. By the end of the first quarter of 2022, crude oil prices had doubled, coal prices tripled, and natural gas prices increased more than five-fold relative to early 2021.

Analysts suggest that these increases could have a significant enduring component. The World Bank has said, relative to January 2022 projections, the prices of energy commodities are now expected to be 46% higher on average in 2023. According to the International Monetary Fund, relative to prices expected in early 2021, about half of the increase in crude oil and coal prices is expected to last through 2026, while for natural gas, about a quarter of the increase is expected to persist through 2026.

Recent Insights

New revenue opportunity for end users launches this Winter

Read moreIndustry exemption from green levy costs

The proposal would help around 300 businesses, supporting 60,000 jobs.

Read moreForecast for the Default Tariff Cap

The energy crisis affects businesses as well as households

Read more“Very high prices” this Winter

In its Winter Outlook 2022-23: Early view report, published on 28 July, ESO said there could be “tight periods” in early December

Read moreIndustries set to receive further support for electricity costs

Energy intensive businesses, such as steel and paper manufacturers, are set to receive further support for electricity costs as the government has confirmed.

Read moreEnergy prices to keep rising, says World Bank

The war in Ukraine has dealt a major shock to commodity markets, altering global patterns of trade, production, and consumption in ways that will keep prices at historically high levels through the end of 2024, according to the World Bank’s latest Commodity Markets Outlook report.

Read morePrepare for more energy turbulence

Challenges and uncertainties at their greatest for almost 50 years

Read moreHedging your bets this winter

If your electricity supply is currently un-hedged, you may have seen your electricity bills rise by 30-35%

Read moreRecent Insights

Increases in US wholesale electricity prices

The US Energy Information Administration (EIA) has forecast that prices in US wholesale electricity markets this summer will significantly increase over last summer’s prices.

Read moreEnergy prices to keep rising, says World Bank

The war in Ukraine has dealt a major shock to commodity markets, altering global patterns of trade, production, and consumption in ways that will keep prices at historically high levels through the end of 2024, according to the World Bank’s latest Commodity Markets Outlook report.

Read morePrepare for more energy turbulence

Challenges and uncertainties at their greatest for almost 50 years

Read moreHedging your bets this winter

If your electricity supply is currently un-hedged, you may have seen your electricity bills rise by 30-35%

Read more

Ai. Services | Turning big data into smarter trades

Digital revolution, known as Industry 4.0, has enabled people, businesses, manufacturing plants, campuses and even entire cities operate in new and innovative ways. As artificial intelligence (AI) is increasingly integrated with other systems and Internet of Things (IoT) devices, it has the potential to improve operational efficiency and asset utilisation.

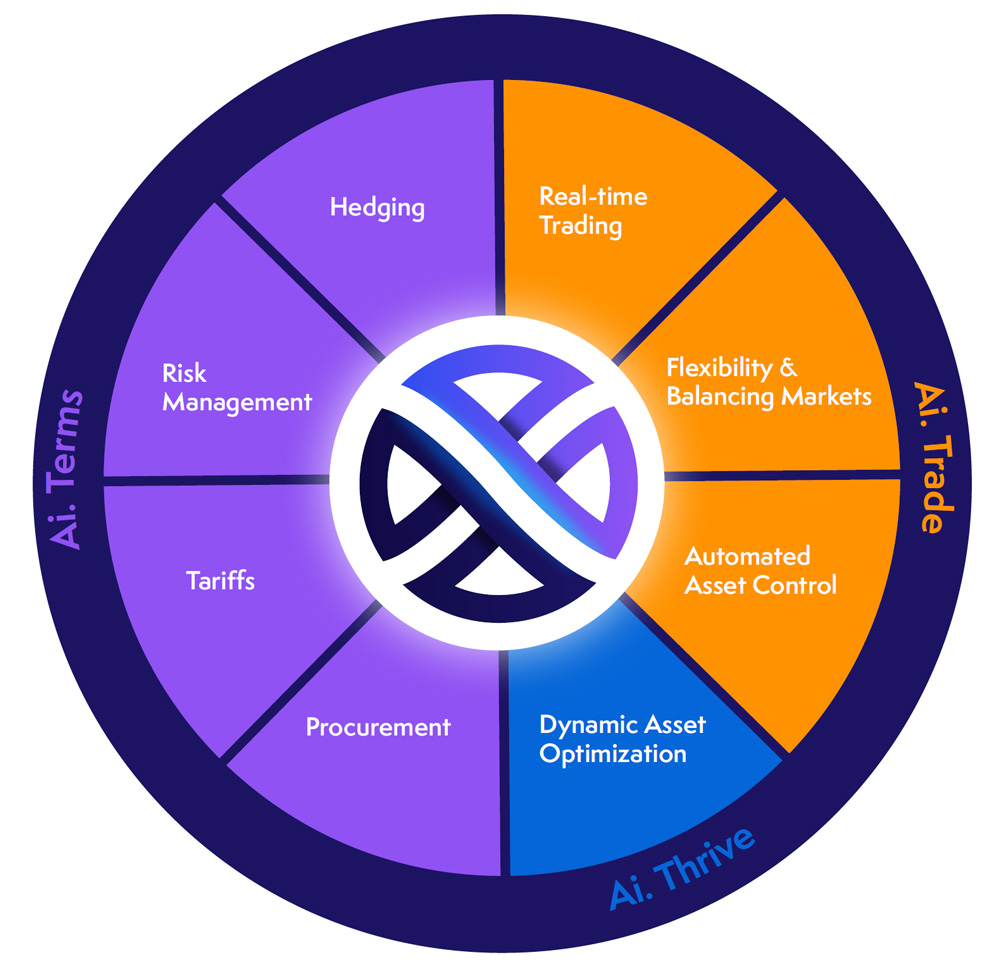

Learn moreOur whole of market services to take your business from passive procurement to active energy management.

Through a deep understanding of your requirements, our trading and energy experts will draw upon our AI smart forecasts to provide advice on a tariff type and supplier that will allow you to best monetise your indexed position.

Using your site profile and our AI forecasting, Ai. Terms will provide recommendations on when and where to buy energy and how to optimise your flexible load to take advantage of market volatility.

Ai. Services

up to 50%

Savings with Ai. Terms, for your Energy procurement strategies

500%

increase in revenue with Ai. Trade, by monetising your position…every hour…every day

up to 150%

Savings with Ai. Thrive compared with reactive maintenance